Share this @internewscast.com

How jolly good it is that financial justice has finally caught up with disgraced investment guru Neil Woodford and his irresponsible and deceitful management of the collapsed Woodford Equity Investment Fund (WEIF).

There is satisfaction to be drawn from the ban imposed on Woodford from holding senior management roles and looking after retail investors’ cash.

Moreover, Woodford personally will have to cough up £5.8million in fines and his eponymous investment firm some £40million.

Yet the process of delivering verdicts for Woodford savers (including this writer), which started when Andrew Bailey was chief executive of the Financial Conduct Authority (FCA), has been exasperating.

It has taken six long years to reach this point, and one fears that there will be victims of Woodford’s nefarious behaviour who will have missed out on seeing the regulator swing into action.

And it is not over yet since Woodford, lawyered to the hilt, is taking the matter to the Upper Tribunal, the FCA’s equivalent of the High Court. That means more delays.

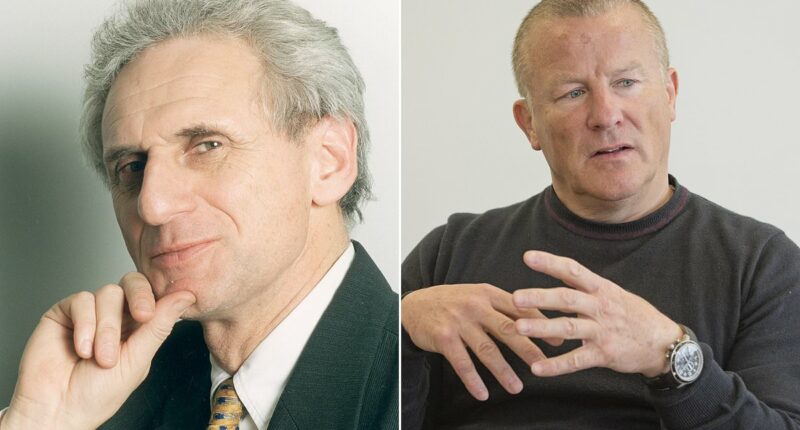

Ban: Disgraced investment guru Neil Woodford (pictured) personally will have to cough up £5.8m in fines and his eponymous investment firm some £40m

Much of the material in the voluminous decision documents relating to Woodford Investment Management and WEIF emerged at the time.

It was known, for instance, that Woodford sought to cover up a lack of liquidity in his funds by transferring assets to the obscure Guernsey stock exchange.

He also sought to shift the blame for what happened to corporate director Link. The FCA found them jointly culpable and Link, now controlled from Down Under, has already paid £230million in restitution for its error.

The rules-based system under which the FCA operates needs to be preserved if retail investors and professionals, such as Kent County Council, are to be protected.

What is intolerable is the bureaucratic faffing which has taken so long to put Woodford in the stocks. In the interim, Woodford still offers his services as a financial adviser.

The FCA has also failed, thus far, to establish how it was that some 300,000 people who invested in Woodford funds were exposed through the Hargreaves Lansdown (HL) platform and its own fund of funds.

HL is now owned by a consortium of private equity investors led by CVC. That is no excuse for escaping culpability and facing up to HL’s responsibility for misleading savers.

Musical chairs

Often it is said that the main duty of the chairman is to fire the chief executive. At Diageo, Sir John Manzoni, who took over as chairman early this year, lost little time in disposing of one of the FTSE 100’s small gang of women bosses, Debra Crew.

Admittedly, at the time, Diageo’s share price was in sharp retreat, falling by 30 per cent.

Authoritative accounts suggest that Crew was ambushed. When she questioned the assertiveness of finance director Nik Jhangiani with Manzoni, she signed her own resignation letter.

The latest results show that, were it not for the Trump tariffs – which cannot be blamed on Crew – the underlying picture was much better than thought with organic sales up 1.7 per cent at £15.1billion.

The vital North American market was still robust with sales up 1.5 per cent. This is despite the trend of Gen Z turning away from alcohol.

Where does this, one wonders, leave Murray Auchincloss, chief executive of BP, in another part of the corporate forest?

New chairman Albert Manifold has ordered a review of the business and costs, and he hasn’t even been seated.

What that means for the sensible Auchincloss strategy, already under fire from activist Elliott, one shudders to think.

Tech leakage

No board of directors would dare turn down a bid premium of 104.9 per cent unless it came from the Ayatollah himself.

So British scientific instrument maker Spectris has been able to sit back as private equity ghouls Advent and KKR fight it out for control, with the latter back in the driving seat.

If the sharp minds at Advent and KKR were able to see the value, where were the British analysts and buy-side investors as Spectris languished in the lower reaches of the FTSE 250?

And doesn’t a Labour government, committed to a high-tech future for the UK, worry about the escape of British intellectual property overseas? It should do.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you