Share this @internewscast.com

Cancer deaths have fallen by more than a fifth over the past 50 years—but diagnoses have soared with cases in younger adults driving the trend, a landmark study reveals.

Experts say the spike in diagnoses is being fuelled in part by lifestyle factors—including smoking, obesity and poor diet—which remain among the leading causes.

The analysis, from Cancer Research UK, is the first to examine 50 years of NHS cancer data, revealing striking progress—but also alarming new trends.

The data reveals that although survival rates have improved dramatically since the 1970s, the risk of developing cancer has risen just as sharply.

In 1973, around 328 in every 100,000 people died from the disease. By 2023, that figure had fallen to 252—a 22 per cent drop—thanks to earlier diagnosis and better treatments.

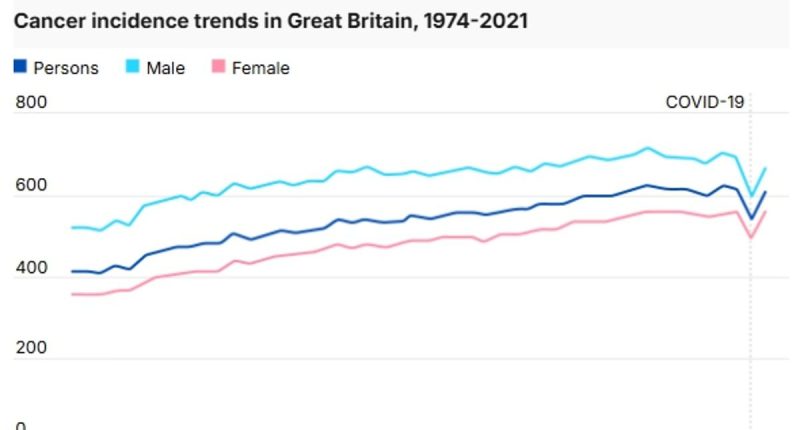

But over the same period, the number of people developing cancer has soared by almost 50 per cent.

Incidence rates have climbed from 413 to 607 per 100,000 people, with some of the sharpest rises seen in under 50s.

Among those aged 20 to 49, rates are up by 23 per cent since the early 1990s.

Scientists are still trying to explore the factors behind the rise in early onset cancers, with some suggesting modern diets and exposure to substances like microplastics, or a combination of several triggers, could be to blame.

Speaking this week at the American Society of Clinical Oncology conference in Chicago—the world’s biggest cancer conference—experts also cautioned that poor lifestyle was likely the driving factor.

Presenting research on the key factors influencing the surge in colon cancer cases among people in their 20s, 30s and 40s, Dr Jessica Paulus a senior director of research at Ontada, said obesity was far higher among early-onset patients than ‘average age’.

Of the 14,611 young patients tracked in the study, more than a third were obese at time of diagnosis.

‘Interestingly, distress thermometer data also showed early-onset patients were more likely to report high or moderate distress’ at time of diagnosis compared to older patients, she added.

This thermometer is a tool health professionals ask patients to use to self-report feelings or issues, such as financial concerns, pain, fatigue and worry.

But drinking, physical inactivity and poor diet too plays a ‘huge’ role too, Professor Neil Iyengar, an expert in breast oncology and the impact of lifestyle factors on cancer at the Memorial Sloan Kettering Cancer Centre in New York, said.

He told MailOnline: ‘The link between obesity and several forms of cancer is already well-established, but this data is mostly from older people.

Bowel cancer can cause you to have blood in your poo, a change in bowel habit, a lump inside your bowel which can cause an obstructions. Some people also suffer with weight loss a s a result of these symptoms

‘Obesity rates are accelerating in the young. But having too much fat—even if you have a normal body mass index—also increases the risk of developing the disease.

‘There’s also more and more data to suggest this rise in early onset cancer may be being driven by changes in the microbiome. ‘

‘That suggests our diet and exercise is largely to blame, but it could also be food contamination.

‘Our microbiome is exquisitely sensitive to what we eat. If microplastics or chemicals are shifting the microbiome, that could be contributing.

‘It’s never too early to start good eating and exercise patterns.

‘We need to start thinking of some foods and high-sugar beverages in a similar way that we think about smoking: unnecessary, addictive, and harmful.’

Other experts, however, cautioned that tobacco was likely not behind the rise in younger cancer cases.

Professor Paul Pharoah, an expert in cancer epidemiology at Cedars-Sinai Medical Centre in Los Angeles told MailOnline: ‘Smoking is unlikely to be a cause of the difference between younger and older people because the incidence of the major smoking related cancer, lung cancer, has come down in virtually all age groups.

He added: ‘Screening is also unlikely to be a cause of the difference between younger and older people, as the screening programmes implemented by the NHS since 1990 would be more likely to increase incidence in older individuals.’

While cancer survival in England and Wales has doubled since the 1970s, progress has slowed sharply over the past decade.

The report found that survival improved three to five times faster in earlier decades than it has since 2010.

And despite the gains, the UK continues to lag behind comparable countries on key cancer outcomes.

Late diagnosis remains a major issue.

Only 54 per cent of cancers in England are diagnosed at stage one or two—the earliest phases, when tumours are usually small, haven’t spread far, and are most treatable.

That figure has barely improved in the last ten years.

Cancer Research UK’s chief executive, Michelle Mitchell, said: ‘It’s fantastic to see that thanks to research, cancer death rates have drastically reduced and survival has doubled.

‘But more than 460 people are still dying from cancer every day in the UK. Too many cases are still being diagnosed too late.’

The report also highlights the leading preventable causes of cancer.

Smoking remains the biggest risk factor, but obesity—now linked to 13 different types of the disease—is rising rapidly.

Other contributors include drinking, poor diet, sunbeds, lack of exercise and failure to protect skin from the sun.

Cancer Research UK is urging the Government to act swiftly and decisively in its upcoming National Cancer Plan for England.

It is calling for earlier diagnosis, faster access to tests, better GP referrals and a national lung cancer screening programme—arguing that these steps could save thousands of lives.

Mitchell added: ‘If this plan is done right, it could transform cancer care in this country and ensure people affected by cancer live longer, better lives.’