Share this @internewscast.com

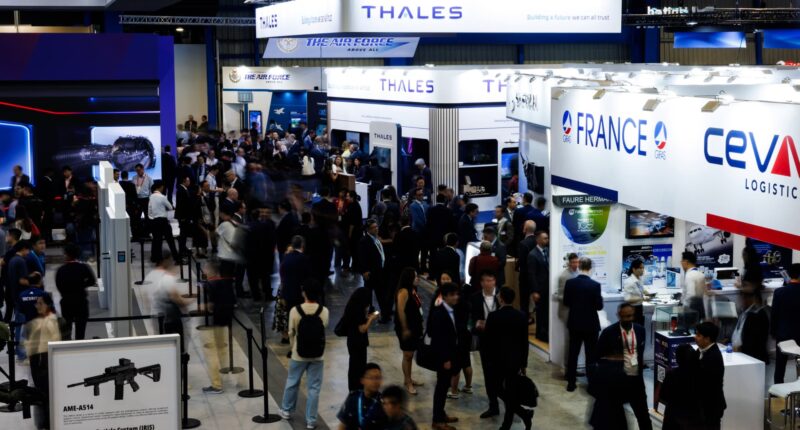

On Wednesday, February 4, 2026, the Singapore Airshow opened its doors to attendees, showcasing the latest advancements in aerospace and defense. The event, which continues through February 8, is a pivotal platform for discussions and deals, capturing the attention of global defense buyers amid growing geopolitical tensions. Photographer SeongJoon Cho from Bloomberg captured the bustling atmosphere under the lens of Bloomberg via Getty Images.

Amid this backdrop of international uncertainty, the focus among defense buyers has shifted significantly towards enhancing national sovereignty. This shift emphasizes the importance of local production, co-development, and control over the software and intellectual property that underpin their defense systems. According to industry experts, these elements of sovereignty are now central to procurement strategies.

As the airshow progresses, executives have highlighted how evolving global alliances and the intensifying rhetoric from major world powers have contributed to this trend. These geopolitical dynamics are prompting countries to seek greater control over their defense capabilities and supply chains.

Pascale Sourisse, the senior executive vice president for international development at Thales, a leading French aerospace and defense firm, expressed this sentiment to CNBC. “There is a notion that is coming around very explicitly … the notion of sovereignty,” Sourisse explained, underscoring the growing importance of self-reliance in defense industries worldwide.

Executives at the show, which closes on Sunday, pointed to shifting alliances and tougher rhetoric from major powers as a catalyst for the trend.

“There is a notion that is coming around very explicitly … the notion of sovereignty,” Pascale Sourisse, senior executive vice president for international development at French aerospace and defense firm Thales, told CNBC.

Sourisse added that this mindset has helped drive defense spending higher as countries conclude they must look after their own security.

Chua Jin Kiat, executive vice president and head of international defense business at Singapore engineering and defense firm ST Engineering, echoed the sentiment, and said that over the last 12 months, U.S. President Donald Trump’s combative stance toward allies has pushed countries to realize that “we may not be able to depend on others.”

Under the Trump administration, the U.S. has pushed its allies to spend more on defense, with NATO committing to spend 5% of their GDP on defense by 2035.

Trump has threatened allies’ such as Canada and most recently Denmark over its territory of Greenland. He has also reportedly said he would sell allies weaker versions of American weapons “because someday, maybe they’re not our allies.”

Chua added that countries are recognizing that old alliances and alignments may not be “so enforceable or relevant” anymore, even organizations such as NATO.

“So you can be a NATO member. But actually, at the end of the day today, what we are seeing is, first and foremost, if I’m Germany, I’m Germany. If I’m Finland, I’m Finland,” he said.

Supply chain resilience

A direct consequence of that shift is a renewed emphasis on boosting supply‑chain resilience. Companies told CNBC they are responding by localizing production, transferring know‑how, or partnering with domestic firms so customers can maintain and upgrade systems without long, fragile supply lines.

Sourisse said Thales is not only marketing its solutions but also planning to localize activities and competencies. The company has set up joint labs in Singapore with local agencies to develop capabilities on the ground.

ST Engineering’s Chua said the company, constrained by Singapore’s limited land area available for large factories, prefers co‑production arrangements overseas.

For example, if ST Engineering can make advanced vehicles in a country with more space for production plants than Singapore, the company would collaborate and teach them how to build them in a co-production effort.

“For many of the big primes, they have to keep their factories at home running. They have got huge production plants, thousands of jobs, and the lights have to be kept on constantly.”

New kids on the block

Sovereignty extends beyond factories to software and intellectual property. Newer firms in the defense tech space are becoming aware of those demands and are structuring deals accordingly.

U.S.- based Shield AI, which develops autonomous warfare systems, signed a memorandum of understanding at the airshow to integrate its Hivemind autonomy software across selected ST Engineering platforms.

Shield AI X-bat flight rendering

Shield AI

The company had earlier in 2025 partnered with the Republic of Singapore Air Force to use Hivemind to enhance the RSAF’s autonomous capabilities.

Brandon Tseng, co‑founder of Shield AI, told CNBC that Hivemind enables other companies and militaries to develop their own artificial-intelligence pilots locally, and Singapore would own that intellectual property.

“They can build AI pilots for whatever they want to do. We don’t own [the IP],” he told CNBC.

Tseng added that while countries will continue to buy some foreign hardware, many want to indigenize critical capabilities such as AI and autonomy.