Share this @internewscast.com

Nvidia might hold the title of the most valuable company globally, reaching an unprecedented $4.395 trillion in market value recently, but in terms of stock growth, Build-A-Bear Workshop surprisingly eclipses it.

Build-A-Bear’s stock skyrocketed over 2,000% in the last five years, placing it among the world’s top 20 companies by share growth, as reported by The Washington Post. Currently, its shares have increased by more than 60% this year alone. According to the second-quarter earnings report as of August 2, Build-A-Bear’s total revenue reached $124.2 million, marking an 11% rise from the same period the previous year. This second quarter was the most profitable in the company’s history.

Build-A-Bear’s impressive stock growth outpaces major tech giants, including Nvidia (whose stock rose over 1,300% in the past five years with a current year increase of over 30%), Microsoft (which saw a 147% increase over five years), and Oracle (whose stock grew by 444% during the same time frame).

In Build-A-Bear stores, customers engage in a personalized experience by stuffing a plush toy, adding a heart, and dressing it. Founded in October 1997 in Saint Louis, Missouri, this unique in-store experience has remained a cornerstone of the brand since its inception.

CEO Sharon Price John, appointed in 2013, shared with CNBC that making a bear is “a really emotional, memorable experience that creates a tremendous amount of equity.” The in-store experience plays a significant role in the company’s longevity, even as other mall retailers like Claire’s close many outlets.

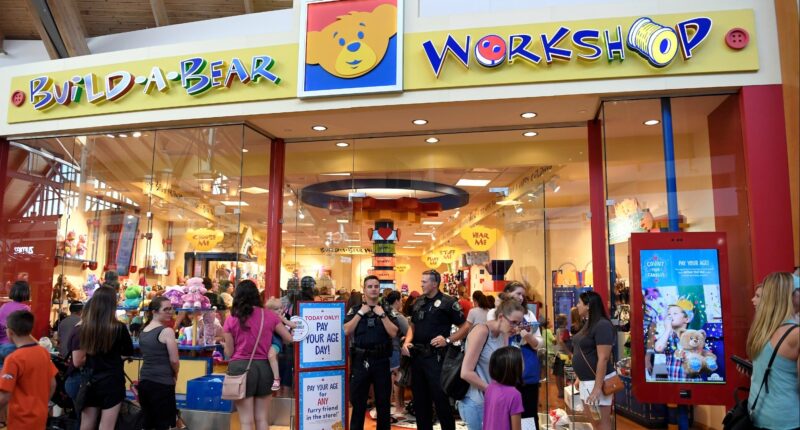

Build-A-Bear Workshop in Denver, Colorado. Photo by Joe Amon/The Denver Post via Getty Images

Build-A-Bear Workshop in Denver, Colorado. Photo by Joe Amon/The Denver Post via Getty Images

“Those strong feelings that consumers have for brands are very stretchable beyond just that one experience,” John told the outlet.

Americus Reed, a Marketing Professor from the University of Pennsylvania, told CNBC that the “ritualistic” process of crafting a stuffed animal at Build-A-Bear ensures a lasting experience that is “really hard to replicate.” Build-A-Bear forges a deeper connection with customers, fostering loyalty, Reed elaborated.

Zach Wray, a customer whose family has hundreds of bears, told The Washington Post that the experience of creating a stuffed animal is what keeps his kids coming back to Build-A-Bear.

“They make it really special for the kids,” Wray told the outlet.

Nostalgia also plays a role in the company’s growth. A recent survey released by Build-A-Bear earlier this month shows that 92% of adults still have their childhood stuffed animal, and nearly 100% say that teddy bears are for all ages. Two-fifths (40%) of Build-A-Bear’s customers are adults, not kids, according to The Washington Post.

Build-A-Bear has 627 stores across 32 countries, 100 of which opened within the past two years. The company told The Washington Post that it plans to open 60 more locations this year, and that almost all of its stores in North America were profitable.

Nvidia may be the most valuable company in the world, surging to a record-high $4.395 trillion market capitalization over the past few months, but when it comes to stock growth, one surprising company has it beat: Build-A-Bear Workshop.

Build-A-Bear’s stock grew by more than 2,000% over the past five years, making it one of the top 20 companies in the world by share growth, per The Washington Post. Company shares are up over 60% year-to-date at the time of writing. According to Build-A-Bear’s earnings report for the second quarter ending August 2, total revenue hit $124.2 million, an 11% increase from the same period last year. It was the company’s most profitable second quarter in its history.

Build-A-Bear’s stock growth beats the world’s biggest tech giants, such as Nvidia (surged by over 1,300% in the past five years, with shares up over 30% year-to-date); Microsoft (stock grew by 147% across the past five years); and Oracle (stock swelled 444% across the same time period).

The rest of this article is locked.

Join Entrepreneur+ today for access.