Share this @internewscast.com

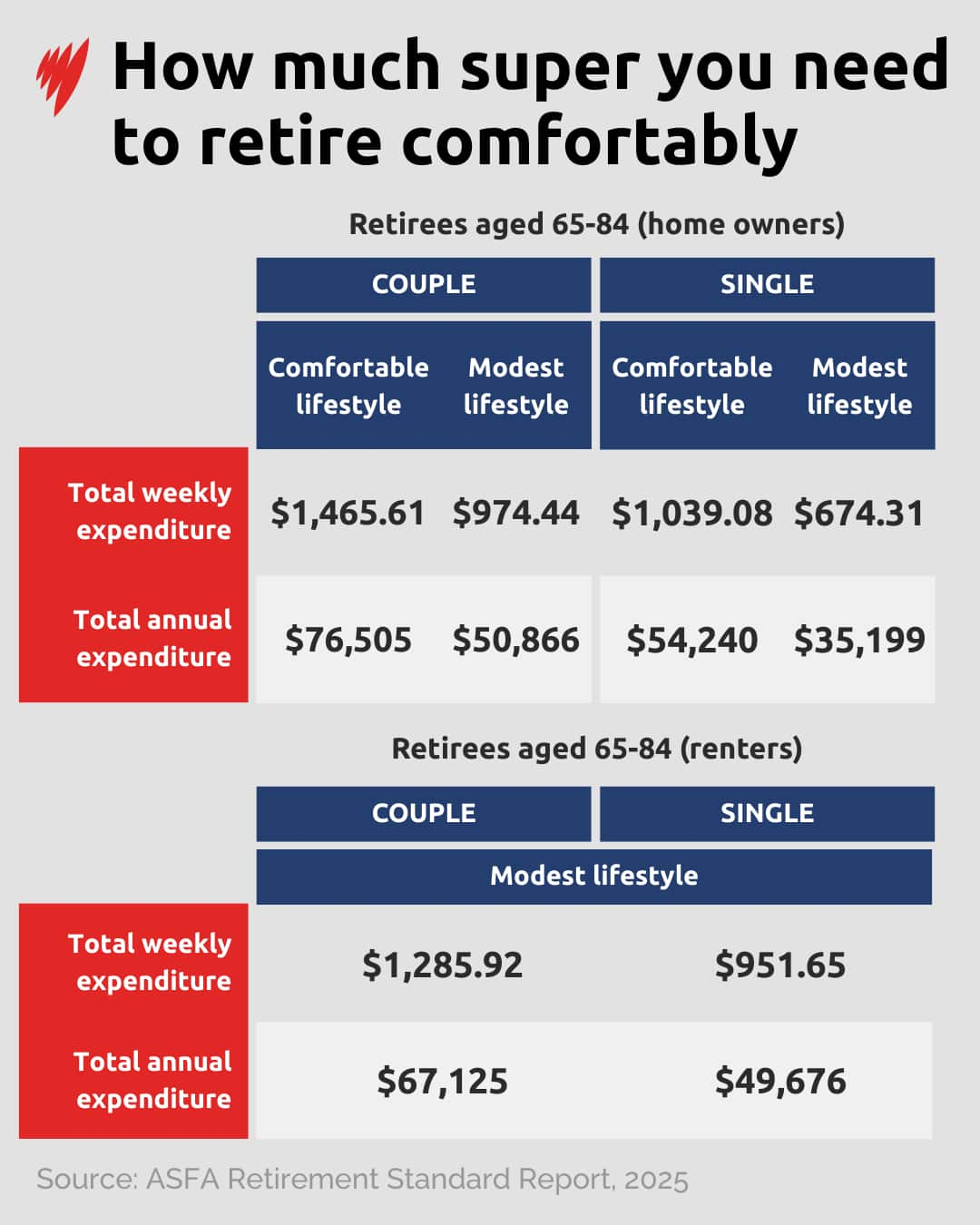

As Australians contemplate their golden years, many may find the financial requirements for a comfortable retirement appear daunting. Recent figures from the Association of Superannuation Funds of Australia (ASFA) highlight this challenge, revealing that a couple aged 65 and over, who own their home, will require approximately $76,505 annually to maintain a comfortable lifestyle. For a single retiree, the estimated annual need is around $54,240.

This financial benchmark has increased by 3.5% for couples and 3.6% for singles compared to last year, a reflection of the ever-climbing cost of living. Such statistics underscore the importance of planning and saving diligently for retirement, as these rising costs show no signs of abating.

For couples, this means amassing a combined sum of $432,000 to ensure they can meet these projected expenses without financial strain. As individuals and families navigate these realities, the figures serve as a reminder of the necessity to prepare thoroughly for the future.

According to ASFA, coupled homeowners 65 and over will need $76,505 each year to live comfortably in retirement, while a single person will need around $54,240 each year. Source: SBS News

That’s an increase of 3.5 per cent and 3.6 per cent respectively compared to this time last year, and it’s directly connected to the rising cost of living.

Couples will need a combined $432,000.

Source: SBS News

In contrast, for those living a ‘modest lifestyle’, the estimated annual budget was approximately $20,000 lower, as they typically spend less on health insurance, cars, and take fewer holidays, among other expenses.

“Pensioners benefit from a bunch of discounts on council rates, electricity, medicines and other benefits that add up to an implicit income of thousands of dollars a year.”

Where have prices risen most?

Meanwhile, the cost of eating out has risen by around 1.3 per cent, while those staying in are paying 9.3 per cent more for media services.