Share this @internewscast.com

Goldman Sachs intends to require junior analysts to confirm quarterly that they haven’t accepted job offers from other companies, as reported by Bloomberg.

This commitment aims to preempt private equity firms, which are capable of providing job offers up to two years in advance of a potential start date. These firms have been known to present positions to junior bankers during or just before their training at Goldman Sachs, utilizing a strategy called on-cycle recruitment.

Goldman Sachs is not alone on Wall Street in its efforts to prevent private equity firms from poaching their staff. Just last month, JPMorgan Chase, the U.S.’s largest bank with $3.9 trillion in assets, issued a warning in a leaked email to incoming analysts, stating that any acceptance of future-dated job offers before their start or within 18 months of employment would lead to termination.

JPMorgan said that the policy was meant to prevent any possible conflicts of interest.

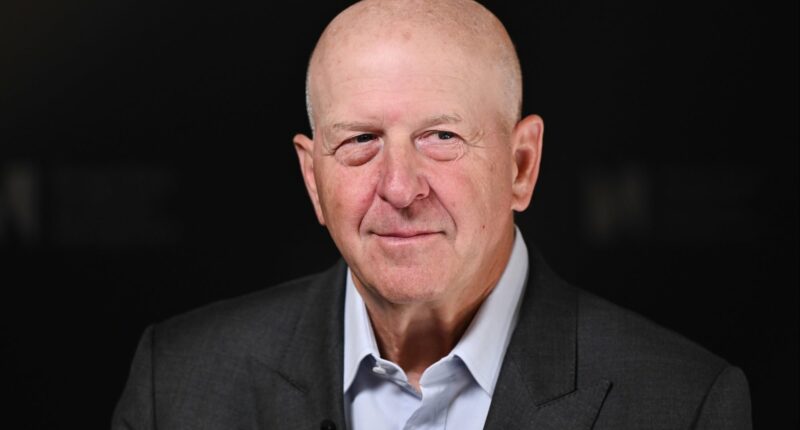

Goldman Sachs CEO David Solomon. Photographer: Naina Helén Jåma/Bloomberg via Getty Images

JPMorgan CEO Jamie Dimon, 69, previously said that the practice of losing talent to private equity was “unethical.” At a talk at Georgetown University in September, Dimon said that moving to private equity puts JPMorgan “in a conflicted position” because staff are already pledged to another firm while they handle confidential information at JPMorgan.

“I think that’s unethical,” Dimon said at the talk. “I don’t like it.”

Major private equity firm Apollo Global Management announced last month that it would not conduct formal interviews or extend job offers to the class of 2027 in response to criticism about the private equity hiring process beginning too early.

Apollo CEO Marc Rowan told Bloomberg in an emailed statement last month that “asking students to make career decisions before they truly understand their options doesn’t serve them or our industry.”

Apollo and Goldman Sachs offer comparable compensation packages. According to federal filings pulled by Business Insider, Apollo pays analysts a base salary of $115,000 to $150,000. Associates make anywhere from $125,000 to $200,000.

In comparison, Goldman Sachs pays first-year analysts $110,000 and first-year associates $150,000. Second-year analysts make $125,000.

Goldman Sachs is planning to ask junior analysts to verify every three months that they don’t have a job lined up elsewhere, in a periodic pledge of loyalty, Bloomberg reports.

The loyalty oaths are meant to get ahead of private equity firms, which can offer candidates jobs up to two years before a potential start date. These firms have been extending offers to junior bankers at the start of their job training at Goldman Sachs, or before they even begin training, in a process known as on-cycle recruitment.

The rest of this article is locked.

Join Entrepreneur+ today for access.