Share this @internewscast.com

The property market appears to be stabilizing, potentially paving the way for a gentler outcome as we approach 2026, according to expert analysis.

Despite this, the forecast for the year remains unpredictable, largely hinging on fluctuations in interest rates, noted CoreLogic’s research director, Tim Lawless.

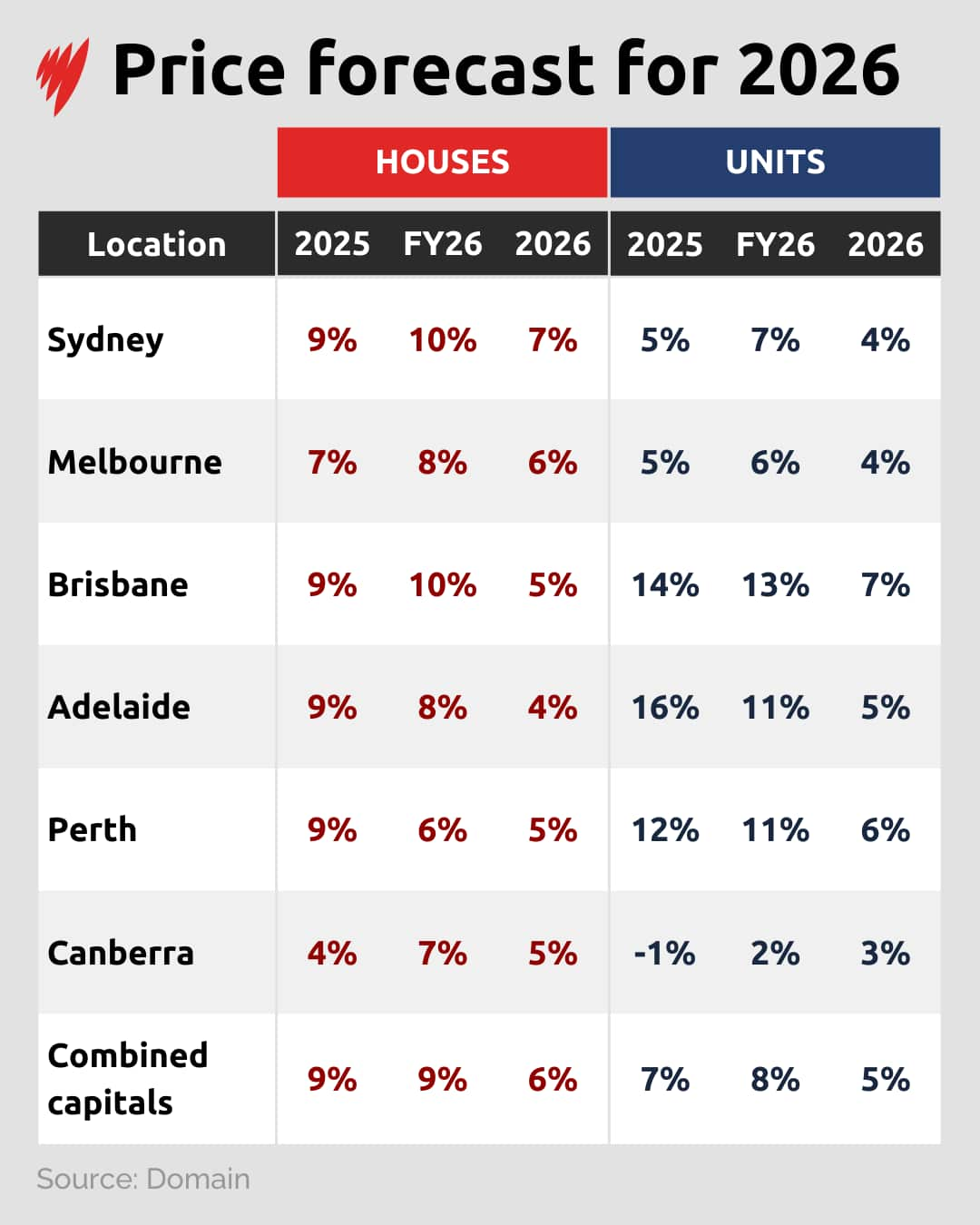

In cities like Brisbane, Adelaide, and Perth, unit prices are anticipated to rise faster than house prices as more buyers gravitate towards cost-effective housing options.

Domain’s latest projections suggest that the median house price across all capital cities is set to climb by 6% by 2026.

Overall, house and unit prices in these urban areas are expected to increase by 6% and 5%, respectively, reaching unprecedented heights by the end of 2026, as per Domain’s analysis.

Reflecting on past trends, Lawless highlighted that in 2025, regional Australia experienced robust growth. However, the most dynamic regional markets are now shifting towards more affordable locations, differing from the pandemic’s top-performing regions.

What will the rental market look like this year?

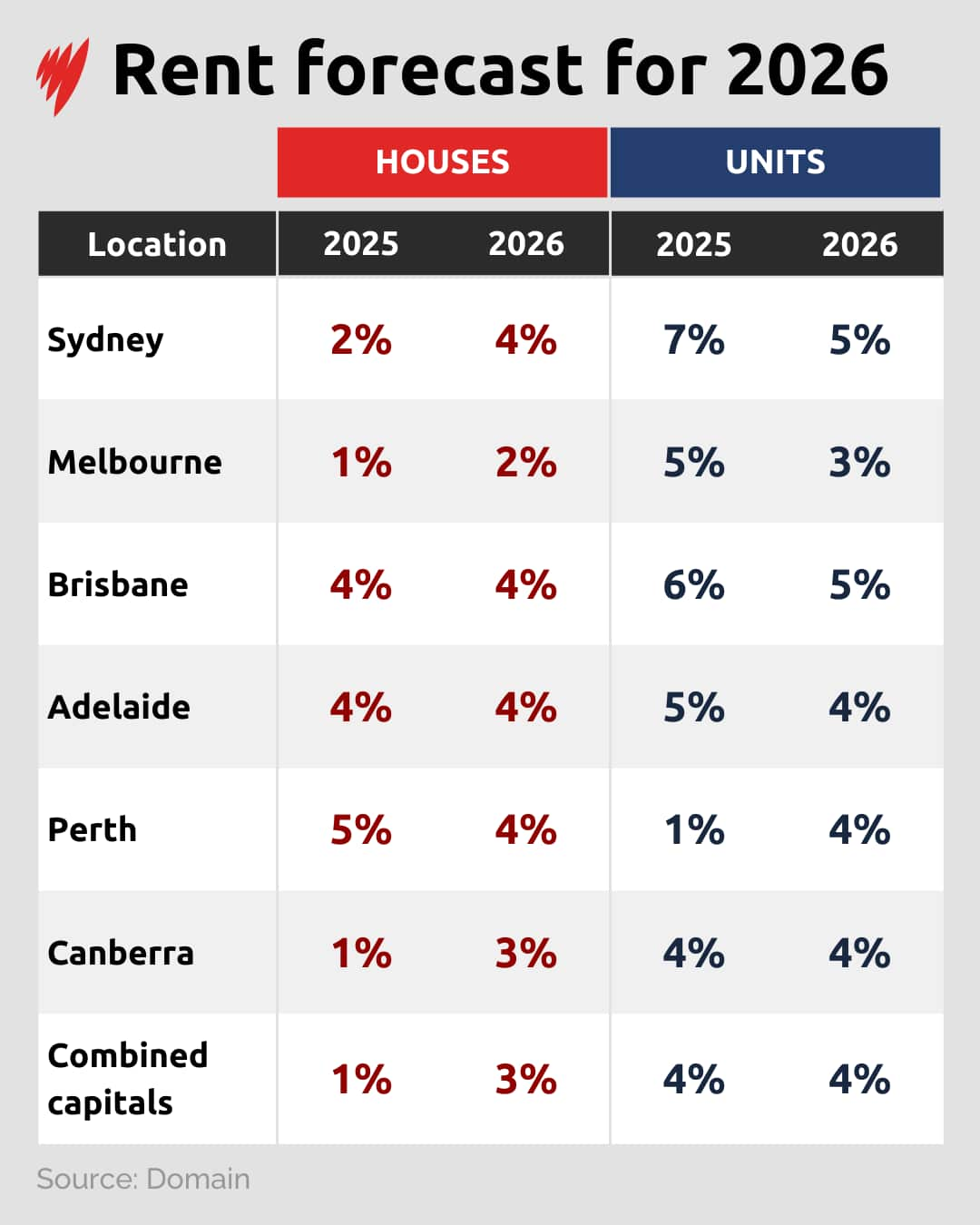

Following years of rises, Perth’s rental market is showing signs of moderation this year.

Rent prices for units are expected to increase more than houses this year.

In most capital cities, unit rent prices are expected to rise slightly faster than house rents, reflecting affordability pressures and stronger demand for smaller, more affordable dwellings.

But Lawless said with vacancy rates nationally at 1.7 per cent, there won’t be much of a rise.

How will policies impact the market?

“Even when we simply split out properties that are above or below the expanded deposit guarantee price caps, it’s really clear there’s been a divergence in growth trends even a month prior to the scheme going live,” Lawless said.

For some jurisdictions, the introduction of policies — such as Victoria’s ban on rental bidding — that protect renters may impact investors seeking to buy.

What are banks predicting?

“Well, clearly, a higher interest rate environment is a net negative for housing markets and housing demand. It probably also sends a bit of a shudder through sentiment, which is really important for housing markets or any sort of purchasing decision that’s on a high financial commitment,” Lawless said.