Share this @internewscast.com

Several utility companies are increasingly looking to “demand response” strategies as a short-term solution, urging businesses to reduce operations during peak periods.

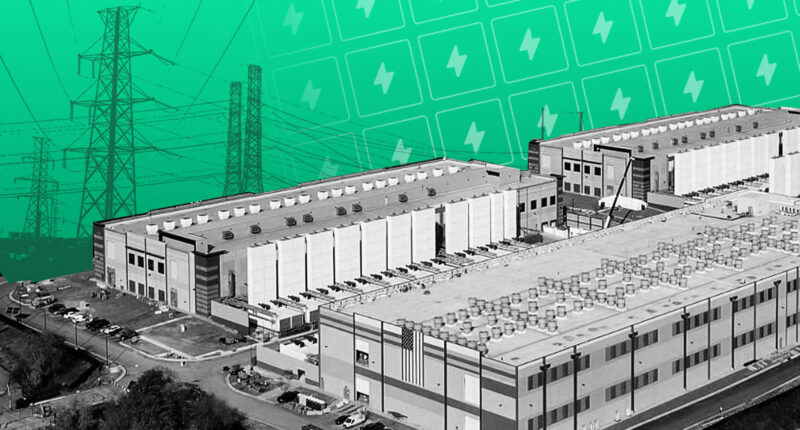

Developers of artificial intelligence models often operate data centers at maximum capacity during “training runs,” where large language models (LLMs) are fed extensive data to enhance their precision. This surge in activity can overlap with other users’ consumption, including households, during high-demand periods, thereby heightening the risk of power outages.

Firms such as OpenAI have petitioned U.S. regulators to expedite interconnection requests for flexible data centers, claiming that this could “lower costs” for all consumers.

“We need to be more intelligent about utilizing the grid’s unused capacity,” stated Daniel Eggers, executive vice president at Constellation, a power supplier serving 2 million U.S. homes and businesses.

Earlier this year, Duke University researchers revealed that if data center operators could limit their consumption just 0.25 percent of the time, the grid could support approximately 76 gigawatts of additional demand. However, they warned that this strategy would not eliminate the necessity for expanding capacity.

Brandon Oyer, head of energy and water for Amazon Web Services in the Americas, noted that while the company could handle temporary curtailments, it does not view sustained reductions as a “smart investment.” He added, “Some customers might be able to tolerate that. Some customers might not. It’s going to be a very nuanced decision.”

A white knuckle ride

The concern for hyperscalers is that this patchwork of measures will not be enough to power data centres coming online over the next few years.

In this scenario, a raft of projects will no longer be viable because they cannot meet contractual commitments. Others will have to simply wait for upgrades to the electricity grid and the construction of new generation capacity to be completed.

In a race between global superpowers, AI could be slowed down by decades old grid infrastructure and a failure to provide adequate capacity.

For some, the power crunch eases concerns of overbuild. For tech companies and the Trump administration, it may undermine billions of dollars in investment.

“We may not get all this done in the timeframe that hyperscalers would like . . . and they won’t be able to interconnect until we’ve got the resources to meet them,” said Nerc’s Robb. “It’s going to be a white knuckle ride.”