Share this @internewscast.com

Historically, the stock market has shown a tendency to ascend over the long haul, although it is not immune to occasional downturns.

Following a significant surge in recent years, primarily driven by major US technology companies, some investors are now apprehensive about a looming major crash.

Numerous analysts are anticipating a substantial market decline in the near term. This concern is fueled by indicators such as high valuations of stocks, the market’s heavy dependence on a few tech giants, and worries surrounding the ‘shadow banking’ private credit sector.

Recently, anxiety that stocks related to artificial intelligence have become overvalued led investors to withdraw funds from the US market.

While this may not signify the onset of a correction, many believe one is imminent. However, the potential severity of such a dip and the duration of any recovery remain uncertain.

Though anxious investors might consider liquidating their investments and hoarding cash, doing so might prove to be a significant miscalculation.

Analysing past crashes shows that the stock market bounceback is often just as hard to predict as its initial fall.

If you want to benefit from the recovery, as long as you have an emergency cash buffer in place it is usually best to grit your teeth and stay invested.

Here we reveal what happened in previous market crashes.

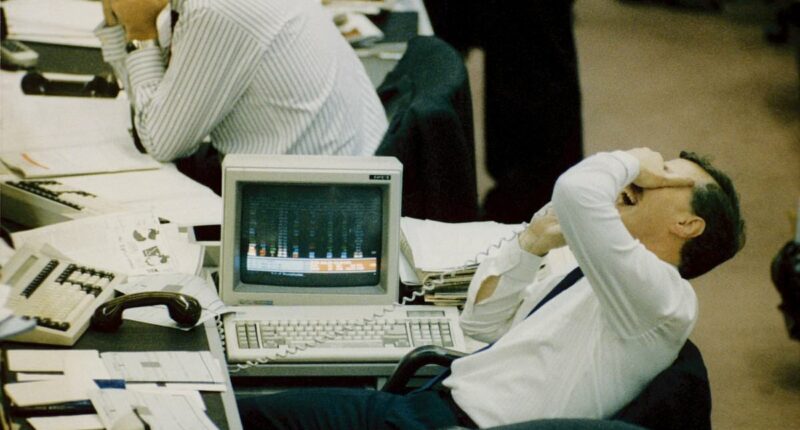

A huge sell-off on the US stock market led to global market turmoil when automated stock trading computer programs created a selling frenzy in October 1987. Pictured: The reaction on the floor of the London Stock Exchange

BLACK MONDAY 1987

A huge sell-off on the US stock market led to global market turmoil when automated stock trading computer programs created a selling frenzy in October 1987.

These programs automatically buy stocks when the market moves up by a certain amount and sell when it falls. A dip in the market the previous Friday had sparked a glut of sell orders, causing a snowball effect, whereby the market then fell further and more sell orders were automatically generated.

Some $500billion was wiped off the value of the American stock market in a single day as it plunged more than 20 per cent.

It ended a long bull run that had been going since 1982.

The following days saw the UK’s FTSE 100 drop 25 per cent and Tokyo’s Nikkei 13.2 per cent. It is estimated that the crash led to global losses of $1.7 trillion.

From its peak that summer to its trough in November, the MSCI World – an index that tracks thousands of companies across the globe – fell by 30.7 per cent, according to number-crunching by the investment platform AJ Bell.

John Wyn-Evans, head of investment strategy at Rathbones, says: ‘Market crashes tend to fall into three categories: event driven, structural and cyclical.

‘Black Monday is an example of an event-driven crash, and while these are often more out of the blue they tend to bounce back quicker because the event can be reversed or because policy can come to the rescue.’

The crash led to new regulations being put in place whereby ‘circuit breakers’ would stop any automatic trading when markets fell by a certain amount.

DOTCOM BUBBLE BURST

While the world braced for the Millennium Bug to wreak havoc on computer systems on New Year’s Eve 1999, the stock market was not properly struck down until March 2000. Euphoria about the rise of the internet in the late 1990s saw investors pour money indiscriminately into tech stocks, regardless of whether they were making a profit. The American tech index, the Nasdaq, climbed from 1,000 in 1995 to 5,000 by the turn of the century.

The end of the bubble has been likened to the moment in the fairy tale The Emperor’s New Clothes, when the pretence is shattered and people see the truth.

The US Federal Reserve raised interest rates, making borrowing more expensive and making it harder for cash-hungry, unprofitable tech firms to raise new capital. Investors started to see that few were truly viable businesses.

The ensuing market crash continued well into 2002, with the MSCI World falling by 53.9 per cent from peak to trough. By October 2002, the Nasdaq had dropped almost 77 per cent to 1,140.

Wyn-Evans says: ‘Structural crashes are the worst type because the whole structure needs to be reset. After the dotcom bubble burst, it was about resetting expectations around tech stocks and a need for deleveraging [companies reducing debt].’

These crashes, he says, are easier to see coming because there are warning signs, such as share price valuations getting too high. However, the exact moment of the crash is still impossible to call, often because FOMO – the fear of missing out – keeps driving the market higher.

Laith Khalaf, head of investment analysis at AJ Bell, says: ‘The dotcom crash was probably the most severe in recent history in its depth and duration, even though it had nowhere near the economic and political impact of the 2007 financial crisis.’

A worker carries a box out of the Lehman Brothers offices in London on September 15, 2008

FINANCIAL CRISIS 2007

The crash began as the US subprime mortgage market started to fail, after banks made loans to borrowers with poor credit histories who would find it difficult to make repayments.

The mortgages were packaged up and sold as investments, with many given credit ratings that could be called ‘optimistic’ at best. Only when mortgage defaults started to gain pace did investors realise the toxic mix of what they had bought.

In 2007, the subprime lender New Century filed for bankruptcy. In September there was a run on Northern Rock bank – the first in the UK since 1866. In 2008, the US investment bank Lehman Brothers collapsed. Other institutions were saved only by government intervention or by being bought by a rival bank. It was not until mid-2009 that the OECD said the global economy had reached the worst of its recession.

Stephen Jones, global chief investment officer at Aegon Asset Management, says: ‘The pressures that lead to a crash often build slowly and then crack dramatically. While the global financial crisis is often dated as 2007, the real period of market distress was in October 2008, when the S&P 500 fell 25 per cent, before stabilising and falling another 16 per cent in November.’

It took 511 days for the MSCI World to fall from its pre-crisis peak to its trough, dropping a total of 40.1 per cent.

In 2008, the FTSE 100 fell by 31 per cent – still the worst year in its existence – while the S&P 500 dropped about 37 per cent.

Another structural crash, it required an entire overhaul of lending standards and stricter regulation around how investments were rated and sold.

The reverberations are arguably still being felt today, with the Financial Conduct Authority (the City regulator) now encouraging banks to relax mortgage affordability tests and loosen lending rules to help homebuyers.

A businessman wearing a mask applies hand sanitiser during the Covid pandemic

COVID PANDEMIC 2020

A prime example of an event-driven crash: global stock markets plunged in March 2020 when the extent of the Covid pandemic started to become apparent and countries across the globe went into lockdown.

Between mid-February and mid-March, the S&P 500 and FTSE 100 each fell about 33 per cent. Over a period of just 25 days, the MSCI World plunged 26.2 per cent, making it the quickest crash in this list. But the recovery was also swift, and it had regained its previous peak within 207 days. The S&P 500 was even quicker to bounce back, recovering in just 141 days.

Markets were helped by governments’ willingness to pump money into the economy. The furlough programme alone is estimated to have cost the UK government about £70 billion. Interest rates were cut to 0.1 per cent.

It also became clear there were stock-market winners from the pandemic – a reminder that a country’s economy and stock market are not the same thing.

Shares in Zoom and Teams owner Microsoft, for example, boomed as businesses and families quickly came to rely on their services.

David Roberts, head of fixed income at Nedgroup Investments, says: ‘Covid was an understandable panic from markets. The reaction from governments arguably saved the financial system but at a huge expense, which we are still living with.’

President Donald Trump announced plans to ramp up tariffs on products imported to America – and global stock markets went into meltdown

TRUMP TARIFFS 2025

You don’t need a long memory to recall the most recent bout of stock market turmoil: Liberation Day. In April this year, US

President Donald Trump announced plans to ramp up tariffs on products imported to America – and global stock markets went into meltdown.

The S&P 500 fell 5 per cent in a single day – its biggest one-day fall since March 2020 – while the tech-heavy Nasdaq dropped 6 per cent. The FTSE 100 fell 10 per cent within a week.

There were widespread fears the measures could spark a global recession: hefty tariffs could push up costs for businesses, affecting their profits, which could lead to large-scale redundancies and see prices rise for consumers, putting more pressure on the cost of living.

The MSCI World dropped 18.5 per cent in the chaos, but the drama was short-lived. Trump soon announced a pause and scaling back of his plans, and the index had recovered within 75 days.

Roberts says: ‘Markets in the G7 tend to look through politics very quickly, and a short, sharp dip often leads politicians to realise the error of their ways. The Liz Truss mini-Budget in 2022 is another example. In our financial system, markets are still bigger bullies than the US president.’

AI CRASH 2025?

The most recent market crashes have been sharp but short, but the next one may take longer to recover from. ‘We have got used to “bounce” recoveries, but you can’t rely on this,’ says Jones.

History shows share prices can and do fall harder and for longer, he warns, depending on the extent of damage to economies and finances, as well as investor confidence.

Structural crashes such as the dotcom bubble and global financial crisis have the closest parallels with the AI boom, which is currently causing experts so much disquiet. ‘There is an extrapolation of current demand into future demand, stoked by “experts” and a fear of missing out from the investing public,’ says Roberts.

If we are headed for a dotcom-style bubble burst, it could mean a more protracted crash which takes longer to recover from, but there are no certainties.

Khalaf adds: ‘The US stock market is trading on an historically high valuation, and technology is again at the centre of excitement. It is entirely possible some kind of market correction, or worse, may lie ahead, but the market could continue upwards for an unquantifiable period before that happens.’

Regardless of what shape the next crash takes, Jones is confident of one thing: ‘Markets do recover,’ he says. ‘Economies and earnings eventually grow, and confidence gradually returns after market upheaval.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Freetrade

Freetrade

Investing Isa now free on basic plan

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you