Share this @internewscast.com

This article is part of this week’s edition of CNBC’s The China Connection newsletter, offering insights and analysis on the developments shaping the world’s second-largest economy. Subscribe here.

The big story

Chinese humanoid robots are gearing up to enter the U.S. market, potentially ahead of Elon Musk’s Optimus robots hitting the shelves.

In the past couple of years, my trips to Shenzhen, China’s equivalent of Silicon Valley, allowed me to witness the evolution of the humanoid startup LimX Dynamics. The company transitioned from a basic setup to a sleek office in a high-rise with expansive views and even bigger dreams.

During an exclusive interview last week, LimX’s founder, Will Zhang, shared that the company is actively seeking business partnerships in the U.S. Just a few days prior, LimX showcased its humanoid robot at the Consumer Electronics Show in Las Vegas.

LimX is aiming to expand globally by collaborating with local partners, including potential investors.

The Middle East is the first target on their international expansion journey. The startup has already attracted its initial foreign investor from the region and plans to commence shipments of its humanoids there this year, according to Zhang.

He was unable to publicly share details on LimX’s new investors or the monetary amount, as the funding round is still in progress. The new round will multiply the startup’s valuation from its earlier Series A round, the startup said.

LimX has raised $69.31 million as of July 2025, according to PitchBook, with backers including Alibaba, JD.com and Lenovo. Zhang declined to comment on IPO plans.

“More than money, I’m focused on local partnerships,” Zhang said, noting plans to speak with more international investors in the next few months. Beyond the Middle East, he also sees potential in what he calls Europe’s large but fragmented market.

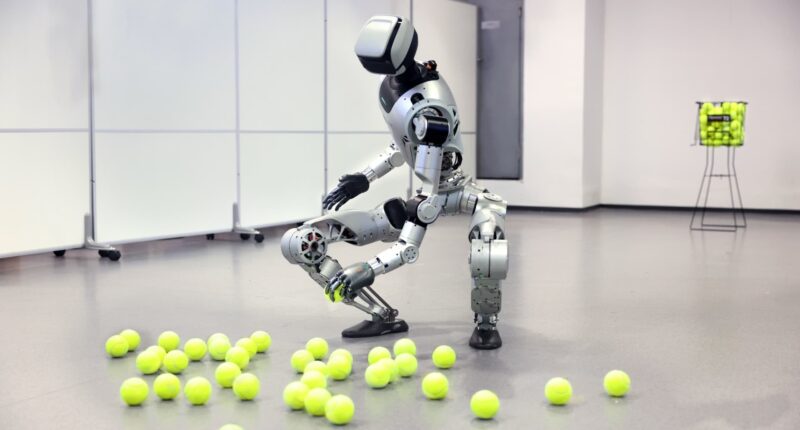

Shenzhen-based Limx Dynamics released its full-sized humanoid robot Oli in the summer of 2025.

Limx Dynamics

Competition with Elon Musk

LimX is not alone. Several other Chinese humanoid robot companies such as Unitree showed off their humanoids at CES. They join an increasing number of China-based consumer electronics companies exploring the U.S. market.

It’s all a sign of how pressure is mounting for Elon Musk’s humanoid robot plans, not just from U.S. rival Figure AI but also from Chinese companies ramping up humanoid deliveries globally.

Last year, about 13,000 humanoids were shipped worldwide, according to research firm Omdia. Chinese companies, led by Agibot, dominated the top five by shipments. Figure ranked seventh, while Tesla was ninth. Omdia said Tesla has shipped Optimus humanoid robot units to business clients, but not to the public yet.

With upbeat numbers from the Omdia report, Morgan Stanley last week doubled its forecast for China humanoid robot sales this year to 28,000 units, up from an earlier estimate of 14,000. The forecast only includes external sales.

“We expect sales to businesses to be the key driver this year, taking over from government, R&D and entertainment-related sales last year,” equity analyst Shen Zhong said in the report. By 2050, the firm predicts China’s humanoid market could reach annual sales of 54 million units.

As for Optimus, Musk said last week at Davos that the robot wouldn’t start sales to the public until the end of 2027.

Ambitions to rank first globally

LimX began delivering its humanoid robot, Oli, several months ago, Zhang said. The base model costs just 158,000 yuan ($22,660), using only LimX-made applications. A version that allows developers to integrate their own functions with the robot costs nearly twice that at 290,000 yuan.

But Zhang wants to be a global leader in the underlying technology, rather than just another Chinese company commercializing existing ideas.

“We don’t think it has to be that the U.S. leads and China follows” in terms of tech innovation, he said.

Before founding LimX in 2022, Zhang was a tenured professor in electrical and computer engineering at Ohio State University.

His goal this year is to improve voice commands – eliminating the need for remote controls that still underpin many robot demos today, such as performing a somersault on command. Zhang aims to do this with agentic artificial intelligence, an advanced form of AI that can make a chain of decisions autonomously to complete a task.

Earlier this month, LimX announced an agentic AI “operating system” called COSA, designed to enable robots to adjust body motion in real time, such as when handling tennis balls.

2026 marks only the beginning of LimX’s three-year plan to deliver several thousand humanoid robots to the Middle East, primarily for research and development, and to build case studies on how the robots can perform services for humans. Plans for the U.S. haven’t yet been fleshed out.

But, Zhang said, rapid advances in the industry mean humanoid robots could be working alongside humans within five to 10 years. If all goes according to plan, those robots won’t just be in China, but deployed around the world.

Top TV picks on CNBC

Benjamin Hung, Chairman of Hong Kong’s Financial Services Development Council, discussed how investors and businesses are reassessing the risk of heavy concentration in U.S. assets while rebalancing portfolios toward Asia, Greater China, gold, and alternative assets.

Hong Kong Financial Secretary Paul Chan said Hong Kong markets are becoming increasingly prominent on a global stage, attracting companies not just from Mainland China but also from Southeast Asia and the Middle East.

Kevin Sneader, President of APAC ex‑Japan at Goldman Sachs, spoke about investor appetite for AI driving flows into Asian markets, while noting key nuances for standouts such as China and South Korea.

Need to know

Quote of the week

What has President Trump achieved? He’s shown the world that China is a viable partner on the trade side, is somewhat more stable than the U.S. … Trump has probably advantaged China in the long run in hard and soft power.

— Ed Price, Non-Resident Senior Visiting Fellow, New York University

In the markets

Chinese and Hong Kong stocks gained in afternoon trading Wednesday.

Mainland China’s CSI 300 index rose 0.49%, while Hong Kong’s Hang Seng Index, which includes major Chinese companies, climbed 2.36%, leading gains among major Asian benchmarks.

The CSI 300 has risen 1.7% so far this year, while the Hang Seng Index is up more than 8%.

China’s benchmark 10-year government bond yield rose to 1.824%, while the offshore yuan last traded at 6.938 per dollar.

The performance of the Shanghai Composite over the past year.

Coming up

Jan. 28 – 31: British Prime Minister Keir Starmer to visit China with representatives from Airbus, AstraZeneca, Baker McKenzie and other UK businesses

Jan. 31: China official manufacturing and services PMI for January

Feb. 1 – 7: President of Uruguay Yamandu Orsi to make a state visit to China

Feb. 2: RatingDog manufacturing PMI for January

Feb. 4: RatingDog services PMI for January