Share this @internewscast.com

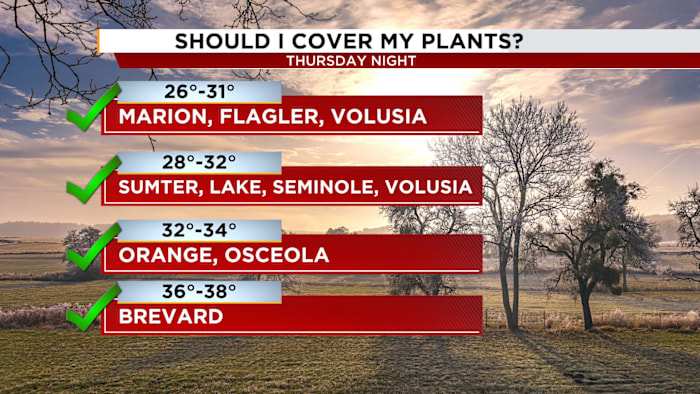

ORLANDO, FL – As colder air descends across the region, gardeners are being urged to take immediate steps to protect their plants. With forecasts predicting temperatures to plunge to frost-inducing levels, the actions taken now could be crucial for the survival of gardens.

The weather has been on a rollercoaster ride, with temperatures swinging dramatically between warm and cold. In some areas, conditions are expected to fall below freezing for several hours, prompting many green-thumbed residents to already start covering or relocating their more delicate flora to shield them from frost damage.

The pressing question for many is: should you cover your plants? With the chillier air settling in, the answer for many is a resounding yes. Anticipated lows are poised to bring frost or freezing conditions, and even brief periods of exposure can spell trouble for vulnerable plants.

Particularly at risk are tender vegetables, tropical plants, and newly planted seedlings. Providing them with cover or moving them indoors can be critical to preventing cold stress and avoiding potential plant loss.

General rules of thumb

-

Understanding the risks, it’s essential to recognize that a light freeze, at temperatures between 30–32°F for 2–4 hours, can harm or kill highly sensitive plants such as basil, tomatoes, and tropical varieties. A moderate freeze, dropping to 26–29°F for 1–2 hours, poses an even greater threat, capable of causing significant damage to many tender plants and, if prolonged, can be fatal.

-

Moderate freeze (26–29°F):1–2 hours can seriously damage many tender plants; several hours can kill them.

-

Hard freeze (25°F or colder):30 minutes to 1 hour can kill most frost-sensitive plants outright.

Plants that need protection sooner

-

Warm-season vegetables such as tomatoes, peppers, cucumbers, and squash

-

Herbs, especially basil

-

Tropical plants and houseplants that have been moved outdoors

-

Newly planted seedlings

Timing tips

-

Cover plants in the late afternoon or early evening to hold in warmth

-

Remove covers in the morning once temperatures rise and sunlight returns

What to use

-

Frost cloth or garden fabric (best option)

-

Old sheets or blankets (make sure plastic does not touch the plants)

-

Buckets or cardboard boxes for smaller plants

After a cold snap, watering is always a good step. Applying water to the lawn after a freeze can help thaw the soil and support recovery for grass and plants that may have been stressed by the cold.

Patience is important when bringing a lawn back to life. Avoid fertilizing right away, as feeding too early can trigger new growth before cold weather has fully passed, leaving plants vulnerable to further damage.

Copyright 2026 by WKMG ClickOrlando – All rights reserved.