Share this @internewscast.com

“The result is coffee with an exceptional full aroma, and it avoids bitterness,” he mentioned.

Tibor Pinci roasts his beans using a flamethrower and a repurposed cement mixer. Source: SBS / Allan Lee

Born in then-Yugoslavia, Pinci migrated to Australia in 1981. Initially, he lived in Sydney and worked as a baker among other roles, finally moving north and starting his coffee plantation 18 years ago in the hills above Coffs Harbour.

“The coffee we sell here is completely different to the usual big roasters.”

Tibor Pinci started his coffee plantation in northern NSW 18 years ago. Source: SBS / Allan Lee

Small plantations like Pinci’s are multiplying in Australia, as global coffee prices soar.

As a result, most of the coffee sold in Australia is brewed from imported beans, mainly Arabica sourced from Brazil.

Small plantations like Tibor Pinci’s are multiplying in Australia, as global coffee prices soar. Source: SBS / Allan Lee

On 22 April, Rabobank predicted a 13.6 per cent drop in Brazil’s 2025-2026 coffee crop to 38.1 million bags, citing dry weather in key Arabica-growing areas that significantly reduced flowering.

The surge in global coffee prices also adds an incentive for Australian growers to experiment with local production.

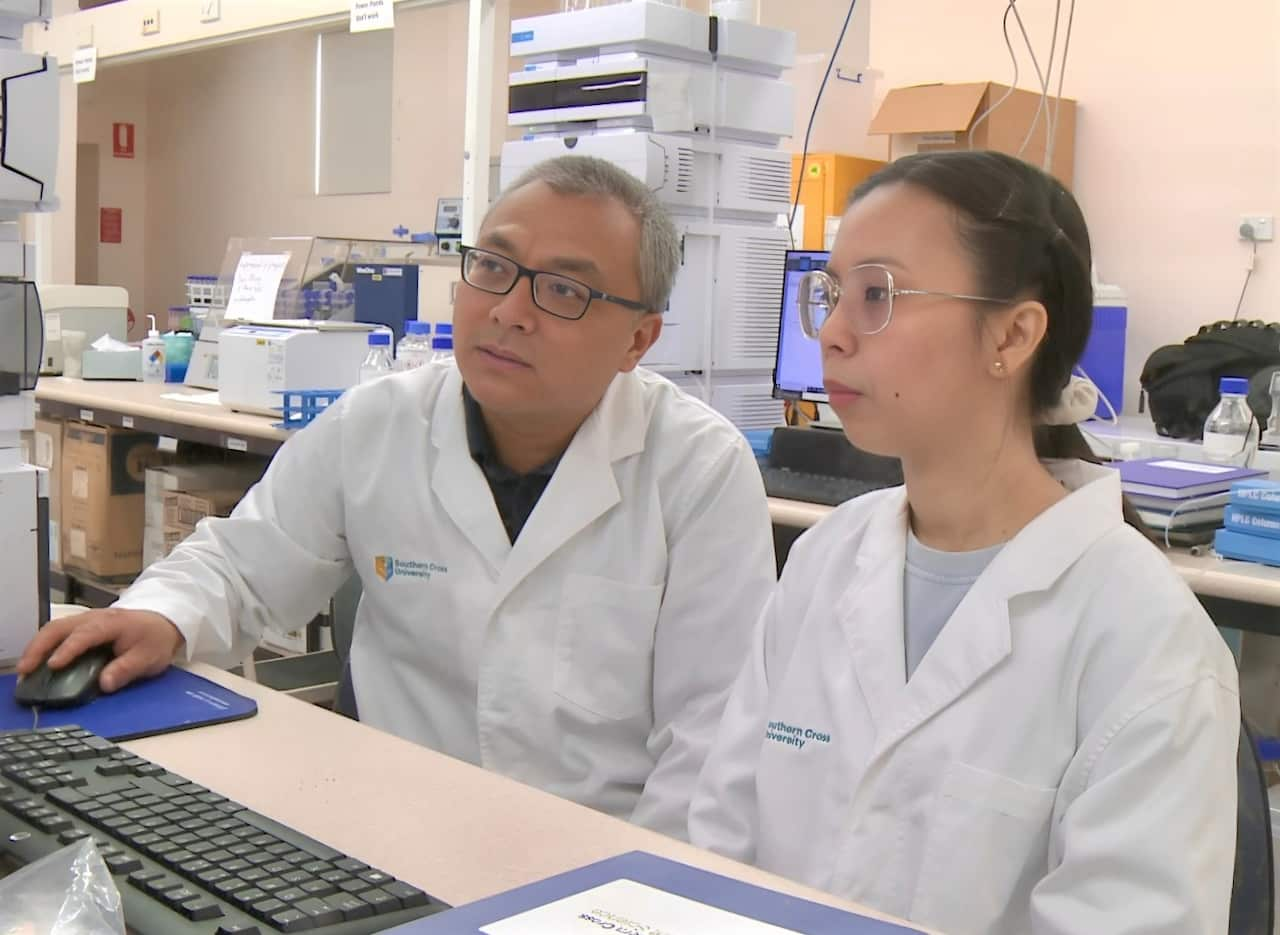

Tobias Kretzschmar, who is a professor of plant breeding and genetics at Southern Cross University, is testing new coffee trees for the country’s producers. Source: SBS / Allan Lee

New coffee varieties fit for Australia

To succeed here, coffee trees must be able to thrive to local conditions.

Scientists are searching for new varieties of coffee crops that are better suited for the Australian environment. Source: SBS / Allan Lee

“Our aim for Australia is to find new varieties that are better suited for this environment and better suited for the mechanised conditions of coffee farming in Australia,” Kretzschmar said.

“So, that means the old varieties require a lot of work and suffer yield losses.”

Most coffee crops in Australia are grown in north Queensland or northern NSW, where warm weather and rain pose challenges. Source: SBS / Allan Lee

Could smaller trees be the answer?

Meanwhile, scientists are experimenting with coffee varieties to discover flavors that appeal to many. For insights, Ben Liu, a researcher at Southern Cross University, referred to a distinctive taste wheel.

Ben Liu, a researcher from Southern Cross University, is experimenting with different coffee styles to discover flavours of mass appeal. Source: SBS / Allan Lee

“Our coffee character wheel basically helps our panel members describe the taste, the flavour, or mouthfeel,” Liu said.

“Based on those characters of the coffee, we can get a better understanding when we’re actually tasting coffee.”

Benefits of locally grown coffee

“This gives you a cup of coffee that was produced within sight of where you’re sitting.”

Cafe owner Kim Towner uses locally grown coffee beans. Source: SBS / Allan Lee

Coffs Harbour cafe owner Kim Towner uses locally grown produce at her business, Happy Frog Cafe.

“And if we can source from our local area, we can make a big difference to how we look after the planet.”

Coffee trees grow vigorously in Australia. Source: SBS / Allan Lee

Pinci is proud to supply to local outlets.

“That, and of course, the precision roasting with the little flamethrower,” he said.