Share this @internewscast.com

Sarah Coles is head of personal finance at Hargreaves Lansdown.

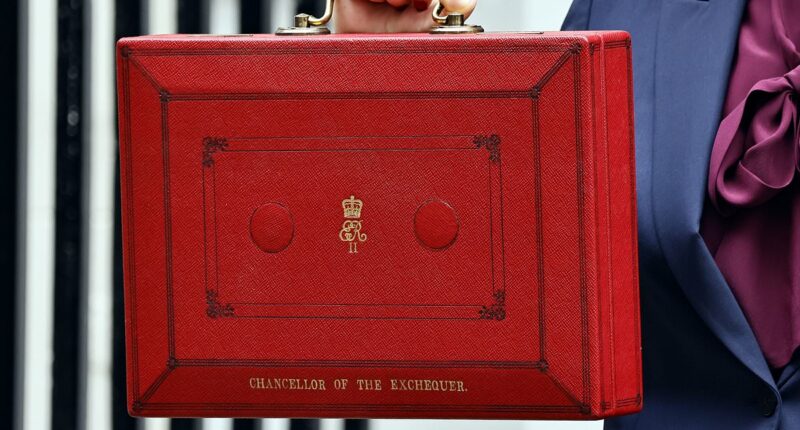

Budget season kicked off in midsummer this year. The rumour runners and riders have shot out of the traps despite the fact there could be months to go until Chancellor Rachel Reeves announces her plans to boost the economy and balance the books.

The Budget date is now set for 26 November.

Yet attention is already focused on potential changes to inheritance tax, council tax, pension tax-free cash, stamp duty, capital gains tax, National Insurance on property income and pension tax relief.

At times like this, the risk is that people feel under pressure to take steps they wouldn’t otherwise consider because they’re stressed about a potential tax hike or rule change.

For example, rumours around council tax and stamp duty could change your home buying plans, while worries about tax-free cash could tempt people into knee-jerk decisions to make pension withdrawals they come to regret.

Other people will be confused into inaction – unsure of the right approach to take.

Fortunately, you don’t need to be tempted into making mistakes.

Here are six sensible steps you can take to help manage your tax bill that you won’t regret – regardless of whether they feature in the Budget or not.

Sarah Coles: The rumour runners and riders have shot out of the traps although we don’t have a Budget date yet

1. Get your investments into an Isa

Rumours about capital gains tax have suggested the exemption for ‘primary’ residences could be removed for properties worth more than £1.5million.

There have also been questions as to whether the CGT rates could rise again, and there’s always the risk of a change to the rule that means CGT resets on death.

If you have existing assets outside an Isa or pension, it makes sense to realise gains within your £3,000 allowance each tax year, as you go along.

You can use the share exchange process known as ‘Bed & Isa’ to sell and buy the same assets immediately in an Isa – which protects them from capital gains tax in future too.

If you are starting on your investment journey, it makes sense for a stocks and shares Isa to be your first port of call, protecting you from both capital gains tax and dividend tax.

2. Protect yourself against savings tax

The Government has pledged not to change taxes that affect working people, so a rise in income tax rate is unlikely.

It has the option though to extend the current freeze in the thresholds, which are set to last until 2028 already. This has been a huge cash cow for recent governments.

Frozen tax thresholds risk pushing you into a higher tax band, where your personal savings allowance shrinks or disappears overnight, so more people will pay income tax on savings.

If you have savings, it’s worth considering a cash Isa, where you pay no income tax on interest.

3. Use your pension to cut income tax

Consider putting more in your pension to get into a lower income tax bracket.

The annual pension allowance is £60,000, or up to 100 per cent of your annual earnings if they are lower.

The annual allowance includes your own and your employer’s contributions into a pension, and the tax relief itself.

The fact you get tax relief at your highest marginal rate means higher earners in particular should look to take as much advantage as makes sense for their finances.

4. Take full advantage of pension tax relief

There are questions over whether the Government might move from a system of tax relief at your highest marginal rate, to a flat rate. This could be set to match the basic rate – or slightly higher.

If you are a higher or additional rate taxpayer, you were planning to pay more into your pension in the current tax year, and if you are worried about changes to the pension tax relief regime, it’s a good idea to make the most of the system as it currently stands.

Make a contribution to your pension in the coming weeks. This means you can benefit from the higher rates of relief on offer.

5. Work out how best to mitigate inheritance tax

There have been suggestions the Government might set some sort of lifetime cap on gifts under inheritance tax rules, or remove the taper relief on large lump sum gifts.

There’s a risk it could persuade people to hang onto their assets, for fear they might bust the cap on lifetime gifts.

Conversely, they might rush into giving gifts they can’t afford, before they are ready to make them, in an effort to get in ahead of rule changes.

Don’t be tempted into making mistakes due to worry about the Budget – take steps you won’t regret

If you’re worried about the best approach, and don’t know how much you can afford to give away, this is one of the times in life

when it is worth doing some proper, long-term inheritance planning.

Getting financial advice can offer real peace of mind. Advisers can help you understand all your assets, and how much of them you will need during your lifetime.

6. Give a child a leg-up in life

If it makes sense for you to give gifts to family to cut inheritance tax, you can consider the most tax-efficient ways to do it. A Junior Isa can be given to any child under the age of 18.

It counts as being given away now for tax purposes, but will be locked away until the age of 18, when it belongs entirely to the child. At that point it rolls over into an adult Isa, where it can continue to grow tax free.

A Junior Sipp (Self-Invested Personal Pension), meanwhile, is an opportunity to help the child get an invaluable head start on their pension planning.

You can pay in up to £2,880 a year and they’ll get tax relief to top it up to £3,600 – despite the fact the majority of children don’t pay tax.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you