Share this @internewscast.com

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

Even those with strong business acumen can feel overwhelmed in the stock market. With an array of charts, ratios, earnings calls, and the modern-day extreme volatility to deal with, it’s understandable why many individuals steer clear of investing. Nevertheless, by avoiding it, you might miss the opportunity for financial independence or an early retirement.

Sterling Stock Picker removes these obstacles by employing smart, strategic AI that tailors your portfolio to your needs and educates you throughout the investing process. You’ll gain confidence before investing your first dollar and know when it’s the right moment to withdraw. Apply code SAVE20 at checkout to secure lifetime access for $55.19, a significant reduction from the usual price of $486.

How it works: Invest in 3 simple steps

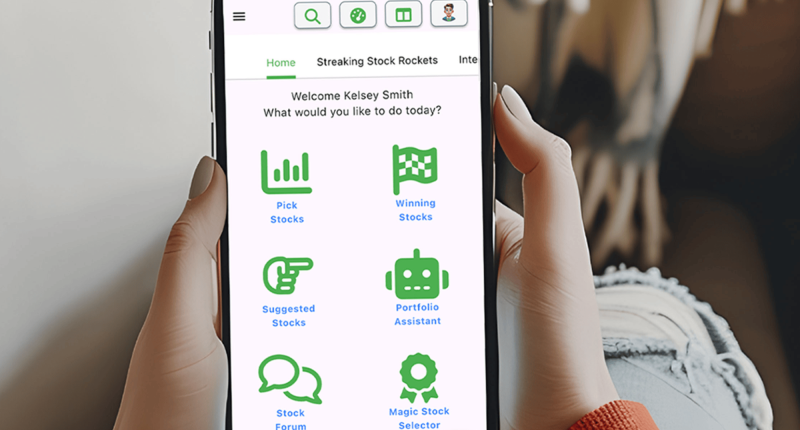

Sterling makes initiating your stock investment journey remarkably easy, even for newcomers. Begin by completing a 5-minute quiz to gauge your risk tolerance, enabling the platform to determine how adventurous or cautious you’d like to be. This guarantees that all recommendations moving forward match your comfort level.

Second, you can use the intuitive stock picker to explore companies that match your values, investment goals, and risk appetite. You don’t need to know what a PEG ratio is or how to read a balance sheet—Sterling does the number crunching for you and gives you a clear “buy,” “sell,” or “hold” recommendation using its patent-pending North Star tech.

Once you’re ready, the platform helps you build a diversified stock portfolio automatically. And if you have questions, like whether a certain sector is a good bet right now or if a trending stock is too risky, you can ask Finley, your built-in AI investment coach powered by ChatGPT. It’s like having a financial advisor and mentor rolled into one.

Whether you’re investing $100 or $10,000, Sterling helps you invest with purpose, clarity, and confidence.

Use code SAVE20 at checkout for a limited time to get a Sterling Stock Picker lifetime subscription for $55.19 (reg. $486).

Sterling Stock Picker: Lifetime Subscription

See Deal

Why this deal is worth it

In 2025, the stock market has been anything but predictable. Between tech surges, inflation swings, and ongoing global shifts, there’s been no shortage of volatility—and with that, opportunity. For self-starters who want to capitalize on market dips and sudden upswings, having an AI stock picking app to guide your decisions is more valuable than ever.

StackSocial prices subject to change.

Even the most business-savvy self-starters can feel out of their depth in the stock market. With charts, ratios, earnings calls, and today’s insane volatility to navigate, it’s no wonder many people avoid investing altogether. However, you may be missing out on financial freedom or an early retirement if you continue to put it off.

Sterling Stock Picker breaks down those barriers using smart, strategic AI that personalizes your portfolio and teaches you while you invest. You’ll feel more confident before investing your first dollar and understand when it’s time to pull out. You can use code SAVE20 at checkout to get lifetime access for $55.19, regularly $486.

How it works: Invest in 3 simple steps

The rest of this article is locked.

Join Entrepreneur+ today for access.