Share this @internewscast.com

Stay informed with free updates

US stocks surged on Friday, offsetting the sharp declines that occurred after Donald Trump’s announcement of the “liberation day” tariffs a month earlier, thanks to labor market data surpassing expectations.

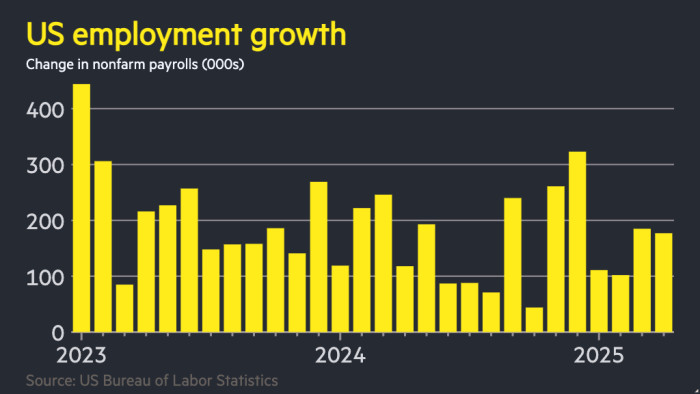

The Bureau of Labor Statistics reported that 177,000 jobs were added in April, exceeding the economists’ forecast of 135,000 gathered by Bloomberg, though this was a decrease compared to March.

The S&P 500 rose by 1.5 percent on Friday, elevating it past the closing mark of April 2, when the US president declared his “reciprocal tariffs.” This marked the ninth straight daily gain for the S&P 500, the longest streak since 2004, and one of the lengthiest ever recorded, as noted by Financial Times analysis.

Wall Street’s benchmark share index had plunged as much as 15 per cent in several days of turbulent trading after Trump’s announcement, triggering tumult across global financial markets.

But global equities have since largely recovered, helped by signs of a possible thaw in trade tensions, including comments by China’s commerce ministry on Friday that Washington had recently expressed “a desire to engage in discussions” on trade.

“This rally seems to be on the expectation that — with regards to tariffs — the worst has passed,” said Ajay Rajadhyaksha, global chair of research at Barclays. But he added: “In fact it is exactly the contrary. The worst has not yet shown up in the data. Nothing has shown up in the data yet.”

Wall Street’s recovery was echoed across several other countries as the initial wave of global stock market volatility after Trump’s “liberation day” tariff plans subsided. Indices across the Asia-Pacific region and Europe notched up multi-day gains.

Most notably, the UK’s FTSE 100 added 1.2 per cent on Friday to rise for a 15th consecutive session, its longest winning streak on record.

Despite the recovery in stock markets, the dollar remains almost 4 per cent below its “liberation day” level.

After Friday’s jobs data, the yield on two-year Treasuries, which tracks interest rate expectations and moves inversely to prices, rose 0.13 percentage points to 3.83 per cent as investors bet that the US Federal Reserve would keep borrowing costs higher for longer.

“People were fearful of a downside surprise that wasn’t forthcoming,” said Mike Riddell, a fund manager at Fidelity International.

Traders continue to forecast at least three interest rate cuts this year, but the likelihood of a fourth halved to about 30 per cent from around 60 per cent before the jobs figures.

Goldman Sachs said that it had pushed back its expectations of the next rate cut a month from June to July.

“THE FED SHOULD LOWER ITS RATE!!!” Trump posted on his Truth Social network shortly after the jobs data came out, as he hailed “employment strong, and much more good news”.

Friday’s jobs numbers came after mass firings of thousands of federal employees by Elon Musk’s so-called Department of Government Efficiency. The data indicated that federal government employment declined by 9,000 in April and by 26,000 since January.

In addition to April’s headline figure of 177,000 new jobs, the total number for March was revised down from 228,000 to 185,000.

The unemployment rate was unchanged from March at 4.2 per cent.

Claudia Sahm, chief economist at New Century Advisors, said that while Trump’s economic policies were “anything but subtle” their initial impact was “relatively small”.

She added that it would take time for the policies “to work through the system, which means the Fed is going to wait”, and that any cuts were likely later in the second half of the year rather than during the next two months.

Official data this week indicated the first fall in GDP for three years but was distorted by a surge in imports ahead of Trump’s tariff announcement, with domestic demand remaining strong.

Many economists anticipate that the duties will act as a drag on underlying growth in the second quarter of the year.

“Overall this is an indication that the labour market is not deteriorating yet,” Gennadiy Goldberg, head of US rates strategy at TD Securities, said of Friday’s job data. “But investors are still nervous that another shoe will drop. We just don’t know when.”

Additional reporting by Ian Smith in London