Share this @internewscast.com

Unlock the White House Watch newsletter for free

Treasuries dropped on Friday in volatile trading, as market participants warned of growing strains in the $29tn market for US government debt.

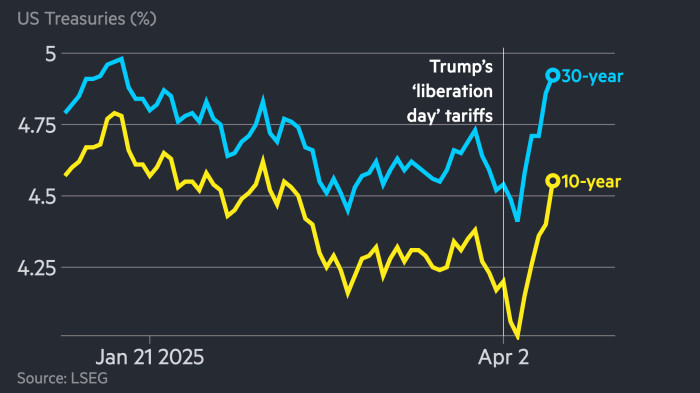

The 10-year Treasury yield climbed as much as 0.19 percentage points to 4.58 per cent on Friday, amid a deepening slump for an asset traditionally considered the global financial system’s premier haven.

The yield later reversed some of those gains to trade at 4.48 per cent after Boston Fed President Susan Collins told the Financial Times that the US central bank “would absolutely be prepared” to deploy its firepower to stabilise financial markets should conditions become disorderly.

Donald Trump’s erratic tariff policies have shaken investors’ faith in US policymaking and the economy, sparking an exodus from American assets. The 10-year yield rose almost 0.5 percentage points this week, the biggest rise since 2001, according to Bloomberg data.

While Trump backed down from his so-called reciprocal tariffs on non-retaliating countries earlier this week — agreeing to a 90-day hiatus for most major US trading partners — he placed even steeper levies on Chinese imports.

“There is real pressure across the globe to sell Treasuries and corporate bonds if you are a foreign holder,” said Peter Tchir, head of US macro strategy at Academy Securities. “There is a real global concern that they don’t know where Trump is going.”

“We are concerned because the movements you see point to something else other than a normal sell-off,” said a European bank executive in prime services, a division that facilitates leveraged trading for firms including proprietary traders and hedge funds. “They point to a complete loss of faith in the strongest bond market in the world.”

Traders said poor liquidity — the ease with which investors can buy and sell Treasuries without moving prices — was exacerbating market moves.

Analysts at JPMorgan said market depth, a measure of the market’s ability to absorb large trades without significant shifts in price, had significantly worsened this week, meaning even small trades were moving yields significantly.

The head of Treasury trading at a major US bond manager said liquidity was “not great today” and explained that “market depth was running 80 per cent below normal averages” on Friday.

“If a stiff breeze blew through the Treasury market today, rates would move a quarter point,” added Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott.

Friday’s Treasury volatility was accompanied by a drop in the dollar.

A gauge of the currency’s strength against major peers fell as much as 1.8 per cent on Friday. Sterling, the Japanese yen and the Swiss franc all made significant gains.