Share this @internewscast.com

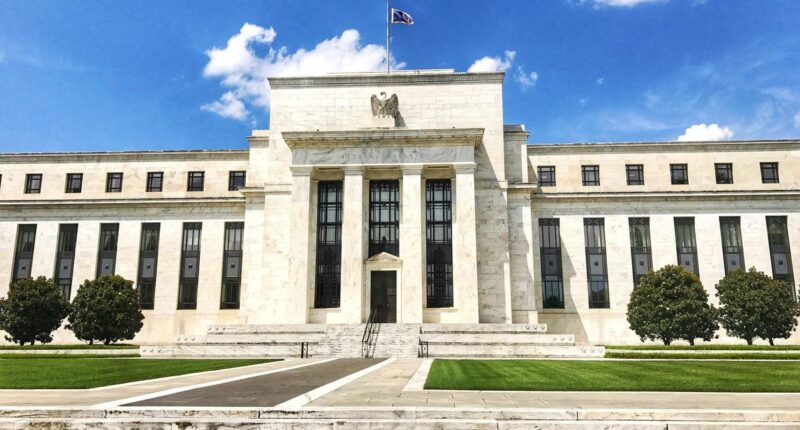

Critical Issues with the current functioning of the Federal Reserve were prominently displayed on Wednesday as Jerome Powell addressed the media following the central bank’s pivotal policymaking committee meeting. This event underscored the urgent need for a significant restructuring of our central bank, as well as a shift in leadership.

The Federal Reserve’s decision to lower interest rates by 0.25% was anticipated. However, Powell’s reluctance to commit to a subsequent rate cut next month caught many off guard. There was widespread belief that the Fed would proceed with another reduction. Powell highlighted the prevailing uncertainty and confusion surrounding the economic outlook, exacerbated by the absence of certain economic data due to the government shutdown. While consumer spending appears robust, labor markets show signs of instability. In Powell’s words, “What do you do when you’re driving in the fog? You slow down.”

Unfortunately, this “fog” epitomizes how the Federal Reserve—and many other central bankers and economists—view the current economic climate.

Here is where the central bank’s approach is misguided: The Fed clings to the mistaken notion that economic prosperity inevitably leads to inflation. It harbors an unusual aversion to a thriving economy, fearing that such dynamism will drive prices upward. The Fed seems to have overlooked the fact that price fluctuations indicate consumer preferences. Without prices that accurately reflect supply and demand, the economy cannot function efficiently. Efforts by the Fed to suppress price movements only distort the marketplace.

Money serves as a unit of value, much like a thermometer measures temperature. The Fed’s primary responsibility should be to ensure a stable dollar. The dollar’s value should be as constant as the number of inches in a foot. Yet, Powell did not address the currently weak dollar, an indicator of potential future issues. The central bank should refrain from attempting to manipulate economic activity.

Another issue highlighted during Powell’s press conference was the bloated size of the Federal Reserve’s securities portfolio. Although its scale has decreased from pandemic peaks, it remains significantly above pre-Covid levels and is now approximately eight times larger than before the 2008–09 financial crisis. During that period, the Fed injected the banking system with reserves without retracting them once the crisis subsided. Prior to 2008, the Fed’s balance sheet represented 6% of GDP; today, it stands at 21%.

Another flaw Powell’s presser highlighted was the obese size of the Federal Reserve’s securities holdings. Though the amount has come down from pandemic highs, it’s still far above pre-Covid levels and some eight times higher than it was before the crisis of 2008–09. Back then, with no discussion, the Fed flooded the banking system with reserves and didn’t remove them when the crisis receded. Before 2008, the Fed’s balance sheet came to 6% of GDP; now it’s 21%.

Powell declared on Wednesday that the Fed will no longer be reducing the size of its balance sheet—with no credible explanation. The real reason is purely for power: An institution that holds $6.6 trillion in securities has immense sway in the financial marketplace. It affects which sectors can get credit more easily than others. No bureaucracy surrenders such power voluntarily.

By the way, around 40% of the reserves the Fed pays interest on are from foreign banks. American taxpayers are subsidizing foreign-owned banks.

A subject that didn’t come up at Powell’s presser was how the Fed arrived at the 2% inflation goal. Actually, it was pulled out of thin air.

The flaws in the Fed demand a fundamental change. A new leader is needed. Now.

And who will that new leader be? Current Treasury Secretary Scott Bessent.