Share this @internewscast.com

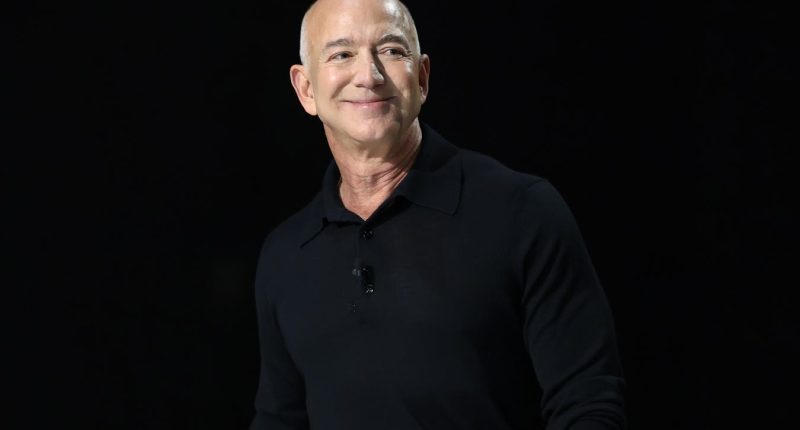

NEW YORK, NEW YORK – DECEMBER 04: Jeff Bezos, founder and executive chairman of Amazon and owner of … More

Getty Images

“It took four decades for the top 0.00001% of Americans’ share of total U.S. household wealth to grow from 0.1% in 1982 – when 11 households made up that rarefied group – to 1.2% in 2023.” The previous statistics come from the Wall Street Journal’s Juliet Chung, and are based on an analysis by Cal-Berkeley economist Gabriel Zucman. Zucman is plainly aghast at the growing wealth gap, and he’s also plainly wrong in his disgust.

The simple, undeniable truth that evades economists is that as wealth at the top soars, so grows opportunity for those not at the top. The greater the gap, the much greater the opportunity.

This statement of the obvious confuses economists because they studied for years to master a mode of thought that worships at the altar of consumption. Economists believe consumption powers economic growth, which reveals the problem…with economists. They don’t grasp that consumption is an effect of economic growth. As in consumption is what happens after the growth. Production always and everywhere precedes consumption, which explains the endless bullishness of the stats that give Zucman, Thomas Piketty, and countless other PhDs the vapors.

Still, it’s useful to address what gives Zucman et al discomfort on their terms to see precisely why their thinking is so backwards. Let’s start with consumption. A major reason economists prefer tax cuts directed at low and middle earners has to do with what’s undeniably true: low and middle earners will be much more likely to spend (think consume) what governments don’t take.

Conversely, economists struggle with reductions in tax rates for the rich for the exact reasons they cheer them for the poor and middle classes: the rich, by virtue of already being rich, won’t spend what governments don’t take. And since economists once again view consumption as the instigator of growth, they fear so much wealth being “controlled” by individuals who couldn’t possibly spend even a fraction of what they have. Except that the joke is on economists. No act of saving ever subtracts from demand, rather it just shifts it into the hands of others. The previous truth is crucial.

To see why, never forget that there are quite simply no jobs, no companies and no entrepreneurs without unspent wealth. Stating the obvious, someone must not spend so that businesses can expand and “impossible” ventures envisioned by the entrepreneurial can be given life. Similarly, the explosion of work opportunities that correlates with unspent wealth being matched with businesses and new vision similarly can’t materialize without unspent wealth.

In other words, the concentration of wealth in the hands of the few that scares economists precisely because the wealth won’t be consumed is the surest sign that enormous opportunity and progress is in the process of being created. For technological, transportation and health advances to morph from idea into reality, existing wealth must be consumed less so that new ideas can attain capital.

The simple, beautiful truth is that the richest of the rich only “control” their wealth as Zucman et al imagine so long as they spend it. If they don’t, and they don’t because they can’t reasonably spend tens to hundreds of billions on themselves, their only real option is to place the money in banks, brokerage accounts, private equity and venture capital funds where financial intermediaries can direct what’s copious to its highest perceived use.

Put another way, if you want wealth created to reach as many people as possible to their certain economic and living standard betterment, cheer economic policies that reward the most creative and that relieve the creative of the fruits of their creativity the least. Once again, the greater the gap in wealth the greater the opportunity for those without it.