Share this @internewscast.com

Stay updated with complimentary news alerts

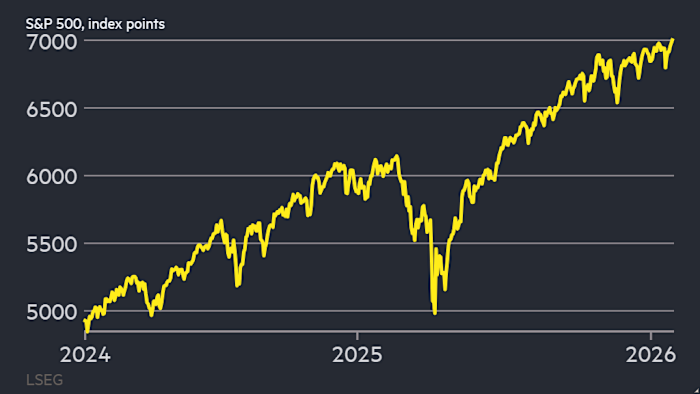

In a historic moment for the financial markets, the S&P 500 surpassed the 7,000-point mark for the first time on Wednesday. This surge came as stocks rebounded following last week’s tumultuous Greenland crisis, redirecting investor focus toward corporate earnings.

The Wall Street index, which has consistently delivered double-digit gains over the past three years, experienced a modest increase of 0.3%, reaching 7,002 points in the early hours of trading.

This notable achievement marks a recovery from the significant dip caused by former President Donald Trump’s tariff threats concerning Greenland, which led to a 2.1% plunge in the blue-chip index in a single session. The rally occurred despite ongoing market instability linked to currency and bond fluctuations in Japan.

Investor sentiment has shifted back to a promising earnings season, with tech giants like Microsoft, Meta, and Tesla set to announce their financial results later on Wednesday, followed by Apple’s earnings report on Thursday.

Technology stocks received a boost following an optimistic sales forecast from ASML, a leading Dutch producer of semiconductor equipment, which anticipates strong demand driven by the AI sector’s growth.

Nvidia rose 1.5 per cent in early trading, while Tesla was up 1.2 per cent ahead of its results.

Analysts at Deutsche Bank are predicting one of the strongest quarters for earnings since the 2008 financial crisis, bar the post-pandemic recovery, in terms of year-on-year growth.

Earnings season was “likely to put a floor under tariff noise”, said Matthias Scheiber, head of the multi-asset team at Allspring Global Investments.

Wall Street analysts are almost unanimously forecasting a fourth consecutive positive year for the S&P, which passed the 6,000 mark in late 2024 and whose gains in recent years have largely been driven by the booming tech sector.

Those predictions have come despite Trump’s erratic policymaking and fears in some quarters that Silicon Valley’s vast AI investments may fail to pay off.

“The S&P 500 just hit 7000 for the FIRST TIME EVER. AMERICA IS BACK!!!” the US president wrote on his Truth Social platform on Wednesday.

Strategists also expect US interest rates to fall, no matter who replaces Jay Powell as chair of the Federal Reserve in May, providing stocks with a tailwind. The Fed is expected to leave rates unchanged at its meeting later on Wednesday.

The Trump administration is rolling back capital requirements imposed on big banks in the aftermath of the financial crisis, which is also expected by analysts to fan economic growth.

Goldman Sachs has tipped the S&P 500 to end the year at 7,600, implying a roughly 8.5 per cent gain, slightly above the average forecast of the other major banks.

“Healthy economic and revenue growth, continued profit strength among the largest US stocks and an emerging productivity boost from AI adoption” would extend the bull market’s run this year, said Ben Snider, Goldman’s chief US equity strategist.