Share this @internewscast.com

Unlock the Editor’s Digest for free

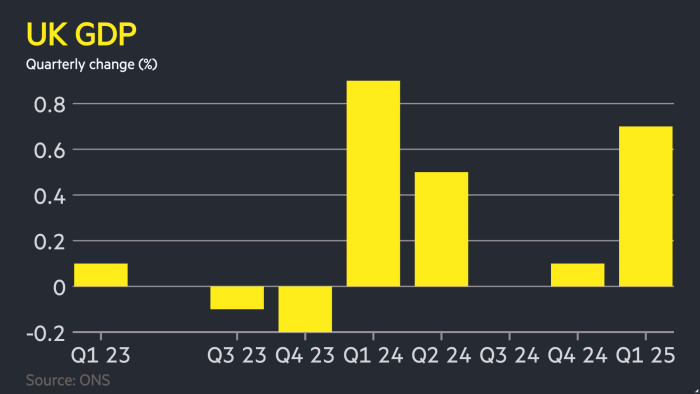

The UK economy expanded by 0.7 percent in the first quarter, marking its fastest growth in a year and providing a boost for the Labour party as US President Donald Trump’s tariffs loom.

The GDP figures released on Thursday, covering the first quarter, surpassed the 0.6 percent prediction from economists surveyed by Reuters and showed an improvement from the 0.1 percent growth seen in the previous quarter.

This quarterly upturn was driven primarily by the services sector and a rise in investment, as reported by the Office for National Statistics. Additionally, net trade had a positive impact, indicating that activities were possibly accelerated in light of anticipated higher tariffs.

The Labour government says growth is its top priority, although its critics accuse it of slowing down the economy with measures such as an increase in employers’ national insurance contributions that took effect last month.

Responding to the news, Prime Minister Sir Keir Starmer hailed the first-quarter expansion as “very good for working people across the country”, adding that the figures showed “the strength and resilience of the British economy”.

The sharp pick-up in growth provides the government a rare fillip on the economy after GDP was near-stagnant in the second half of last year.

UK GDP for the quarter compares with a 0.3 per cent expansion in the Eurozone during the period and a 0.1 per cent contraction in the US — figures that were distorted by a surge of imports.

While welcoming the first-quarter figures, Mel Stride, the shadow chancellor, hit out at the government’s tax increases and said that “both the OBR [Office for Budget Responsibility] and IMF have downgraded the UK’s growth [forecasts]”.

Economists cautioned that Thursday’s figures are based on data compiled before Trump’s April 2 announcement of tariffs on countries across the world, including 10 per cent duties on imports from the UK.

Many say the duties will hit global growth, even though Trump has scaled back many of them.

While Washington and London agreed a limited trade deal last week — lowering tariffs on UK car and steel exports to the US — the flat 10 per cent charge remains in place.

Simon Pittaway, senior economist at the Resolution Foundation, said that “this growth rebound is unlikely to last, with data for April looking far weaker, and huge tariff-shaped clouds hanging over the global economy”.

The ONS figures showed the economy grew 0.2 per cent in March compared with analysts’ forecast of no growth.

Economists suggested that first-quarter growth was boosted as companies sought to get ahead of Trump’s tariffs.

Paul Dales, economist at the consultancy Capital Economics, said a 5.9 per cent increase in business investment in the period was “completely at odds with the plunge in business sentiment”.

Export volumes rose 3.5 per cent in the first three months of the year, snapping three straight quarterly declines, with exports to the US climbing.

Despite the economy’s improved performance in the first quarter, traders still expect one or two more interest rate cuts from the Bank of England this year, according to the swaps markets.

The pound was marginally higher against the dollar at $1.327 following the data.

The BoE cut rates by a quarter point to 4.25 per cent this month but governor Andrew Bailey stressed that the path of interest rates was not on “autopilot”, as officials assess the effect of the US tariffs.

The central bank has already warned that first-quarter growth is likely to be “significantly above” the UK’s underlying economic momentum, highlighting weak productivity and high borrowing costs. It expects growth to slow to 0.1 per cent in the second quarter.

Additional reporting by Sam Fleming and Ian Smith in London and George Parker in Tirana