Share this @internewscast.com

Rachel Reeves’s stewardship of the economy becomes more perilous by the day. The Chancellor takes credit for the four interest rate cuts by the Bank of England since Labour took office.

After a calamitous rise in consumer prices in ‘awful April’ the odds on borrowing costs coming down further this year are dented badly.

The return of inflation will not come as an enormous shock. Most households will have seen the brown envelopes from utility suppliers, the DVLA, water companies and the rest, warning of price rises.

All that Reeves has done, with her over-generous pay rewards to public sector employees, is to raise the pain threshold for other working people.

The first and lasting mistake, in the ‘Fixing the foundations’ audit unveiled in July, was to fall into a Treasury trap.

It long has regarded the winter fuel allowance as a gift to the elderly, with too much deadweight. The payment rewarded many people who don’t need it.

Blame game: Chancellor Rachel Reeves says surging UK bond yields are a consequence of global conditions and little to do with domestic policy

It was a pre-packed way of saving the Exchequer £1.5billion. Pensioners don’t think about heating bills in July. But by the time of the local elections it had become an anvil around the Chancellor’s neck.

A second decision in the October 2024 Budget, the rise in employers’ National Insurance Contributions, has come back to bite the Government by raising payroll costs and destroying jobs.

The jump in inflation to 3.5 per cent is not simply down to administered prices, as headlines would suggest.

Core inflation is up and, worryingly, there was a sharp rise in the pace that the price of services is climbing at, from 4.7 per cent to 5.4 per cent.

This is significant because it is closely monitored by the Bank of England where leading hawk, chief economist Huw Pill, is unhappy at the speed of interest rate cuts.

None of this is happening in a vacuum. Bond markets across the globe are in turmoil. There has been a seismic rise in the yield on the Japanese 30-year bond ,which climbed to its highest on record at 3.197 per cent in latest trading.

The yen carry trade – borrowing in the Japanese currency and ploughing the funds into higher-yielding US assets – is unwinding, sending out shock waves.

The American 30-year bond has zipped up to 5 per cent. Reeves likes to argue that surging UK bond yields, now at an alarming 5.53 per cent for the 30-year, are a consequence of global conditions and little to do with domestic policy.

Maybe. But every rise in global yields increases the cost of funding UK national debt and erodes ‘headroom’ for current spending. The doom fiscal and political noose rapidly is tightening.

Spoiled party

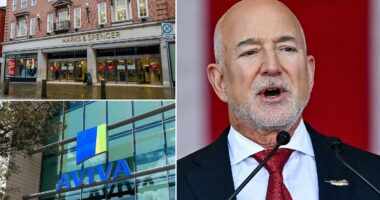

Were it not for Scattered Spider, Stuart Machin and colleagues at Marks & Spencer would be having a celebratory drink.

The long journey back for M&S picked up momentum over the last year with profits up 22.2 per cent at £875.5million, the highest for more than 15 years and ahead of forecasts.

Instead, chairman Archie Norman and chief executive Machin have been in crisis mode since Easter, seeking to overcome one of the most toxic and visible hacking attacks on British commerce and shoppers.

The potential £300million cyber hit to operating profits, though some of it will be recoverable, is a body blow to progress.

And the company doesn’t look likely to be marking a return to £1billion profits in the current year.

Nevertheless, customers and investors will be reassured by the 20 per cent lift in dividend – a signal that it will overcome woes, and confidence in the future.

Full normality for online shopping may not be restored until at least July. M&S is fortunate in the loyalty of its customer base and an enduring reputation for being on the side of quality and innovation.

A 50 per cent stake in Ocado in the UK has meant that not all food customers have been deprived of M&S delights. But a £248.5million write-off of the value of the Ocado holding suggests thwarted ambition.

Homecoming!

Upstart £43billion US online broker Robinhood has hoovered up a whole new generation of investors with its no-commission, social media model.

Now it is heading across the Atlantic and proposes to launch a commission-free Individual Savings Account platform in the UK. Eat your heart out Hargreaves Lansdown, AJ Bell et al.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you