Share this @internewscast.com

Investor excitement over Generative AI is driving a surge in stock prices, fueled by the belief in its potential to revolutionize the economy. While many investors are optimistic, pension fiduciaries, tasked with safeguarding the financial futures of workers and retirees, must remain vigilant. Their responsibilities of prudence and loyalty necessitate evaluating and mitigating risks, and Generative AI introduces significant portfolio-wide risks. One such risk is the U.S. tech industry’s strategy for constructing data centers for Generative AI, which could potentially derail global efforts to transition to clean energy and reduce greenhouse gas emissions.

An energy-intensive building spree

The launch of OpenAI’s Chat GPT-4 in late 2022 sparked a speculative boom in the construction of “hyperscale” data centers. By the end of the decade, capital investments by technology, real estate, and utility sectors are expected to mark the largest private infrastructure spending in history. McKinsey predicts that by 2030, capital expenditures could reach an astronomical $6.7 trillion.

Although estimates regarding the scale of data center construction vary, such a vast development significantly impacts the environment. A major concern is the emissions from powering these gigantic hyperscale complexes, which are designed to use up to 2 gigawatts (GW) of power — approximately 15 times the energy needed by Philadelphia during peak summer periods. According to a 2025 industry review by energy analyst Rystad, data centers using up to 100 GWs of power could become operational in the next decade, much of it from gas-fired plants.

Another issue is the limited capital available for infrastructure development. Resources allocated to building hyperscale data centers are being diverted from initiatives to electrify heavy industry, buildings, and transport sectors, as well as from powering these sectors with clean energy. U.S. tech leaders argue that their hyperscale data center model, with its significant power demands, is essential for delivering the GenAI applications that consumers desire. However, consumer demand has yet to materialize, with revenues still only a fraction of expenditures.

Meanwhile, as highlighted by the Center for Strategic & International Studies and other experts, recent technological advancements could enable the development of competitive GenAI applications at a much lower cost, without the need for extensive hyperscale data centers. Should this occur, the U.S. might face a significant misallocation of capital and stranded assets on a large scale.

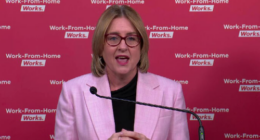

In areas where data centers are being constructed, community members are increasingly frustrated by secretive negotiations and unaddressed concerns about the health, environmental, and electricity cost impacts of these massive facilities. As Louisiana Public Service Commissioner Davante Lewis points out, “real health risks come from the utilities rushing to build more gas plants and delaying renewable energy commitments,” resulting in “decades of pollution and higher bills” for these communities.

Growing concerns about pollution and electricity costs

In the communities where data centers are being sited, residents are becoming increasingly angry about secretive, backroom deals and unaddressed health, environmental, and electricity cost impacts of the gargantuan facilities. As Louisiana Public Service Commissioner Davante Lewis states, “real health risks come from the utilities rushing to build more gas plants and delaying renewable energy commitments,” locking communities into “decades of pollution and higher bills.”

Louisiana Public Service Commissioner Davante Lewis has been leading community efforts to ensure concerns about the pollution and electricity cost impacts of Meta’s proposed data center complex are addressed (Photo by Jemal Countess/Getty Images for Legal Defense Fund)

Getty Images for Legal Defense Fund

The Power of Pensions to Shape AI’s Direction

For institutional investors invested in the tech, real estate, utility companies building and powering data centers, the key question is how best to use their ownership power to mitigate GenAI’s systemic risks to the value of their portfolios.

With $6.17 trillion of retirement savings under stewardship, trustees of state and local pensions–which include elected officials such as treasurers and comptrollers– have enormous power to shape corporate decision-making, including the power to shape the approaches of the tech, utility, and real estate to data centers. Engagements of these pensions and their asset managers with portfolio companies in these sectors must now make data centers a priority focus.

The vast majority of returns in pension portfolios are determined by systemic factors (those affecting the economy as a whole) rather than idiosyncratic ones (limited to specific companies or sectors). This means that in these engagements, pension trustees and their asset managers must address more than company profitability. Likewise, diversification or stock-picking will not suffice to protect beneficiaries. They must work with companies on strategies that reduce data centers’ impacts to the entire economy.

AI’s Systemic Climate Risks

Climate change science makes clear that building a new generation of fossil fuel infrastructure to power data centers would cause irreparable damage to the economy and the life savings of millions of workers and retirees.

Rising GHG emissions are contributing to a growing number of extreme weather events, causing a crisis in the property insurance industry. Reduced affordability and availability insurance raises concerns that climate risks could cascade into the banking system and the broader economy. Photo by Apu Gomes/Getty Images)

Getty Images

Some pension trustees are acutely aware of threats posed by rising GHG emissions to portfolio value. The Minnesota State Board of Investment, for example, has stated that “market returns depend on the long-term health of the economy, which in turn depends on the productivity of social and environmental systems” and that climate change therefore threatens its funds’ long-term viability. A 2024 study by Ortec Finance highlights this point, finding that “US pension funds could experience the most significant impact [of a failure to reduce GHG emissions], with investment returns declines approaching 50% by 2040, followed by further declines without recovery until at least 2050.”

Ortec Finance (2024) finds that US pension funds could face investment return declines of up to 50%* by 2040 if climate policies remain unaddressed, with further declines through 2050.

Ortec Finance (2024)

Fortunately, climate solutions that provide affordable electricity and an economic boost to U.S. workers and communities are readily available. Perhaps the most exciting success story in technology is the rapid scaling and cost declines in renewable energy and battery storage over the past decade. Despite federal policy headwinds, these clean technologies represent 93% of new capacity additions to the U.S. grid this year.

State and local pensions, along with other climate-aware institutional investors, have played an important role in the growth of these sectors. However, with global GHG emissions still climbing, they do not have the luxury of coasting on this success. They must help accelerate the pace of the energy transition.

This requires coming to terms with the dramatic changes underway in the power sector. Industry analyst Rystad anticipates that global power demand will rise 30% over the next decade. Data centers are a key contributor to this surge, especially in the U.S., where roughly half of the world’s data center power demand is currently found.

Opportunities for near-term clean energy deployment

Transitioning sectors such as industry, buildings and transport to carbon-free electricity requires time and large capital expenditures for electrification. In contrast, the tech sector is well-positioned to tap carbon-free electricity in the near term. A host of cost-effective clean energy solutions are poised to meet data center demand:

- Large-scale renewable energy projects can be paired with battery storage, such as was done with the Gemini solar and battery project in Nevada;

- Enhanced geothermal energy can provide around-the-clock power, as Fervo Energy has done for Google in Nevada;

- Increasing grid managers’ flexibility in balancing supply and demand can eliminate the need for new power plants. Rewiring America shows how tech companies could achieve this outcome and reduce household energy costs by investing in distributed energy resources such as heat pumps, rooftop solar, and home batteries; and

- Off-grid solar “microgrids,” paired with batteries and small backup gas generators, can be built in sunny locations, as shown in research conducted by Scale Microgrids and Stripe.

Pension trustees have a fiduciary duty to assess these and other strategies for mitigating systemic climate risks to their portfolios. Once they conclude that the tech industry’s energy-intensive and fossil fuel-reliant strategy for data center buildout is generating systemic risks that can be averted with a shift in strategic direction, it is their duty to seize the opportunity to help bring about that shift.