Share this @internewscast.com

Twitter is “set to accept” Elon Musk’s offer to purchase the social media company.

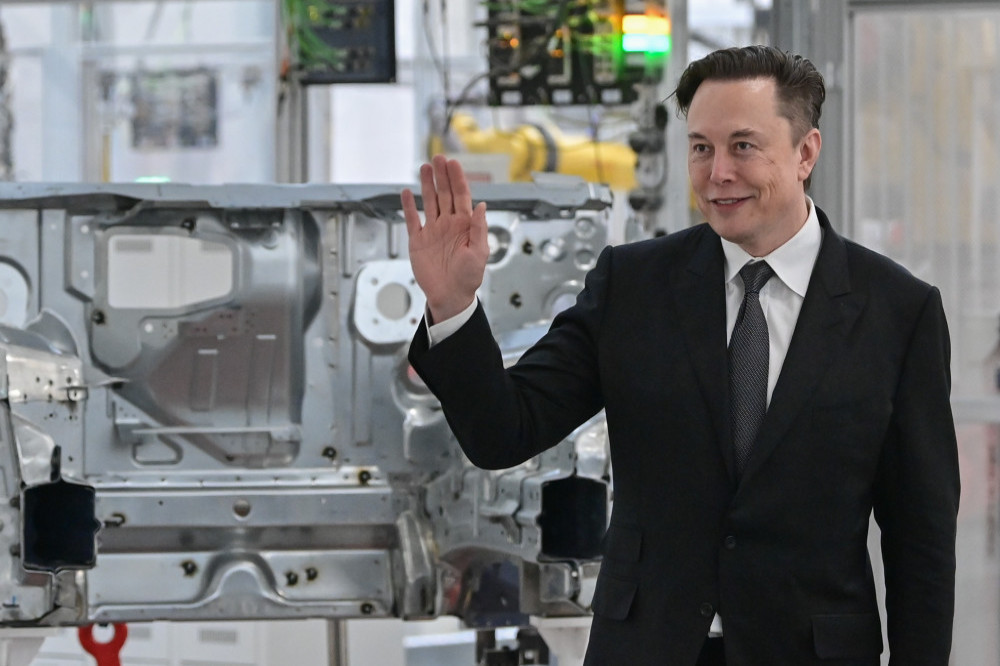

Elon Musk is on the brink of purchasing Twitter

The 50-year-old multi-billionaire made a bid to buy the social networking site for $41.39 billion in the middle of April after initially purchasing a 12.5 per cent share in the business and has reportedly had a meeting with the 11-member board which could see negotiations reached as soon as later today (25.04.22), according to The New York Times.

The outlet went on to describe the alleged meetings as a “turning point” for the proposed privatisation of the microblogging platform and claimed that his offer of buying the site for $54.20 a share was a nod to the number 420, which is a cultural slang term for marijuana.

Despite initial concerns over how exactly the CEO would raise the funds to facilitate the mammoth purchase, The New York Times has claimed that Musk reached an agreement with investment bankers at Morgan Stanley to loan him a sum of money just under $25 billion to help finance the deal and that he would pay the rest in cash.

The Tesla founder – who is ranked as the richest man in the world with an estimated net worth of almost $265 billion – previously insisted that his proposed takeover of Twitter was not money making exercise but more of a way to ensure there is a platform that can be “trusted” and is “broadly diverse”.

Speaking at TED conference in Vancouver on Thursday (14.04.22), Elon – who is a frequent tweeter and has 83.3 million followers – said: “Twitter has become kind of the de facto town square. So it’s just really important that people have both the reality and the perception that they’re able to speak freely within the bounds of the law. This is not a way to sort of make money. My strong intuitive sense is that having a public platform that is maximally trusted and broadly inclusive is extremely important. So the future of civilisation, but you don’t care about the economics at all.”

Post source: Female First