Share this @internewscast.com

Amid growing concerns of a potential artificial intelligence (AI) bubble, stock prices in the sector continue to climb, driven by enduring investor interest, according to recent research.

Data from the investing information platform Finimize reveals that 60% of investors worry about inflated AI stock valuations, fearing a possible bubble. Despite these apprehensions, the appetite for AI stocks remains strong.

The research indicates that a significant 67% of investors plan to either maintain or increase their investments in AI-related stocks, undeterred by the high valuations.

Furthermore, over 60% of investors expressed optimism, anticipating market growth in the next 12 months.

Major players like Nvidia, Alphabet, Apple, Meta, Microsoft, Tesla, and Amazon, collectively dubbed the “magnificent seven,” currently account for approximately 35% of the S&P 500’s total value, underscoring their substantial involvement in the burgeoning AI industry.

In fact, the technology sector as a whole has been a major contributor to the index’s impressive 16.4% gain this year, accounting for a substantial 49% of the increase.

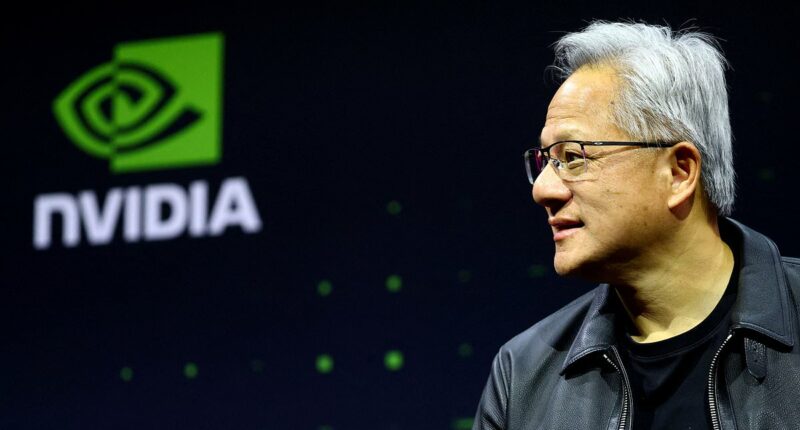

Nvidia chief executive Jensen Huang says expectations are so high that Nvidia is in a no-win situation

In November, chipmaker Nvidia smashed forecasts, posting revenue of some $57billion for the three months ended 31 October, an increase of 62 per cent year-on-year.

The firm earned $31billion in profit, up two thirds on the same period a year ago.

Yet despite over-delivering on earnings, Nvidia shares have slid some 13 per cent in the past month as investors pull back due to bubble concerns.

‘If we delivered a bad quarter, it is evidence there’s an AI bubble. If we delivered a great quarter, we are fuelling the AI bubble,’ chief executive Jensen Huang said.

‘If we’re off by just a hair, the whole world would have fallen apart.’

‘The market did not appreciate our incredible quarter.’

While these firms are leading in the AI race, and Nvidia remains the most popular retail stock pick, there are plenty of other firms that benefit from the rapid growth and adoption of the technology, such as those providing datacentres, energy and cloud computing.

Some 47 per cent of investors said they are favouring these AI infrastructure beneficiaries instead of firms building large-language models.

On top of this, 17 per cent of investors are reducing their exposure to the magnificent seven in favour of alternative AI beneficiaries.

Carl Hazeley, chief executive of Finimize, said: ‘Retail investors recognise that AI stocks are expensive, but they’re not abandoning ship. What’s changing is the mindset – people are holding their positions and managing risk more carefully.

‘They’re thinking beyond the obvious plays that dominated 2025 headlines and looking at where the real value is in the AI value chain.’

While the AI bull run may have faltered, figures show investors are still betting on AI stocks.

According to Robinhood, the ten most traded stocks in November on its UK platform are all AI focused apart from Robinhood itself (in fifth place).

While Nvidia and Tesla made the list, AI infrastructure firms like Mara, Nebius and Iren were all hugely popular.

Finimize says this reflects cautious optimism among investors, with people being more selective when it comes to stock choices.

It said 60 per cent of investors do expect markets to be higher over the next 12 months, but this is down from 67 per cent in the previous quarter.

This also means that investors are reducing their risk exposure, with 30 per cent adding to their cash reserves before investing further.

Just a third, 36 per cent, say they will invest more this quarter than in the last quarter.

Hazeley said: ‘What we’re seeing is retail investors are showing a more balanced approach at record-high markets. They’re building cash and slowing their investment activity, which takes discipline.

‘They’re not abandoning their positions, but they’re not chasing every rally either. They’re waiting for the right opportunities and taking a strategic, long-term approach.

SAVE MONEY, MAKE MONEY

4.52% cash Isa

4.52% cash Isa

Trading 212: 0.67% fixed 12-month bonus

£100 cashback

£100 cashback

Transfer or fund at least £10,000 with Prosper

4.65% cash Isa

.jpg)

4.65% cash Isa

Includes 12-month boost for new customers

£200 cashback

£200 cashback

10% cashback on investments, up to £200

£20 gift card

£20 gift card

Hold £1,000 after three months in Plum’s cash Isa

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.