Share this @internewscast.com

Navigating the world of dating apps can be a tough experience. Users find themselves swiping left or right until their thumbs tire, exchanging endless small-talk messages in an effort to appear sane, interesting, and worthy of a real-life meeting. If fortune favors them, they may encounter someone special, enjoying the thrill of a budding relationship. However, if not, the experience can lead to a disappointing fizzle, a dramatic implosion, or a heartbreakingly painful breakup.

Interestingly, the journey of a dating app as a publicly traded company mirrors this challenging landscape.

Not too long ago, Bumble was among the most talked-about pre-IPO companies globally. The app, known for its female-first approach, was established in 2014 by Whitney Wolfe Herd, a former executive at Tinder. After facing allegations of sexual harassment and being effectively erased as a co-founder from Tinder, Whitney left with a modest settlement. She went on to create a new dating app centered around female empowerment, making Tinder seem outdated and unappealing in comparison.

In February 2021, Bumble’s initial public offering was a resounding success, propelling Whitney to the status of the youngest self-made female billionaire. But, much like a once-promising relationship that takes a turn for the worse, Bumble experienced its own setbacks.

Vivien Killilea/Getty Images

The Rise

From its inception, Bumble made a significant impact. Whitney Wolfe Herd designed the app as a direct contrast to Tinder, offering a platform where women led the conversation, toxic behavior was not tolerated, and dating felt less like a chaotic digital encounter. The concept was both straightforward and ingenious. In heterosexual matches, the app required women to send the first message, while in same-sex matches, either participant could initiate contact. This seemingly small change addressed a major emotional challenge and distinguished Bumble in a market teeming with competitors like Tinder, Hinge, and countless other lesser-known apps.

By the end of 2015, Bumble had facilitated 80 million matches and was rapidly gaining popularity across college campuses, corporate hubs, and major cities. Unbeknownst to many users, the app was not an independent startup; it was part of Russian entrepreneur Andrey Andreev’s dating empire. Initially, Wolfe Herd held about 20% of the company, while Andreev controlled roughly 80%. Bumble was supported by the technological resources of Badoo’s engineering team in London. Although Whitney did not have full control over her company in its early days, this unconventional corporate structure provided her with access to financial resources, engineering expertise, and user-acquisition strategies that most founders could only dream of.

The growth was staggering. By 2017, Bumble had over 22 million users. By 2019, the number had passed 100 million. That same year, Blackstone acquired Andreev’s stake in a deal valuing Bumble’s parent company at $3 billion. The deal removed Andreev, reorganized the board, installed Wolfe Herd as CEO, and gave her a life-changing liquidity event: a $125 million payout, plus a loan to her holding company that she later repaid. For the first time, Whitney truly controlled Bumble.

With a clean cap table, a new governance structure, explosive user growth, and a brand that dominated the cultural conversation, Bumble made its move. In early 2021, Whitney took the company public. Bumble priced its IPO at $43 per share, opened at $76, and briefly flirted with $84. The market cap surged to roughly $8–9 billion, instantly minting Wolfe Herd as the youngest self-made female billionaire in history. Investors were euphoric. Analysts were glowing. The media treated Bumble like the new gold standard for female-led tech.

For a brief, dazzling moment, Bumble was the future of online dating — a $9 billion rocket ship, fueled by cultural relevance, investor appetite, and a founder whose story was irresistible.

Bryan Bedder/Getty Images

The Fall

The trouble started almost immediately. After the euphoric IPO spike, Bumble’s stock settled into a long, grinding descent that no amount of optimistic press releases or product updates could reverse. By the end of 2021 — barely ten months after Whitney Wolfe Herd became a billionaire — the share price had fallen enough to wipe out her billionaire status. Wall Street’s early excitement about a female-first dating revolution faded fast once investors dug into the numbers: user growth was slowing, engagement had cooled, and Bumble’s expansion into friendship (BFF) and networking (Bizz) wasn’t producing meaningful revenue.

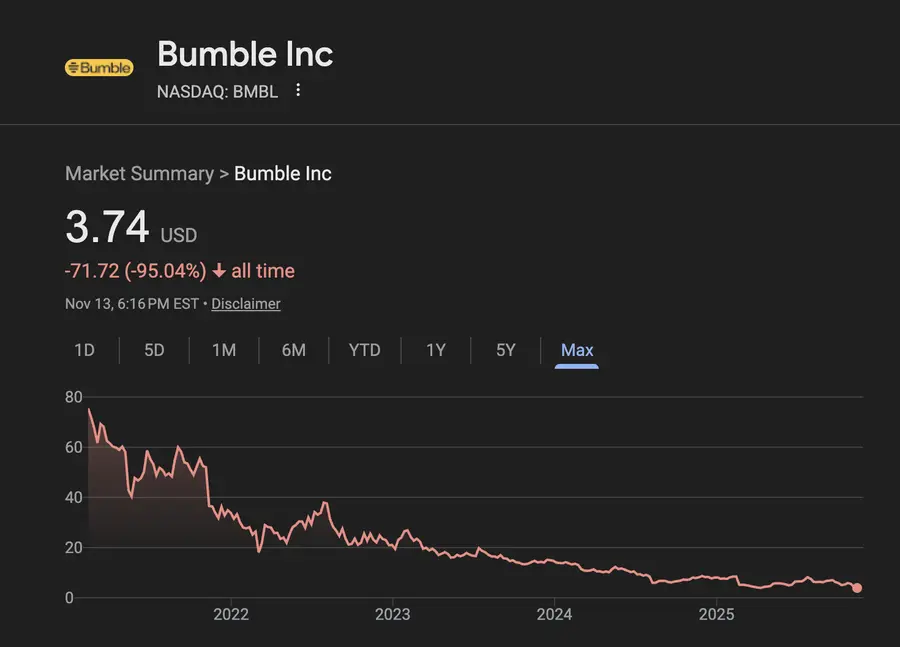

Then came 2022. And 2023. And 2024. Each year brought a new round of disappointing guidance, weaker-than-expected earnings, and intensifying competition from Tinder, Hinge, and an explosion of niche dating apps. Here’s a chart of how Bumble’s stock has performed since going public in early 2021. Note the red “all time number”:

95% Drop

Whitney Wolfe Herd was a paper billionaire for only about ten months — from February 2021 to November 2021. At the time of the IPO, she owned a little over 11% of the company, a stake worth more than $1.5 billion at its peak. Today, according to Bumble’s latest SEC filings, Whitney owns roughly 1.5% of Bumble, or about 1.7 million shares. At the current stock price, that stake is worth approximately $6 million.

However, that number doesn’t represent the full value she has realized. Wolfe Herd cashed out meaningful sums along the way.

In addition to her one-time $125 million pre-IPO windfall from the 2019–2020 Blackstone acquisition and restructuring, Whitney has sold at least $50 million worth of Bumble shares since the company went public. That includes:

- $40+ million from a 2023 secondary offering tied to Blackstone’s sell-down

- $8.5 million from her 2025 open-market sale

- Plus several smaller disposals to cover RSU tax obligations

Where Whitney and Bumble Are Today

Whitney stepped down as CEO in 2024, moved into an executive-chair role, and then returned to the CEO seat in 2025 to help steady the business. Bumble still has millions of users and strong brand recognition, but it now operates in a far more competitive, slower-growth landscape.

Whitney is far from being a billionaire. Today, we estimate her net worth at around $100 million.

She and her husband, Texas oil heir Michael Herd, have channeled some of that wealth into high-end real estate, including a 6.5-acre Lake Austin compound, which was briefly listed in 2020 for $28.5 million, and a historic Montecito estate, which they bought from Ellen DeGeneres for $21 million and sold in 2025 for $22.8 million.

At home, Wolfe Herd leads a quiet family life centered around Austin, where she and Michael are raising their young son. Whether Bumble can mount a second act — and whether Whitney can rebuild anything close to her former billionaire-level paper fortune — remains to be seen. For now, Wall Street is swiping left hard.

(function() {

var _fbq = window._fbq || (window._fbq = []);

if (!_fbq.loaded) {

var fbds = document.createElement(‘script’);

fbds.async = true;

fbds.src=”

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(fbds, s);

_fbq.loaded = true;

}

_fbq.push([‘addPixelId’, ‘1471602713096627’]);

})();

window._fbq = window._fbq || [];

window._fbq.push([‘track’, ‘PixelInitialized’, {}]);