Share this @internewscast.com

Business leaders have expressed disappointment with Chancellor Rachel Reeves, asserting that her Budget falls short of her growth-stimulating pledge. Instead of fostering economic expansion, the Budget focuses on raising £26 billion in taxes to support increased welfare spending and enhance fiscal reserves.

Top executives voiced concerns that Reeves has not provided adequate incentives for business growth. The limited relief came primarily from her decision not to impose certain taxes, such as those potentially targeting banks.

Meanwhile, companies are grappling with significant cost increases, including a substantial hike in the minimum wage announced on Wednesday. Additionally, new legislation aimed at strengthening workers’ rights, coupled with last April’s rise in employer national insurance contributions, adds to the financial burden.

The chancellor’s decision to target salary sacrifice pension contributions has also drawn criticism, with businesses warning they are unable to supplement employees’ pension funds effectively.

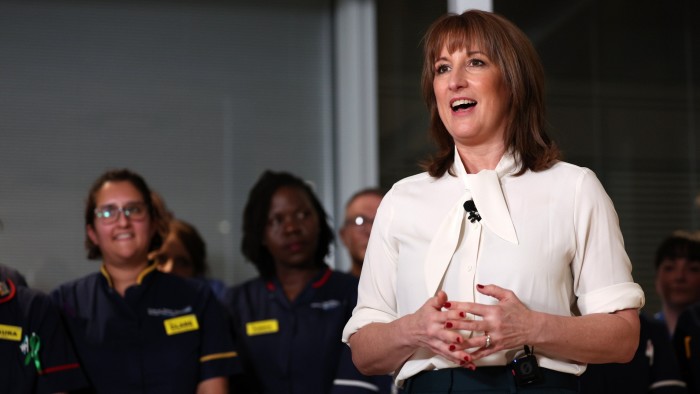

In her inaugural major address, Reeves declared that driving growth would be a “national mission” for the Labour party. However, business leaders see little in the Budget that aligns with her ambitious promise.

Analysis of the language used by Reeves shows her Budget speech on Wednesday appeared to put less emphasis on economic growth than a year ago.

The number of mentions of “growth” nearly halved compared with last year’s Budget, with Reeves using the word 31 times in 2024 and 17 times this year. Instead the chancellor appeared to focus more on the concept of fairness, with variations including “fair” and “fairer” used 17 times this year, up from four in 2024.

Andrew Murphy, chief executive of toy chain The Entertainer, which has 165 stores across the UK, told the Financial Times that the Budget — and its multiple tax-raising measures — was “the least bad that it could be”.

He went on to say that it was “bloody exhausting digesting this smorgasbord of stuff compared to the promises of big reform and big ideas [Labour] gave when they came in”.

Shevaun Haviland, director-general of the British Chambers of Commerce, expressed disappointment the Budget “did not provide a more compelling blueprint to deliver transformational growth”.

One FTSE 100 board director said: “In City terms, this is the chancellor offering a debt restructuring rather than providing an equity story for a listing . . . there was little ‘feel good’ factor.”

A chief executive of a FTSE 250 company added: “There is nothing for growth in this Budget, the only thing they have done is increase the size of the public sector again — which is not the side of the economy responsible for growth.”

The Office for Budget Responsibility said that none of the policy measures in the Budget had a “sufficiently material impact” to justify changes to its forecast for potential growth.

While the fiscal watchdog upgraded its GDP prediction for this year to 1.5 per cent, it went on to cut its outlook for the remainder of its forecast. Growth will be just 1.5 per cent in 2029, below the OBR’s previous prediction of 1.8 per cent in March.

Ministers were frustrated that the OBR refused to score several measures that the government believes will boost growth, including the recent planning and infrastructure bill as well as trade agreements.

One reason for the unusually late Budget was that the Treasury wanted to wait until the planning bill had passed through its final stages, but in the end the OBR took minimal account of this legislation.

Several industries were dissatisfied with Budget outcomes, including retail.

After supermarkets called on ministers to ditch plans for large retail premises to be included in the top band of business rates, the Treasury instead made concessions by setting the so-called multiplier — a key component in calculating the property-based tax — at a much lower level than expected.

However, inclusion of supermarkets’ large premises in the top bracket was meant to fund the government’s promise that it would make a temporary discount on business rates for small retail, hospitality and leisure businesses a permanent arrangement.

By reducing the multiplier for large premises, and therefore raising less in business rates, government documents revealed the discount will now be much smaller for small and medium-sized enterprises.

Alex Probyn of global tax firm Ryan said the proposed business rates settlement meant the average small shop’s bill would rise by between 40 to 65 per cent next April, as the discount drops from 40 per cent to an average of 11 per cent.

Craig Beaumont, executive director of the Federation of Small Business, a trade body, said SMEs would be “disappointed to hear that their bills are going to be higher than thought”.

The Treasury had been leaning on companies to announce supportive investments in response to the Budget if they got what they wanted.

Lloyds Banking Group, Barclays and HSBC, which were spared higher bank taxes, announced shortly after the Budget that they would make billions of pounds of finance available to UK companies and reduce mortgage costs for British households.

Reeves hosted a drinks reception on Wednesday evening with senior City executives, where she said her move to more than double her fiscal headroom demonstrated that she was restoring stability, according to people familiar with the meeting.

In an effort to encourage City figures — who included executives from NatWest, Lloyds, Goldman Sachs and Deutsche Bank — to sell the Budget to investors, she also touted her move to provide a stamp duty holiday to shares in new company listings on the London stock market.

One person briefed on the meeting said the mood among attendees was “a lot more positive and warmer than expected while the chancellor struck a confident tone”.

Another said it was “an obviously tricky Budget that seemed to have landed OK with the market so far. We may have been hoping for slightly stronger signals on addressing spending.”

Meanwhile, Alex Depledge, the government’s entrepreneurship adviser, highlighted the government’s proposals to help entrepreneurs through tax relief.

“Everyone accuses Labour of not having a growth story but this support for our scale-ups is part of the growth story — we need to back founders that are taking risks, building intellectual property and research and development because that’s where the good jobs and growth come from,” she said.

Additional reporting by Stephanie Stacey and Anjli Raval