Share this @internewscast.com

VyStar Credit Union is alerting its members to be vigilant during the holiday season, a peak period for scammers taking advantage of increased shopping activity.

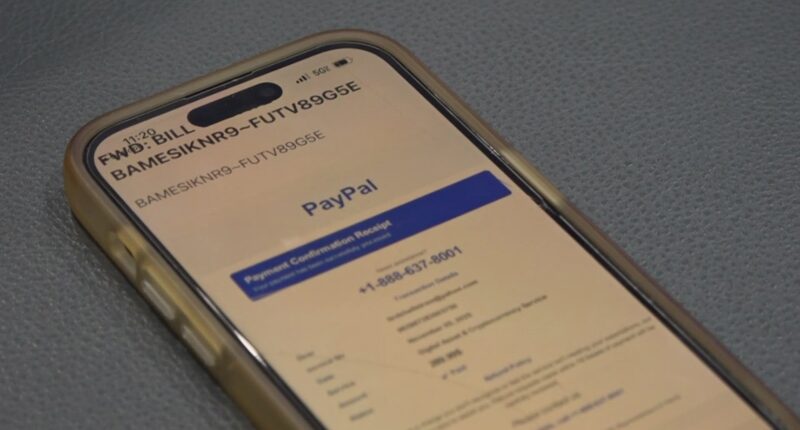

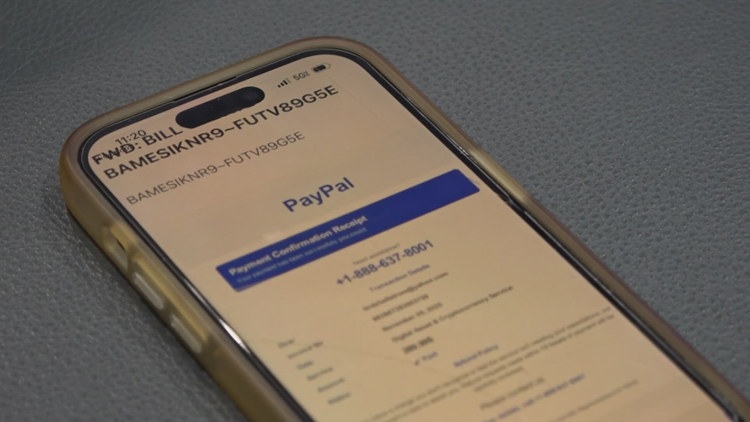

JACKSONVILLE, Fla. — Just last week, Lindz Hellstrom, a VyStar customer, received an email from an imposter posing as PayPal, prompting her to visit her local branch. Had she engaged with the fraudulent message, her accounts might have been at risk, according to the branch staff.

“I noticed something that seemed suspicious. It appeared to be a PayPal advertisement, but I decided not to interact with it,” Lindz remarked.

The email’s urgent message with bold letters stating “This is an emergency” was a clear sign to VyStar employees that Lindz was among many being targeted by scammers.

“Sadly, she’s not alone. This is a daily occurrence for many people across the nation,” noted Nicholas Shaw, a relationship specialist at VyStar.

Bank representatives report a noticeable increase in scam attempts via text messages, emails, and phone calls over the past few years.

They have had a handful of customers like Lindz Hellstrom come into the bank unsure what to do, especially in Lindz’s situation, where the message urged her to call a number and take action quickly. But that urgency, experts say, is exactly how scammers get people.

“When those things happen, you get nervous. You react. Instead, take a breather. Ask yourself, ‘Did you really make that transaction?’” Shaw added.

For Hellstrom, she says her gut told her not to trust that the message was legitimate.

“It says ‘PayPal payment confirmation receipt.’ And I knew I had not done anything with PayPal for probably 20 years.” Hellstrom explained.

VyStar employees say that her hesitation allowed them to investigate the fake message and even call the number themselves to confirm it was a scam.

“I got to watch someone actually go through the process of catching someone, or something. And I’m glad I came in,” she mentioned.

With the holiday shopping season underway, experts say scam attempts spike, and awareness is your best protection.

“Now more than ever, we want people to be aware of where their funds are being used,” Shaw said.

Just like Hellstrom did, if you get a suspicious message asking you to urgently withdraw money, stop and really analyze the request. Do not click links or call the numbers listed. If you still have doubts, contact your financial institution or the customer service number on the back of your card to verify if the request is real.