Share this @internewscast.com

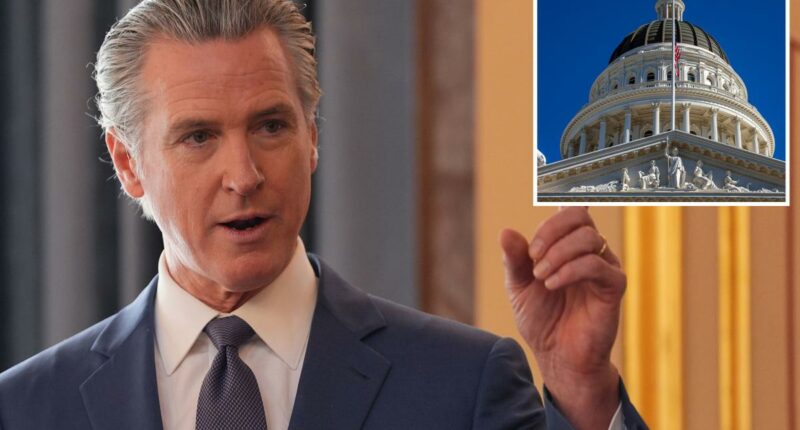

Governor Gavin Newsom is facing increasing dissatisfaction among California voters, marking a significant shift in public opinion not seen since 2024. A recent poll conducted by Emerson College reveals that 45% of voters now express disapproval of Newsom’s performance, which represents a notable rise of six percentage points since December 2025.

This survey, which gathered opinions from 1,000 registered voters, shows that Newsom’s approval rating has slipped to 44%, a decrease of three points compared to the previous December. This downward trend highlights growing concerns among constituents, as the governor’s disapproval figure had previously been lower, standing at 43% in October 2024.

Despite these findings, Governor Newsom’s office has yet to provide any comments on the poll results. Meanwhile, the survey also sheds light on the primary issues troubling Californians. The economy emerged as the leading concern, with 37% of voters identifying it as their top priority, a slight increase from December’s figures. Additionally, 19% of respondents pointed to housing affordability as the state’s most pressing issue.

These results underscore the challenges facing the governor as he navigates the complex political landscape and addresses the pressing issues confronting California residents. The data serves as a stark reminder of the shifting sentiments within the electorate, emphasizing the need for responsive leadership in these turbulent times.

Newsom’s office did not respond to a request for comment regarding the figures.

The poll also asked voters about the top issues facing Californians, with 37% citing the economy as their No. 1 concern — up three points from December. Nineteen percent citied housing affordability at the state’s top issue.

Critics have argued that California’s high cost of living — particularly soaring housing prices, elevated gascosts, and rising insurance premiums — has worsened during Newsom’s tenure.

They point to strict environmental regulations, limits on new oil drilling permits, and slow housing construction as contributing factors to persistently high consumer prices.

A whopping 53% percent of voters said they have considered leaving the state over affordability concerns, the poll found.

Download The California Post App, follow us on social, and subscribe to our newsletters

California Post News: Facebook, Instagram, TikTok, X, YouTube, WhatsApp, LinkedIn

California Post Sports Facebook, Instagram, TikTok, YouTube, X

California Post Opinion

California Post Newsletters: Sign up here!

California Post App: Download here!

Home delivery: Sign up here!

Page Six Hollywood: Sign up here!

Business groups have also raised concerns about regulatory hurdles and taxation.

Newsom has recent sought to raise his profile, drawing criticism from some Republicans for attending global events such as the World Economic Forum in Davos and the Munich Security Conference while economic frustrations persisted at home.

The California Democrat has been laying the groundwork for a potential 2028 presidential run as his term as governor nears its end.

The Emerson College poll also found Republican and staunch Newsom critic Steve Hilton opening up a lead in the governors race.

Seventeen percent of voters named the Fox News contributor their top choice, with Democratic Rep. Eric Swalwell and GOP hopeful Sheriff Chad Bianco tied for second at 14%.