Share this @internewscast.com

Britain should become a shareholder democracy, or so Rachel Reeves has decreed. The Chancellor wants to change the ‘negative’ narrative around investing in the stock market so that more of the nation’s £360 billion stash of cash Isa savings is invested in shares.

She has a point. The stock market accounts for just 8 per cent of Britons’ wealth. Among Americans, it’s 33 per cent.

At last week’s Mansion House speech in the City, Reeves said: ‘For too long, we have presented investment in too negative a light, quick to warn people of the risks, without giving proper weight to the benefits.’

One of those often overlooked ‘benefits’ is the right of share owners to hold the boards of companies they own to account.

And the forum to do that is the annual general meeting (AGM).

Before Covid, AGMs generally were done in person, often over a cup of tea, a few curly sandwiches and a Rich Tea biscuit.

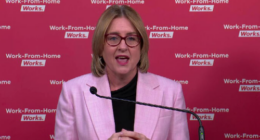

Shut out: Members cannot quiz Debbie Crosbie face-to-face over £7 million pay

Turnout might have been low, and board directors may have had to smile through gritted teeth as they answered seemingly innocuous or irrelevant questions, but it was a small price to pay to maintain a fundamental principle.

Since the pandemic, most firms have adopted a hybrid model, giving investors the choice of either watching AGMs online or physically turning up as they used to do.

But in recent years, some firms have effectively barred their owners from attending in person by making meetings virtual only. This robs shareholders of a chance to engage with directors face-to-face and gives companies more scope to control proceedings.

Drug giant AstraZeneca, defence contractor BAE Systems and toothpaste-maker Haleon have all moved AGMs to what amounts to a digital-only format. The National Grid banned journalists from dialling in to observe the online action.

Last month, the entire board of Informa even decamped to the sun-drenched French Riviera for its AGM, meaning UK-based share owners of the events organiser would have had to shell out the best part of £1,000 to attend. Campaigners say firms are doing this to suppress scrutiny, debate and dissent, in a blow to shareholder democracy. And it is not just companies whose shares are listed on the London stock market moving their AGMs to digital-only.

Nationwide, Britain’s biggest financial mutual, is also under fire for not allowing any of the 16 million members who own the building society to attend this coming Friday’s AGM in person, leading to charges that bosses are not being held to account.

And there is much to discuss.

Members will be asked to approve a controversial plan to hand chief executive Debbie Crosbie a pay package of up to £7 million. It comes as Nationwide is still swallowing Virgin Money after a £2.9 billion deal – the biggest in banking since the financial crisis – which the mutual’s members did not get to vote on.

Small wonder critics say Nationwide is becoming more like the shareholder-owned High Street banks it parodies in ads fronted by actor Dominic West.

For its part, Nationwide says it has seen ‘a significant increase’ in attendance and engagement since moving to an online format in 2023, reversing a previous decline.

But campaigners such as James Sherwin-Smith, who tried to stand for election to the society’s board, remain unconvinced. He said: ‘Nationwide is the only building society to go virtual-only. It’s not a great look for a supposed ‘beacon for mutual good’.’ He also notes that attendance at Nationwide’s online-only AGM last year fell.

The move to virtual-only meetings is shrouded in uncertainty and may even be illegal, according to the Financial Reporting Council, a governance watchdog.

Ministers are under pressure to clarify the law over the physical location of AGMs to halt the shift online. A review is expected soon.

Catherine Howarth of the ShareAction group said: ‘It’s vital the Government and FRC take steps to stop this pattern in its tracks.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you