Share this @internewscast.com

St James’s Place has cut exposure to US stocks within its £16.4billion Polaris 4 fund as the wealth manager becomes increasingly wary of the world’s biggest market.

US stocks have endured a rollercoaster 2025 after rebounding from heavy losses suffered in the wake of President Donald Trump’s ‘liberation day’ trade tariffs.

‘It’s difficult to argue that US equities aren’t riskier today than they were in the past,’ Justin Onuekwusi, chief investment officer at St. James’s Place, told This is Money.

‘This isn’t about trying to call the top of the market. It’s about acknowledging that the risk profile of US equities has fundamentally changed.

‘If an investor’s risk appetite hasn’t shifted, it’s hard to justify allocating more to an increasingly concentrated and expensive market.’

The wealth manager has shifted its exposure away from the US, and now holds underweight positions across the board.

Polaris 4 instead holds a significantly higher allocation to Europe and the UK, at 18 per cent and nine per cent respectively

SJP said its underweight position is consistent in all of its portfolios.

For its Polaris 4 fund, part of its flagship Polaris range, this means shifting to a 15 per cent underweight position in US equities.

SJP said this is a deviation equivalent to as much as £2.4billion compared with a market-cap weighted global benchmark.

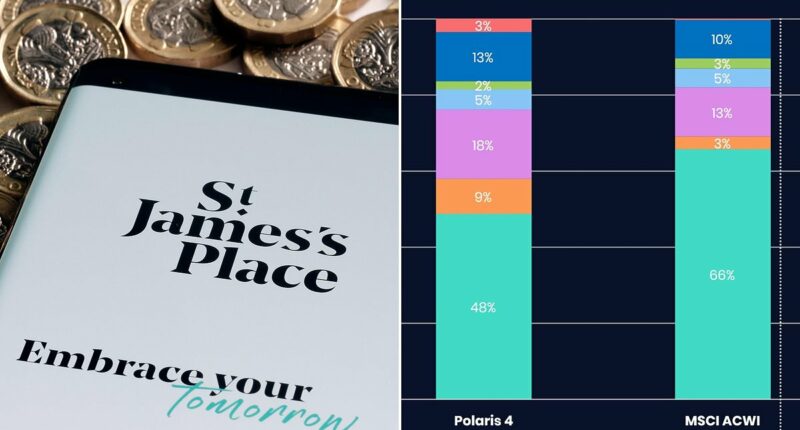

The fund holds a 48 per cent weighting towards the US. Though still significant, this compares to a 66 per cent weighting held by the MSCI ACWI index.

Onuekwusi said: ‘The US remains our single largest regional equity allocation. But given current valuations and concentration, we believe a more balanced, risk-conscious allocation is appropriate.’

Polaris 4 instead holds a significantly higher allocation to Europe and the UK, at 18 per cent and nine per cent respectively, compared with 13 per cent and three per cent for the MSCI ACWI.

Justin Onuekwusi, chief investment officer at St. James’s Place, says US equities are riskier today than they have been in the past

Onuekwusi says the risk associated with the US market has changed, and as a result it is ‘justify allocating more to an increasingly concentrated and expensive market’, if an investor’s risk appetite hasn’t shifted.

He added that the lower weighting towards the US is ‘not just due to political uncertainty’, but ‘a combination of market concentration and stretched valuations across many US companies’.

High valuations in the US market, which accounts for two-thirds of global stocks, has been a topic of market concern for some time.

This week chip giant Nvidia surpassed $4trillion in market cap, meaning that it is worth all of the UK’s publicly listed firms combined.

‘The top 10 US stocks now represent more than a third of the US market, the highest level of concentration in over 60 years,’ Onuekwusi said.

‘Despite some recent sector reclassifications, such as Amazon moving from Technology to Consumer Discretionary, the index remains heavily tech-oriented, reminiscent of late-1990s market dynamics.

‘We are positioning away from US mega-cap stocks in favour of a more balanced exposure to large and small caps – a consistent stance across Polaris 1 through 4.’

The magnificent seven companies, that is Apple, Alphabet, Amazon, Meta, Nvidia and Tesla, currently accounts for almost 34 per cent of the S&P 500’s total value.

Onuekwusi added: ‘Over the past 18 months, while maintaining our US underweight, we have shifted our overweight from Emerging Markets into a broader allocation across the UK and Europe. This repositioning has helped add resilience, particularly during periods of tariff-related uncertainty and in the subsequent recovery.’

He added: ‘Our decision to underweight US equities in Polaris 4 reflects a belief that more compelling risk-adjusted opportunities currently lie outside the US markets. Both our medium-term asset allocation and our bottom-up analysis – driven by our primarily active manager lineup – point to stronger prospects in regions such as Europe, the UK, Japan, and Emerging Markets, where we are currently overweight.

Combined with the US’ higher concentration in global markets, is the large valuations many US equities are exhibiting.

Onuekwusi says valuations are reaching the levels seen during the dotcom bubble, highlighting concerns over their future.

Nvidia, for example, is currently operating on a price to earnings ratio of 32.8, while Amazon is at 32.9 and Tesla operates at an eye watering PE ratio of 132.6.

He said: ‘Investors are paying a premium for future earnings growth, which reduces the margin for error. If that growth doesn’t materialise, share prices become more vulnerable to correction. The higher the valuation, the less cushion there is against disappointment.’

SAVE MONEY, MAKE MONEY

Isa offer

Isa offer

40% off account fees for six months

Fix energy bills

Fix energy bills

Check price cap beating deals with uSwitch

Fee-free Isa investing

Fee-free Isa investing

Free share and ETF dealing, no account fee

5.44% cash Isa

5.44% cash Isa

Rate boosted for three months, then 4.59%

Get £20 off an MOT

Get £20 off an MOT

£20 This is Money Motoring Club voucher

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.