Share this @internewscast.com

Barclays CEO, CS Venkatakrishnan, commonly known as Venkat, is making commendable efforts to address the lingering shadow cast by the Epstein scandal. However, stakeholders and clients are rightfully demanding more substantial actions.

Barclays’ stock, which had been a source of prolonged disappointment, has experienced a notable upswing, climbing approximately 60% this year. This surge reflects a positive change in the bank’s financial health and investor sentiment.

In a bid to reward shareholders, Barclays is planning to return £15 billion over the next two years. This return will be facilitated through share buybacks and an increase in dividend payouts, signaling confidence in the bank’s future profitability.

Unexpectedly strong profits have bolstered the bank’s standing, and Venkat has recently been in the spotlight, discussing his personal battle with cancer in 2022. He shared his story to inspire and support employees facing similar health challenges, showcasing a compassionate leadership style.

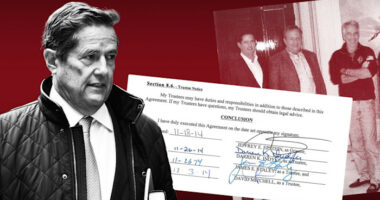

Venkat has publicly condemned the ‘moral depravity’ and ‘corruption’ revealed in the emails linked to Epstein, addressing the scandal with the seriousness it deserves. Yet, these statements alone are insufficient to divert attention from former CEO Jes Staley’s controversial connections with Epstein, nor should they be.

None of this is sufficient to shift the focus from former chief executive Jes Staley and his dealings with Epstein, nor should it be.

Turnaround: Barclays, led by boss CS Venkatakrishnan (pictured), is returning £15bn to shareholders in the next two years through share buybacks and by lifting its dividend

Pertinent questions remain about the erstwhile boss of one of our biggest banks, the full extent of his embroilment with the loathsome Epstein and why on earth the board appeared to ignore loud warning signs.

In particular, there should be a full investigation of Staley’s recruitment and whether sufficient due diligence was performed before he was hired.

Once he was in post, the bank and its top brass appeared to be at pains to defend Staley without proper checks.

Soon after his appointment, he was caught up in a scandal over a whistleblower who wrote to the board raising concerns about a senior appointment.

Staley was fined by City regulators for attempting to unmask the whistleblower but, unusually, allowed to stay in his job.

In the autumn of 2019, Barclays wrote to the City watchdogs playing down Staley’s involvement with Epstein. The missive, approved by Staley, was deemed inaccurate and misleading by the regulator.

Former chairmen John ‘Mac the Knife’ McFarlane, who hired Staley, and Sir Nigel Higgins, who took the role in 2019, need to account for their handling of the former chief executive.

Barclays has a long and shameful history of scandals: Libor interest-rate rigging and the deal with Middle Eastern investors in the financial crisis to name but two.

Venkat’s warm words fall short of the reassurance needed that the bank is fully facing up to the Epstein affair.

Apprentice drive

Halfords, a great British name synonymous with motoring and cycling, is concerned about a shortfall of young apprentices entering the trade, with numbers down by 14 per cent over three years.

To those of my generation, this is sad news. When I was a teen, boys – few girls, back then – aspired to work with cars.

Halfords plans to hire up to 250 apprentices, but there needs to be a much bigger push to revive the noble institution of the apprenticeship, undermined by academic snobbery.

The UK is in the grip of a youth employment crisis. Nearly a million of those aged 16 to 24 are NEET – not in education, employment or training.

Hikes in National Insurance and the minimum wage have made it much more expensive to hire young people.

A Skills Tax Incentive for apprentices would help. A tax rebate equivalent to two days a week of apprentice pay has been proposed by the Jobs Foundation, the Christopher Nieper Foundation (where I am director), and 125 leading employers.

The outlay would rapidly be recouped and turn positive for the Exchequer. If the Government wants to do something positive in the sea of troubles engulfing Keir Starmer, it need look no further.

High hopes

Donald Trump thinks that if Kevin Warsh, the new supremo at US central bank the Federal Reserve, ‘does the job that he’s capable’ of, then ‘we [the US] can grow at 15pc, I think more than that’.

It’s not clear from the President’s remarks what time period he has in mind and they do raise questions over his understanding of the Fed chairman’s job.

This is not to stoke runaway expansion – and at 15 per cent, inflation would almost certainly run rampant – but to provide the conditions for sustainable growth.

Whatever the thoughts behind the remarks, it is an eye-catching number given the US economy has grown on average by less than 3 per cent over the past 50 years.

No pressure, then, Kevin.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you