Share this @internewscast.com

Medline Industries, a colossal name in the medical supplies sector, is gearing up for what is anticipated to be a landmark initial public offering (IPO) this winter, with a valuation potentially soaring to $55 billion. The IPO documents, recently released, also shed light on the remaining stake held by the Mills family, who established the company back in 1910 and managed it across generations until its transition to private equity hands in 2021 for a staggering $30 billion.

According to a new securities filing, the Mills family retains a stake valued between $6 billion and $7 billion. This valuation is based on the disclosed shareholdings of Mozart HoldCo and an anticipated share price ranging from $26 to $30 per share, as estimated by Forbes.

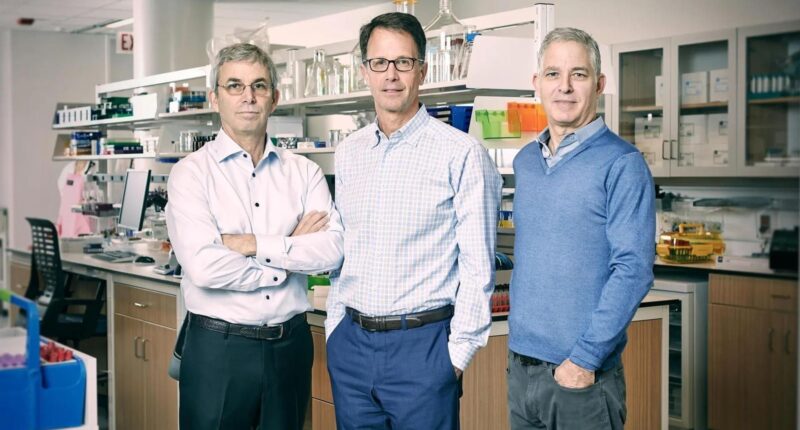

Adding to their financial laurels, the family had previously secured an estimated pretax stake worth $22 billion from the earlier sale. Collectively, this positions the Mills family—comprising Charlie Mills, the former CEO; Andy Mills, his cousin and past president; and Jim Abrams, Andy’s brother-in-law and ex-chief operating officer—with a combined net worth of approximately $20 billion, according to Forbes estimates. This remarkable figure is a significant leap from the $1.1 billion valuation Forbes attributed to them in 2014. Following the 2021 sale, the family established a family office known as Council Ring Capital, and the trio began stepping back from daily operations by 2023.

At this time, Medline has not issued a response to inquiries for comment.

The origins of Medline date back to 1910 when A.L. Mills, the great-grandfather of Charlie Mills, transitioned from Arkansas to Illinois. Initially selling handmade butcher’s aprons to workers in Chicago’s extensive meatpacking sector, Mills soon diversified into hospital garments upon a seamstress nun’s suggestion, marking the inception of their medical business. Over the years, Medline pioneered innovations such as the first surgeon’s gown offering 360-degree coverage, and were among the pioneers in using blue and green fabrics in operating rooms to reduce glare from lights. They also introduced the widely recognized pink-and-blue striped blankets for newborns.

Despite the ubiquitous presence of Medline’s products—from baby blankets to bandages—the Mills family largely remained under the radar until Forbes spotlighted them in 2020 amid the height of the Covid-19 crisis. During the pandemic, Medline’s role in supplying medical essentials to nursing homes, pharmacies, and nearly half of the hospital systems across the nation proved to be a crucial element of the United States’ healthcare response.

Though Medline’s supplies–everything from baby blankets to bandages–are everywhere, the Mills family was largely unknown until Forbes profiled them in 2020 when Covid-19 was at its peak. At the time, its distribution of medical supplies to nursing homes, pharmacies and 45% of hospital systems nationwide was a critical part of the country’s pandemic response.

Then, in June 2021, the family–which had till then owned 100% of the company–sold a majority stake to a consortium of private-equity firms that included Blackstone Group, Carlyle Group and Hellman & Friedman, who beat out other blue-chip bidders. In October 2023, current CEO Jim Boyle took on that role, the first non-family member to hold it.

Private-equity ownership has been good for Medline. The company’s sales reached $25.5 billion in 2024, up 83% from $13.9 billion five years earlier. Meanwhile profits rebounded to $1.2 billion last year, compared with a small loss two years earlier.

MORE FROM FORBES