Share this @internewscast.com

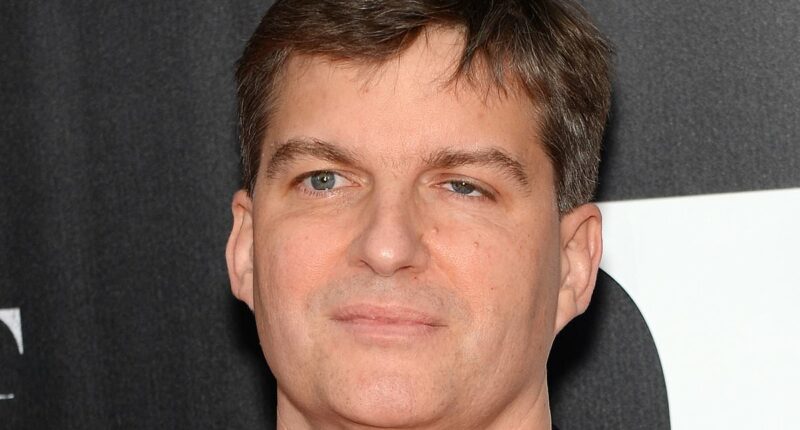

Why should British savers heed the grim forecasts from a Californian doctor with autism, a prosthetic eye, and a penchant for heavy metal music regarding the AI stock bubble? Because when Dr. Michael Burry speaks, the world’s financial markets take note.

Last month, a wave of unease swept through London’s financial district and Wall Street following Burry’s ominous prediction: “I think we are in a bad situation with the stock market. The stock market could be in for a number of bad years.”

During an appearance on the “Against the Rules” podcast with Michael Lewis, the author of “The Big Short,” Burry highlighted two major beneficiaries of the AI craze: Nvidia, a leading computer chip manufacturer, and Palantir, a prominent data analytics company.

The seasoned investor revealed that he has placed bets against these companies, anticipating a significant decline in their values within the next two years.

Burry also expressed his skepticism toward bitcoin, whose value has surged dramatically over the past five years. He dismissed it as “the most ridiculous thing… worse than a tulip bulb,” alluding to the 17th-century Dutch tulip mania. As bitcoin’s price has recently dipped, other experts are questioning whether it has become a ‘digital tulip’ after all.

He also derided bitcoin, whose value has shot up over the past five years, as ‘the most ridiculous thing… worse than a tulip bulb’ – a reference to the Dutch craze for the flower in the 17th century. Bitcoin has recently fallen back, prompting other experts to wonder whether it is indeed a ‘digital tulip’.

Burry argued that this AI bubble ‘looks an awful lot like the dot-com bubble’, which burst in 2000 after years of euphoria about the internet.

And, while on paper, the 54-year-old does not seem like someone whose smallest comment concerning AI would be tracked by investors worldwide – he is in fact legendary for predicting the 2008 sub-prime mortgage meltdown, making hundreds of millions of dollars for himself and his clients while the rest of the financial system went into freefall.

Last month, Dr Michael Burry warned: ‘I think we are in a bad situation with the stock market. The stock market could be in for a number of bad years’

His role in that drama was immortalised by Christian Bale in the 2015 film The Big Short. And the author and podcast host Michael Lewis, for his part, has been a respected chronicler of Wall Street folly and excess since the 1980s era of Gordon Gekko.

So when Burry warns the astonishing surge in AI shares will end badly, big investors take notice, even if they beg to differ.

Concerns about the AI bubble are not new. Hype about AI and its potential to transform business through improved productivity, lower costs and innovation sent some share valuations into the stratosphere.

Nvidia, the chipmaker powering the AI revolution, recently became the world’s first company to hit a stock market value of $5trillion.

But doubts are growing that the technology is turning into a bottomless money pit for investors and that the promised returns on the vast investments being made will prove elusive.

Burry’s intervention has taken that unease up several gears.

His wager against Nvidia was revealed in a US regulatory filing, where he also disclosed a similar bet against Palantir. Neither firm, he pointed out, actually produces AI technology – yet both have become poster children for the boom.

In the case of Palantir, he questioned how its share price growth has made five executives billionaires, on paper at least, even though it has made less than $4billion in sales revenue. ‘You really don’t make anything,’ he said. ‘Just a tiny bit of revenue and yet all these billionaires.’

British savers should be alarmed too, because millions of us are now exposed – often unknowingly – to the whims of these booming US tech giants through our pension funds, Isas and investment trusts. A sharp fall in AI stocks would not stay in Silicon Valley: Its reverberations would soon be felt in the UK.

The venerable Foreign & Colonial trust, for instance, counts Nvidia as its biggest position, though one would never guess from its old-fashioned name.

And if Palantir runs into trouble, the impact in Britain could extend beyond markets: it holds a controversial contract to manage NHS patient records.

A major collapse in AI-linked shares would not be confined to the US markets or to tech stocks. Banks could face rising bad debts, global stock markets would slump and pension pots would shrink.

But before we all head for the hills, it must be said that Burry is far from infallible.

In 2017 he predicted a global meltdown that would trigger World War III, which has not happened yet.

Two years later he warned of a bubble driven by index-tracking funds, which has not yet materialised either. He also bet against Tesla in late 2020 – just before its shares accelerated further.

Palantir’s combative chief executive, Alex Karp, has dismissed him as ‘bat crazy’.

Indeed, Burry has been predicting a crash for years in the US as stocks continue to soar – so much so that the asset manager closed Scion – Burry’s hedge fund – in November.

‘My estimation of value in securities is not now, and has not been for some time, in sync with the markets,’ Burry wrote in a letter to investors.

Cynics may wonder why the normally taciturn Burry chose to make such incendiary comments now.

The podcast where he made his remarks, hosted by the author who made him famous, coincides with anniversaries of both book and film.

All of that might raise the suspicion of publicity-seeking. Burry insists he agreed to appear only after details of his trades spread across social media, and says he has barely spoken in public since a 2012 speech to students at the University of California, Los Angeles. The conversation with Lewis, he suggests, may be his last of its kind.

In truth, he does not need to give interviews to win attention. Investors pore over his regulatory filings for clues to his thinking. His latest quarterly report to US regulators made headlines instantly because of those bearish positions on Nvidia and Palantir.

Burry’s unusual background only adds to his mystique.

Jensen Huang’s Nvidia recently became the first company to have a stock market value of $5trillion

The investor abandoned a career in medicine in 2000 to set up his hedge fund, using a small inheritance and loans from family and friends.

As a toddler he lost his left eye to a rare cancer, retinoblastoma, and he has Asperger’s syndrome.

He says his neurodivergence gave him an investment edge because he can study dense financial documents for hours – the skill that led him to spot fatal flaws in the sub-prime mortgage market. It also, crucially, meant he was not swayed by the common human desire to stick with the herd that has repeatedly proved disastrous on markets.

In the run-up to the 2008 crash, Wall Street banks bundled risky ‘sub-prime’ mortgages into supposedly safe bonds. However, they did not account for the high chance many borrowers would be unable to repay their loans.

Burry persuaded the banks to sell insurance policies against this eventuality, known as credit default swaps, and to sell them to him.

This they did – but for years it appeared he had gravely misjudged the market. His investors rebelled and for many in the market, Burry was a figure of ridicule.

When the bubble burst, those who stuck with him made around $700million and he is reported to have made $100million personally.

That episode points to a key issue: It is relatively easy to spot a market that is over-valued and ripe for a fall, but what is really hard is predicting when the meltdown will come – and getting that wrong can prove costly.

As the economist John Maynard Keynes said: ‘The market can stay irrational longer than you can stay solvent.’

If the sub-prime bubble had taken a bit longer to burst, Burry would just be another casualty of 2008.

This time he admits he does not know when the AI bubble will burst and says the 2008 experience was unique.

He also believes his autism gives him less advantage than it once did, because less money is controlled by human managers, with more in funds that simply track indexes and are controlled by algorithms. Therefore, the ability to see beyond the consensus view does not give him the same edge.

So what should savers do? Burry has owned gold since 2005, regarding it as protection against turmoil (it has soared over 60 per cent in 2025). He believes healthcare stocks are ‘really out of favour’ and may offer value. If you own something that has ‘gone up a lot’ and looks overvalued – a description that fits many AI-related shares – it may be sensible to bank the gains.

Burry’s track record includes moments of brilliance but also some notable misfires. Plenty of experts believe the AI boom has further to run, and that selling out now would mean missing out on more profit.

Investors must make up their own minds – but it is hard to ignore the doctor who diagnosed the last great financial crash.