Share this @internewscast.com

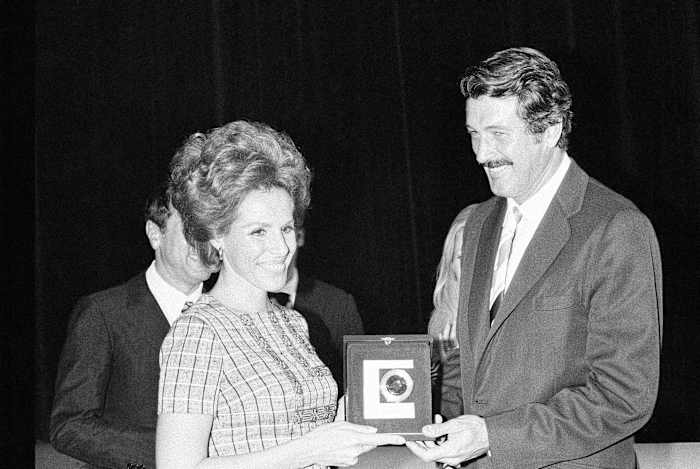

NICOSIA – Ornella Vanoni, the cherished artist renowned for her seven-decade career in music with global hits like “Senza Fine” and “L’appuntamento,” has passed away at the age of 91.

On Saturday, Italian Prime Minister Giorgia Meloni took to X to convey her profound grief over Vanoni’s passing, praising her “distinctive voice” that has profoundly shaped Italian culture across generations. Meloni remarked, “Italy bids farewell to a singular artist, leaving behind an unparalleled artistic legacy.”

According to the Italian newspaper La Stampa, Vanoni succumbed to cardiac arrest at her residence in Milan.

Throughout her illustrious career, Vanoni released over 100 albums, amassing sales exceeding 55 million copies. This monumental success earned her the affectionate title “The Lady of Italian Song,” as reported by LaPresse newspaper.

Born in Milan in 1937, Vanoni initially pursued a passion for theater, which led her to grace the Broadway stage in 1964. However, her deep love for music, coupled with a “highly personal and sophisticated performing style,” as described by LaPresse, spurred her to explore a diverse range of genres from jazz to pop, collaborating with significant songwriters both in Italy and internationally.

Vanoni’s artistic and romantic partnership with the celebrated Genovese singer-songwriter Gino Paoli resulted in the celebrated track “Senza Fine” (Without End), propelling her to international fame in 1961.

Her later collaborations spanned a range of artistic talent including Gil Evans, Herbie Hancock and George Benson, according to Italy’s ANSA news agency.

Vanoni excelled in numerous prestigious music festival awards in Italy, including the country’s most popular Sanremo Music Festival in which she participated eight times, earning second place in 1968 with the song “Casa Bianca.”

Her talent extended into songwriting which was recognized when she twice won the prestigious Tenco Award — the only Italian singer to be awarded the prize as a songwriter and the only woman to have won it twice.

ANSA said Vanoni was much sought-after as a guest on television programs in her later years because of her unpredictable nature, the vast wealth of anecdotes she shared and her “complete indifference to political correctness.”

Copyright 2025 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.