Share this @internewscast.com

Access the Editor’s Digest at no cost

Global financial markets have experienced a significant upswing, fueled by anticipation that Donald Trump and Xi Jinping might agree to prolong their trade truce during a tense meeting scheduled in South Korea this week.

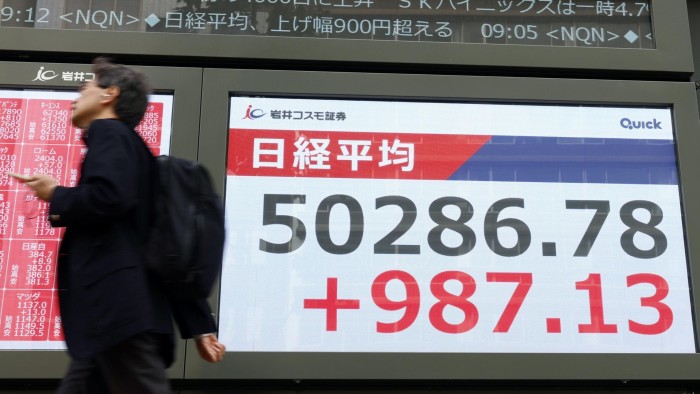

The Nikkei 225 index in Japan soared beyond the 50,000 mark for the first time ever on Monday, while South Korea’s Kospi index rose by over 2 percent, achieving a new record high.

In the United States, futures for the S&P 500 and Nasdaq Composite saw increases of 0.8 percent and 1 percent, respectively. Meanwhile, futures for the Euro Stoxx 600 edged up by 0.3 percent. China’s CSI 300 index witnessed a 1 percent rise, and Hong Kong’s Hang Seng index climbed by 0.9 percent.

Conversely, the price of gold dipped by 0.7 percent to $4,083 per troy ounce, as interest in safe-haven assets waned. Bitcoin, on the other hand, enjoyed a 1.9 percent increase, reaching $115,526 and building on its momentum from the weekend.

U.S. officials are optimistic that China might postpone the introduction of export controls on rare earth elements, following productive trade discussions held over the weekend in Malaysia. The potential extension of the truce, set to expire next month, has buoyed stock markets across Asia, according to Wee Khoon Chong, a senior strategist at BNY. “All indicators suggest that market sentiment is improving,” he remarked.

Three month copper futures rose 0.9 per cent on the improving outlook for global growth. Signs of progress on trade talks has “boosted sentiment across the metals space,” said Daniel Hynes, senior commodity strategist at ANZ.

The Nikkei’s gains were also fuelled by optimism around new Prime Minister Sanae Takaichi’s growth policies.

The Nikkei, made up of blue-chip names, had performed better than the broader Topix, which includes many hundreds of small companies. The performance indicated that the rally was being driven by foreign investors, said Neil Newman, Japan equity strategist at Astris Advisory.

“I think that 60,000 by next summer is entirely doable . . . The rate that the market is moving is something we haven’t seen since the big Abenomics rally 10 years ago. It is all looking very stretched but there is real momentum,” said Newman.

Nicholas Smith, Japan equity strategist at CLSA, said: “Breaking the Big Five-Oh captures the changing of the zeitgeist: breaking 40 last year smashed the curse of the glass ceiling, but the 62 per cent rise from this year’s lows screams that, for the first time in a generation, Japan’s again a place where you can really make money.”

The Nikkei rally, led by a 7.1 per cent rise for defence manufacturer Kawasaki Heavy Industries, followed Friday’s policy speech by Takaichi in which she set out plans to stimulate economic growth and accelerate an increase in defence spending.

That announcement came ahead of Trump’s visit to Japan this week and what are expected to be strenuous efforts by Takaichi to bolster the US-Japan alliance and strike up a friendship with the American president.

US markets hit fresh records on Friday following lower-than-expected inflation numbers, underlining the likelihood of a rate cut by the Federal Reserve this week. “You are in this environment where you see the Fed easing further when there is no recession in the US,” said Frank Benzimra, head of Asia equity strategy at Société Générale. “It has some influence on every other stock market.”