Share this @internewscast.com

US stock market dominance over the UK, and pretty much everywhere else, has sliced potential returns off my pension savings in the past few years.

That is because I have been leaning toward British funds and shares in recent years.

However, recent market mayhem has levelled things off a little.

Consider that the FTSE 100 is only 3 per cent down in 2025 compared to more than 10 per cent for America’s S&P 500 – and more than 15 per cent for the Nasdaq technology market. (Those figures were to the Thursday close, and may be very different by the time you’re reading this…)

Every country and every company is still digesting Donald Trump’s ‘Liberation Day’ tariffs. And the daily volatility suggest markets can’t seem to calculate the impact. Down 6 per cent one down, up 3 per cent the next.

These are difficult times for investors. It is hard to know whether to buy or sell. Or lock yourself in a room and hope it all blows over.

Best of British: Fidelity’s Andrew Oxlade has been leaning towards home-grown shares in his pension in recent years

But a crisis often offers opportunity. Market falls sharpen your focus and provide the perfect catalyst to review the balance of your portfolio.

Were you holding bonds, which often rise when shares falls? Or were you 100 per cent invested in shares but coped with the discomfort. If so, maybe you don’t need to hold bonds.

The engaged DIY investor will also be attuned to the geography of their investments.

And with a new world order emerging, should they be tweaking that global allocation?

The problem is that we don’t know what the new world order will look like. It is likely to be one of faltering global trade, but it could be one of greater exchange between Asia and Europe.

Who knows? I’m going to limit my theorising and instead focus on a stock market we know better than any other. Let’s talk about Britain first.

The appeal of British shares

The British market has been cheap for a long time and remains cheap. This view is based on various measures.

The price-to-earnings (p/e) ratio is one common gauge of value. Before the recent turbulence, the FTSE 100 was trading at 11.9 times forecast earnings. In contrast, Europe was on 13.9 and the US on 21. In other words, British shares were 43 per cent cheaper than those in the US.

The recent turbulence will mean some late nights for analysts as they redraw their forecasts for earnings.

Most British companies will earn less money and so cheaper share prices will not necessarily pass through to a lower p/e ratio.

But to repeat the point, British shares were cheap against their historic norms and against elsewhere, and now they’re likely to be even cheaper.

Secondly, the UK offers better dividend yields than other markets. The income from UK shares was at 3.8 per cent before the tariff war rattled markets.

That compared with 1.8 per cent for world stock markets and 1.2 per cent for the US.

Once again, the ability of companies to pay dividends may be undermined by the economic uncertainty or directly by tariffs. But notional yields will be pushed up by falling share prices. Some of them are incredibly high.

Shares in Britain’s biggest listed insurer, Legal & General, now yield 9.8 per cent.

Shares in investment companies Phoenix and M&G both offer yields above 10 per cent. Double digit income from such big companies is rare.

More broadly, we’ve had a long market rally where returns were driven by growth in share prices. We may move to one where dividends become more important to total returns.

The Great British economy

An improving economy helps company profits. Forecasting the economy is difficult even during stable conditions, let alone amid the current maelstrom.

The red pencils are already being sharpened. A survey of forecasts compiled by Consensus Economics shows UK GDP is now expected to grow by just 0.8 per cent in 2025, down from 1.2 per cent at the start of the year.

But there are some near-term positives. It was revealed on Friday that the UK economy grew by a remarkable 0.5 per cent in February.

Big projects: Infrastructure plans such as airport expansion and a tunnel under the Thames could provide a boost to growth in the UK

More remarkable, it was driven by manufacturing – cars, electronics and pharmaceuticals. Mr Trump would be envious.

Another positive has been inflation which was lower than expected in February at 2.8 per cent. It means the Bank of England may be more inclined to cut rates, which would boost the economy.

Markets are now close to pricing in four UK rate cuts for 2025 – from 4.5 per cent to 3.5 per cent. It’s good news for borrowers but rate reductions also encourage investors to seek income, moving away from cash and to shares and other investments with growing income.

The approval of several big infrastructure projects, such as airport expansion and a new tunnel under the Thames, may also help growth. And today, some of these projects can be backed by individual investors – and they offer this potential of growing income.

The International Public Partnership investment trust (INPP) has invested in hundreds of infrastructure projects. More than 70 per cent are in the UK, including the recently opened ‘super sewer’ in London.

It aims to grow its yield each year, currently 6.11 per cent, and makes our list of Select 50 favourite funds. It is worth noting that it ended this week up around 5 per cent. I hold INPP shares in my personal pension.

But the real question is, how will the UK fare in the new world order? Can Britain forge a new role amid the chaos and become a bridge between Europe, Asia and the US? It is a big unknown.

What seems more likely is that so-called defensive sectors of the stock market will continue the run of the past week in doing better than the rest.

his includes drug companies, supermarkets, and utilities. Although nothing is simple now. Pause or no pause, drug companies face an extra 10 per cent cost for selling into their biggest market – the US.

Could refuge lie in companies entirely focused on the UK? These are more likely to be found in the FTSE 250 index of medium-sized companies than the FTSE 100.

Winners over the first week of turmoil (yes, there were some) include electronics retailer Currys, up 6.5 per cent, building materials supplier Travis Perkins, up 4.1 per cent, and Mitchells and Butlers, behind All Bar One and Toby Carvery, up 7.6 per cent.

Alternatively, you can buy the lot: the Vanguard FTSE 250 ETF is the pick from our Fidelity Select 50 list, with a low charge of just 0.1 per cent.

Finally, we may be seeing a return of love for UK shares among the home audience. Our Fidelity Be Invested survey asked in February where UK investors see the best buying opportunity in the next 12 months.

British shares were named by 45 per cent of respondents compared, up from 34 per cent two years earlier. Among those aged under 35, 68 per cent named the British stock market. We’re about to ask investors again and I expect another rise.

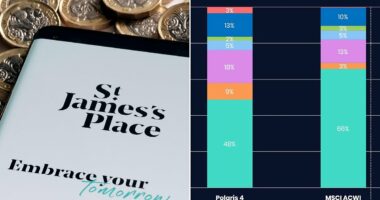

For my part, 24 per cent of my portfolio is invested in the UK, a high figure compared with a typical global portfolio, and up from 20 per cent a few months ago and around 10 per cent a few years ago.

But what about the current volatility?

There are so many aphorisms thrown around at times like this – ‘buying now is like trying to catch a falling knife’, etc.

I turn to two bits of historic data to retain balance at times of high market stress. The chart below shows what happens if you lose your nerve and are not invested in the best days.

The impact of missing the best five and 30 days in the S&P 500

The data is for the US but the pattern is similar for the UK and elsewhere, albeit with lower returns.

For the UK, if you missed the best 30 days over a 32-year period, your total return would be reduced from 763 per cent to 81 per cent.

The pattern is similar for the UK and global stock markets

Secondly, I look at what’s happened to the FTSE 100 after the biggest one days falls. Each time, the market has posted impressive gains in the five years that followed, as shown below.

Even after the biggest one day falls in the FTSE 100, the market made impressive gains in the five years that followed each time

Of course, these historic market patterns may not be repeated. There is a further caveat when buying cheap markets.

They can remain cheap for extended periods, as the UK has already experienced. It requires patience from investors.

The upside is that with the British stock market you should at least collect very decent income while you wait, patiently.