Share this @internewscast.com

The Trump administration is allegedly exploring the possibility of acquiring a stake in troubled chipmaker Intel to support the company’s postponed factory project in Ohio, sources acquainted with the plan have disclosed.

Bloomberg indicates that, demonstrating the administration’s growing readiness to step into crucial sectors, there are ongoing discussions between the Trump administration and Intel regarding purchasing a stake in the embattled semiconductor leader. Individuals familiar with the ongoing talks suggest that this move aims to strengthen Intel’s projects in Ohio, which have suffered repeated delays.

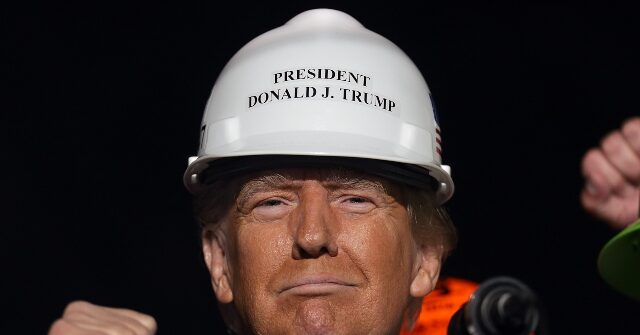

The talks build upon a recent meeting between President Donald Trump and Intel CEO Lip-Bu Tan, previously criticized by Trump over concerns regarding his connections to China. The specifics of the potential stake are yet to be determined as ideas remain in flux and may not result in a finalized agreement.

Prompted by the news, Intel stocks surged almost nine percent before closing up by 7.4 percent at $23.86 in New York, bringing the company’s market worth to around $104.4 billion. The upward trend in shares extended into after-hours trading, continuing to show a more than five percent increase on Friday morning.

The White House refrained from commenting on “hypothetical deals,” whereas Intel expressed its dedication to aiding Trump’s initiatives to reinforce U.S. leadership in tech and manufacturing, though it did not address the rumors directly.

This prospective undertaking signifies the latest instance of the Trump administration’s direct engagement in a vital sector. Previously, the White House forged a deal to secure a 15 percent share of specific semiconductor sales to China and obtained a “golden share” in United States Steel in exchange for transaction approval.

It also echoes the Defense Department’s unprecedented $400 million preferred equity stake in rare-earth producer MP Materials Corp., turning the Pentagon into the company’s largest shareholder. These moves signal a shift in how the federal government interacts with private industry in sectors deemed critical to national security and combating China.

Intel, once a chip industry pioneer, has struggled in recent years with market share losses and eroding technological advantages. The Ohio factory expansion was part of former CEO Pat Gelsinger’s comeback plan, but financial woes have imperiled the project, with delays pushing it into the 2030s.

Read more at Bloomberg here.

Lucas Nolan is a reporter for – News covering issues of free speech and online censorship.