Share this @internewscast.com

A well-known criminal was given a £50,000 government-backed coronavirus bounce back loan – and blew it all on drugs.

Serial crook Louis Maxwell, 35, has 16 previous convictions for 49 offences – including 12 for dishonest behaviour, nine for driving while disqualified and six for burglary.

He claimed through Rishi Sunak‘s Bounce Back Loan scheme to help his tow-truck business, based in Newport, Gwent, survive after lockdown, spending less than half the money – £22,000 – on a new truck.

Maxwell blew away the rest on Class A drugs. He later sold the truck, using cash from the sale to buy more drugs.

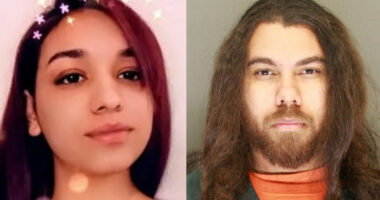

Serial crook Louis Maxwell, 35, has 16 previous convictions for 49 offences – including 12 for dishonest behaviour, nine for driving while disqualified and six for burglary

He was jailed last May for driving a stolen car and filed for bankruptcy three months later – triggering an Insolvency Service investigation.

Maxwell owned the Mr Tow Recovery Logistics business using a Jeep Cherokee and trailer – despite being banned from driving himself.

Sue Tovery of the Insolvency Service said: ‘Taxpayers’ money was made available to help genuine businesses get through the lockdown period and where there have been abuses, we will not hesitate to take action.’

Maxwell, of Newport, is now banned from borrowing more than £500 without disclosing his bankrupt status, and he cannot act as a company director without the court’s permission.

Maxwell had previously been mocked for looking like Beaker from the muppets after police posted his mugshot while he was wanted over a driving offence.

Under Mr Sunak’s scheme, firms could borrow up to £50,000 interest-free for 12 months, with the loan guaranteed by the Government

Police published Maxwell’s mugshot onto their Facebook page after he led them on a high speed chase in 2017.

But the site was quickly taken over by wannabe comedians having a laugh at his unkempt curly haircut and bleary-eyed appearance.

Police eventually traced Maxwell and arrested him, but not before he was ruthlessly compared to Bert from Sesame Street and Beaker from the Muppets online.

Last December furious MPs had claimed fraudsters were able to steal nearly £5billion from Chancellor Rishi Sunak’s Covid Bounce Back Loan scheme because the Government’s anti-fraud measures were ‘too little too late’.

A damning report by the spending watchdog has found that controls to ensure companies were not applying for more than one bounce back loan were ‘inadequate’ and put in place ‘too slowly’.

The National Audit Office said that by the time the Government implemented any anti-fraud measures in June 2020 – a month after the scheme was launched – more than £28billion had already been paid out.

Other measures did not begin until September 2020 as Ministers focussed on getting the loans out to support businesses that were struggling during the pandemic, the watchdog said.

In its report, the NAO also said that around £17billion may never be repaid due to fraudulent activity as well as legitimate borrowers defaulting, citing official estimates.

The watchdog added that the Government knew the risks as it launched the scheme, but had to weigh them against the consequences of not getting money to businesses quickly.

Under Mr Sunak’s scheme, firms could borrow up to £50,000 interest-free for 12 months, with the loan guaranteed by the Government.

It was a lifeline for small firms, but has also provided rich pickings for fraudsters who disappear, leaving the taxpayer to reimburse banks.

This post first appeared on Dailymail.co.uk

Source: This post first appeared on