Share this @internewscast.com

A tradie devastated to be scammed out of $17,000 has accused his bank of not providing enough support.

Sydney resident Bradley Turner, aged 33, operates a microcementing business called Pure Deco. On June 1, he received a text message that seemed to be from his bank, ANZ, as it appeared within an existing message thread he had with them.

The message indicated that his voice ID had been updated and advised him to ‘immediately contact the number provided below’ if he hadn’t requested this change.

He quickly became worried because he had made no such request, and it was for his business account.

‘The guy made me panic. I spoke to three people, they make you panic,’ Mr Turner told news.com.au.

Scammers have become more sophisticated and are using technology to ‘spoof’ numbers and get into established texting threads.

Upon calling the number, Bradley was informed that he was the target of a scam originating from New Zealand and was advised to transfer his money into a new account to protect his assets.

Mr Turner was sent a text with the new account details, with the message again appearing on his previous ANZ message chain.

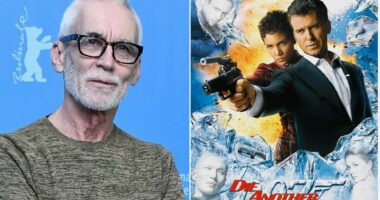

Bradley Turner (second from the left) was scammed out of nearly $17,000

He made two transfer payments, one of $16,941 and another of around $7,000, to the new bank account.

A chance conversation with a friend minutes later prompted him to call ANZ to check everything was legitimate.

‘I rang ANZ and was told it was a scam. I had to report it to the police,’ Mr Turner said.

ANZ was only able to stop the $7,000 transfer, but the $16,941 was already with another bank.

Mr Turner said he felt violated, and it got worse when ANZ told him there was no way it could help him get his money back.

He thought the bank should take some responsibility for the fact the scammers were able to get into the texting chain and spoof their official communications.

‘It came through their feed and it is so frustrating. I don’t see how they can wipe their hands of it,’ he said.

‘If it was through a random number, I’d understand.’

ANZ Bank said scammers were good at quickly making the money they took disappear

An ANZ spokesman told Daily Mail Australia there were certain giveaways on whether or not a message from the bank was legitimate.

He said in a genuine ANZ call, SMS or email, the bank would never ask a customer to share sensitive online banking details like passwords, PINs, ANZ Shield codes, token codes, or one-time passcodes for payment.

The spokesman said it would also never ask someone to transfer money to another account to keep it safe, or join an online chat with an ANZ team member.

‘We work with the major telecommunications companies on measures that stop scammers from adopting the “ANZ” label in text messages, including reporting instances where ANZ has been impersonated for telcos to block and prevent these attempts,’ he said.

‘We always attempt to recover funds customers have lost to scams or fraud.

‘However, the ability to recover funds depends on a number of factors, including how quickly it is reported to us, whether they are transferred to another financial institution, and the speed in which funds are then on-transferred by scammers.’

The ANZ spokesman said in many instances, cyber criminals transfer funds within minutes or use them to purchase cryptocurrency.

Mr Turner said he still felt ANZ had ‘let me down and now they just want to palm me off’.