Share this @internewscast.com

While there are no additional superannuation hikes on the horizon, ASFA CEO Mary Delahunty expressed optimism to SBS News, citing “strong” investment returns and a “maturing” superannuation system as key drivers for healthier balances.

“If you consider your investments over a 30-year span, superannuation funds have consistently delivered average annual returns of approximately 7.5%, even when factoring in the downturns from the Global Financial Crisis and the COVID-19 pandemic,” Delahunty explained.

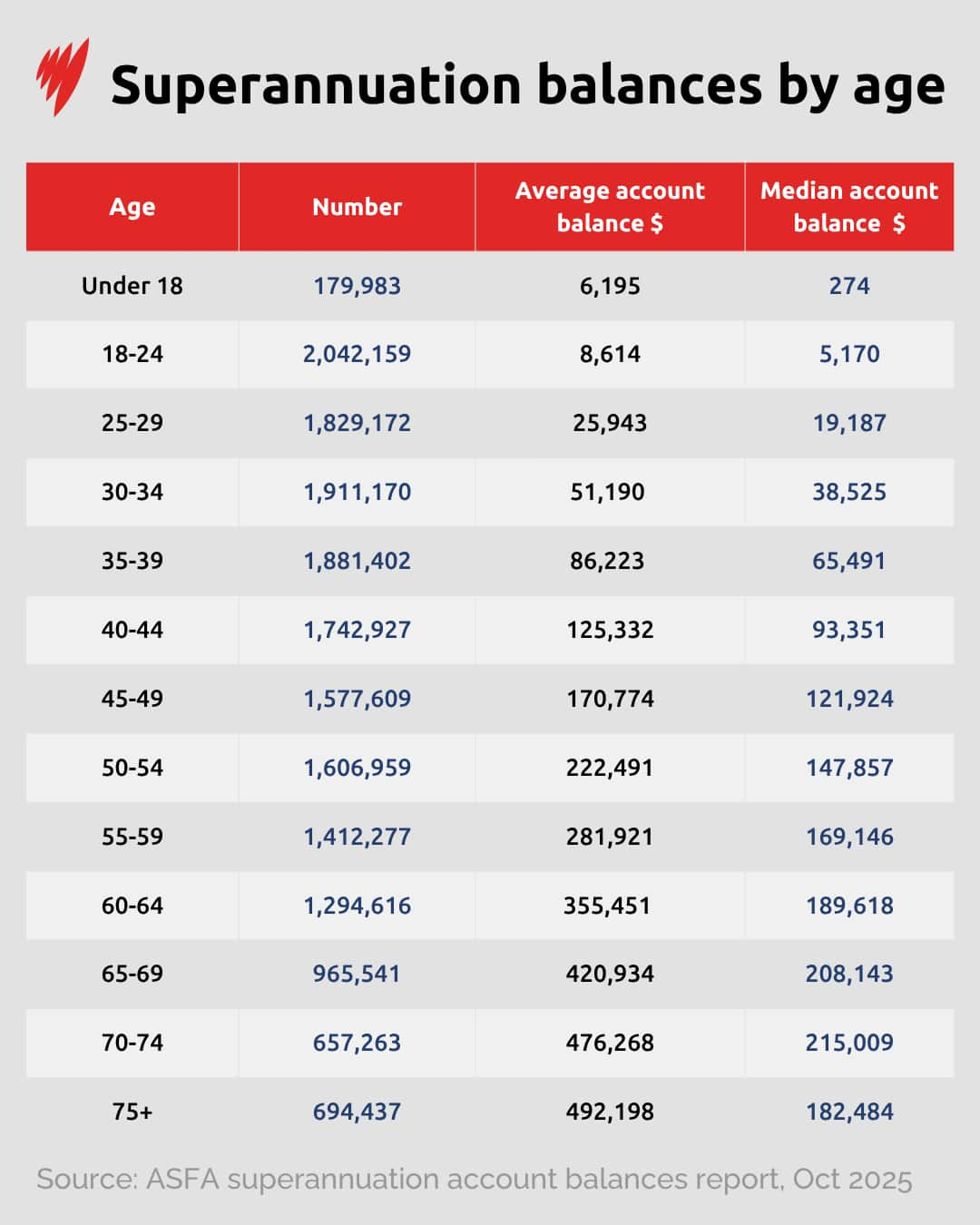

As of June 2023, data indicates that Australians approaching the typical retirement age, notably those between 60 and 64, possess an average superannuation balance of $355,451.

Delahunty noted that while these figures represent robust balances, examining the median balance provides a more precise reflection of how the majority of Australians are managing their superannuation savings.

The average superannuation for an Australian nearing typical retirement age, from age 60 to 64, is $355,451.

Delahunty said these are strong balances, but looking at the median, or midpoint, value can give a more accurate description of how most Australians are faring.

And someone aged between 70 and 74 years old has a median balance of $215,009 in their superannuation account.

How are people funding their retirement?

The result is that the super system has generated around $1 trillion in additional household savings that Australians wouldn’t otherwise have, Delahunty added.

Where are the gaps?

Women now hold 43.6 per cent of the total superannuation assets, up from 41.9 per cent five years ago.

“Meanwhile, younger towns like Darwin tend to have lower balances as workers haven’t had as much time to build up their savings.”

Proposed changes to superannuation in the works

The changes include the removal of tax on unrealised capital gains, which Treasurer Jim Chalmers said “was a genuine sticking point” for critics, hoping its removal will mean “no excuses but to support” the changes.