Share this @internewscast.com

The Pentagon plans to acquire up to $1 billion in essential minerals as part of an international effort to build reserves and reduce Chinese control over vital metals used by defense manufacturers.

The Trump administration’s push to enhance the national reserves is detailed in recent public documents from the Pentagon’s Defense Logistics Agency. This initiative responds to China’s export limitations on several resources, which China largely controls, necessary for items from smartphones to fighter jets.

A former defense official noted, “The US defense department is intensely focused on boosting their stockpile.” They are actively pursuing new sources for ores required in defense products.

Another former defence official said the $1bn is an acceleration over previous stockpiling efforts.

This week, Beijing announced broad new export restrictions on rare earths and associated technologies, leading Donald Trump to cancel a planned meeting with Chinese leader Xi Jinping later this month.

In retaliation, Trump announced a 100 percent tariff on Chinese goods, stating, “China must not be allowed to keep the world ‘hostage,’ but that appears to be their strategy.”

Beijing’s restrictions have fuelled fears in the US and Europe about their continued access to the metals.

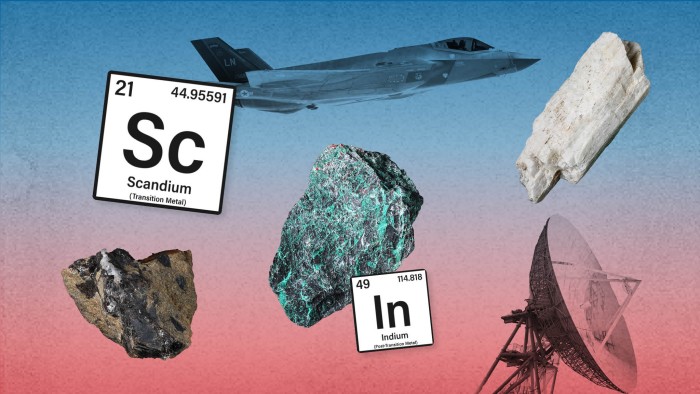

Critical minerals are crucial for national security because they are integral to nearly all weapons systems, as well as essential technologies like radar and missile detection systems. The recent stockpiling by the defense department marks a significant increase, reflecting the Trump administration’s renewed focus on essential minerals. Some metals the Pentagon aims to procure were not previously included in their reserves.

“China’s ability to turn off the supply of these critical minerals would have a direct, palpable and adverse effect on US ability to field the kind of high-tech capabilities that we’re going to need for any kind of strategic competition or conflict,” said Stephanie Barna, a lawyer at Covington & Burling in Washington.

Recent expressions of interest from the DLA include plans to buy up to $500mn of cobalt, up to $245mn of antimony from the domestic US Antimony Corporation, up to $100mn of tantalum from an undisclosed US company and up to a combined $45mn of scandium from Rio Tinto and APL Engineered Materials, a chemical manufacturing company based in Illinois that has offices in Japan and China.

The plans show that the US government was “conscious of how critical this stuff is, and wants to support whatever domestic capacity they have,” said one sector executive. “It’s very early days for western governments to stockpile critical minerals but they’re increasingly focused on it.”

The DLA stockpiles dozens of alloys, metals, rare earths, ores and precious metals, which are stored in depots throughout the country. Its assets were valued at $1.3bn as of 2023. The materials can only be released by the president in times of declared war, or if deemed necessary for national defence by the under-secretary of defence for acquisition and sustainment.

The price of germanium has soared this year as exports from China have fallen, with western traders warning of “panic” in the market as companies struggled to get hold of it. The germanium issue is one the Pentagon is trying to fix.

The price of antimony trioxide has almost doubled over the past 12 months, while carmakers have struggled to secure rare earth materials this year after China restricted certain exports.

Trump’s One Big Beautiful Bill Act contains $7.5bn for critical minerals, including $2bn to bolster the national defence stockpile which the Pentagon intends to spend by late 2026 or early 2027.

The OBBA also includes $5bn for defence department investments in critical minerals supply chains and $500mn for a Pentagon credit programme to spur investments.

One former defence official said several offices involved in securing the critical mineral supply chains were now “flush with cash” following the passage of the OBBA.

The DLA declined to comment.

Analysts at Jefferies said the Rio deal, for around 6 tonnes of scandium oxide, was at a price that was “higher than market expectations”. Global consumption of scandium oxide is around 30-40 tonnes, according to price reporting agency Fastmarkets, with China the leading producer.

The DLA stated in its filings that Chinese export controls on scandium had “constrained the supply chain”.

The deal with USAC for antimony, meanwhile, would grow a stockpile “sufficient for industrial base mobilisation in a national emergency” and enable the company to continue producing in what was a “volatile” sector, it said.

USAC sources the mined material that it turns into metal from Canada, Mexico, Australia, Chad, Bolivia and Peru, chief executive Gary Evans told the FT. The company reported revenues of $15mn in 2024 and does not report its annual antimony metal production. The DLA deal for around 3,000 tonnes of antimony metal compares to total US antimony consumption in 2024 of 24,000 tonnes, according to the US Geological Survey.

“Market participants have been taken aback by the volumes requested by the DLA across several metals. Many consider the quantities to be unrealistic, especially within the proposed five-year timeframe,” said Cristina Belda, from Argus Media. “In most cases, the requested tonnages exceed the US’s annual production and import levels.”

The DLA has also sought information for the potential acquisition of rare earths, tungsten, bismuth and indium to add to the stockpile.

The volumes of bismuth and indium were “significant” given the global size of the markets, said Solomon Cefai from Fastmarkets. “It is hard to imagine a situation where non-China supply would not be pressured by the volumes the DLA is looking at,” he said.

The DLA is seeking information for the potential acquisition of 222 tonnes of indium ingots, which compares to US consumption of refined indium of around 250 tonnes in 2024, according to the USGS.