Share this @internewscast.com

So what leads economists to believe that a drop to 3.6 percent is almost certain, and how much could you potentially save?

‘No reason to wait’

One commentator expressed he would be “staggered” if the RBA does not reduce the rate, citing indications of a weakening job market and a positive Q1 CPI (quarter one consumer price index) report.

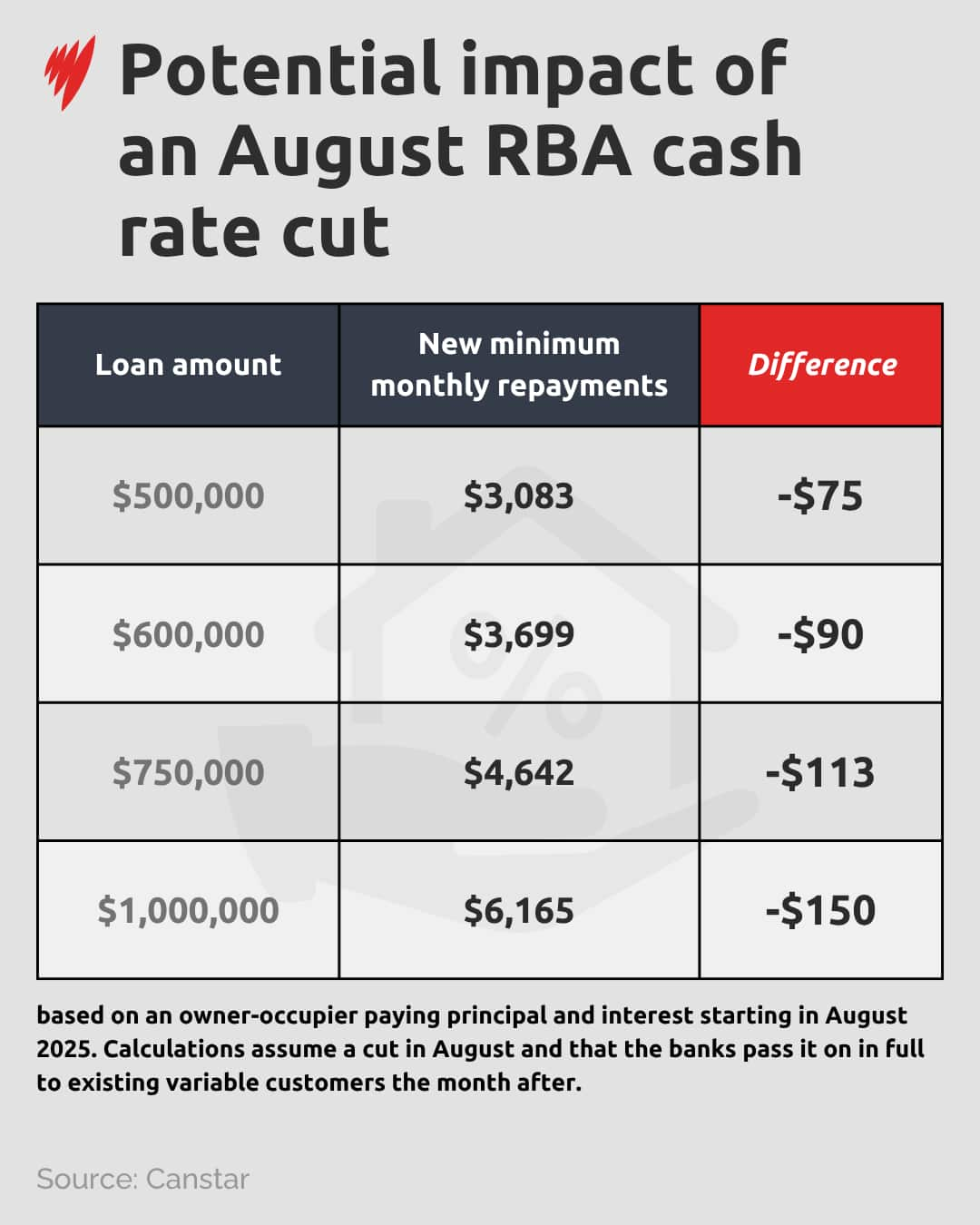

The larger the loan, the greater the savings.

An owner-occupier on a $500,000 loan could save around $75 per month following a 0.25 per cent rate cut, according to Canstar. Source: SBS News

Devika Shivadekar, an economist at financial services firm RSM Australia, told SBS News an official rate cut this week should create optimism, with further relief expected in the coming months.

The ‘big four’ banks are all forecasting a rate cut on Tuesday. Westpac anticipates a series of four cuts throughout this financial cycle—in August and November, then again in February and May—ultimately reducing the cash rate to 2.85 percent.

The ‘big four’ banks are all predicting a rate cut on Tuesday. Source: SBS News

Commonwealth Bank and ANZ are estimating a 0.25 percentage point cut in August and another in November, taking the cash rate to 3.35 per cent, while NAB is forecasting 0.25 percentage point cuts in August and November, and another in February, taking the cash rate to 3.10 per cent.