Share this @internewscast.com

Authorities are probing an incident where shots were discharged into a residence while two adults and a young child were asleep.

Law enforcement responded to Janamba Avenue in Kellyville following notifications of gunfire at 3:10 am this morning.

According to NSW Police, the bullets caused damage to the windows of the house.

A man and woman in their 30s were asleep inside the home with a two-year-old child.

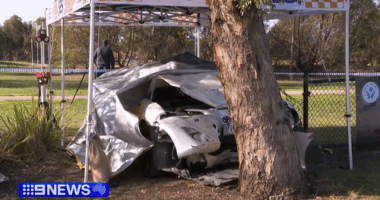

Shortly after, officers were called to a car fire on Gorman Avenue in Kellyville.

Fire and Rescue extinguished the fire, but the vehicle was destroyed.

The fire is being treated as suspicious and inquiries into the shooting are underway.

Sign up here to receive our daily newsletters and breaking news alerts, sent straight to your inbox.