Share this @internewscast.com

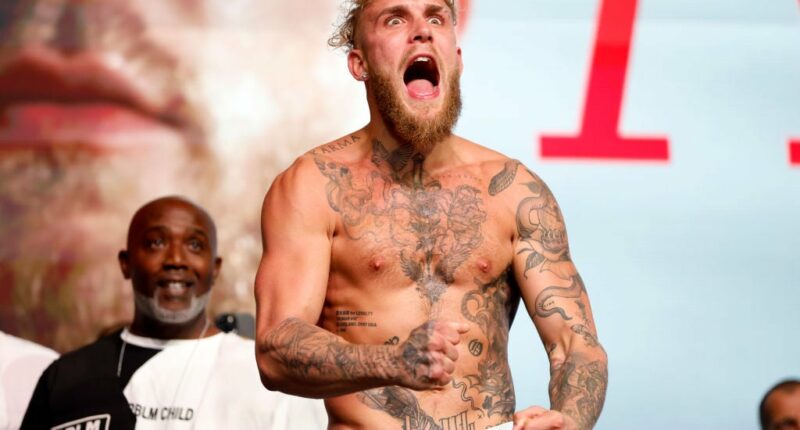

On Friday, December 19, a highly anticipated showdown between Jake Paul and Anthony Joshua will be broadcast worldwide on Netflix.

Jake Paul has built his boxing career on facing opponents who were often either past their athletic peak or competing outside their usual weight classes and disciplines. Despite these strategic matchups, Jake has confessed to experiencing early symptoms possibly indicative of CTE, including memory issues and declining cognitive abilities. Facing Anthony Joshua poses an entirely different challenge. Joshua’s superior size, strength, and experience make him a formidable adversary, presenting a genuine risk of Jake suffering injuries with lasting impacts.

This begs the question: Why does Jake continue to fight? With his fortune exceeding $100 million, what motivates him to take on such high-stakes bouts?

The straightforward answer seems to be financial gain.

Jake and Anthony are set to divide a jaw-dropping purse of $184 million, with each fighter taking home an astounding $92 million.

While earning $92 million for a single night’s work is undeniably tempting, Jake Paul actually has the luxury of declining such offers. What many may not realize is that Jake is an astute venture capital investor. One of his early ventures has already been acquired for billions, and several of his other investments have substantial paper valuations. Should these ventures go public or be acquired, Jake’s wealth, along with that of his future generations, could be secured for years to come.

Chris Coduto/Getty Images

Anti Fund

In 2021, Jake co-founded Anti Fund with Geoffrey Woo, a Stanford-educated serial entrepreneur who previously sold a company to Groupon. The pair realized they had a unique arbitrage opportunity. In a world awash with venture capital dollars, money had become a commodity. The one thing startups couldn’t buy? Attention.

Their thesis was simple: Traditional VCs provide capital and board meetings. Jake Paul provides capital and a megaphone to 70 million followers.

This wasn’t just a marketing gimmick; it was a rigorous investment strategy. They employed a “barbell approach”—writing smaller angel checks ($100k–$500k) into scrappy seed-stage founders, while deploying massive capital ($10M+) into breakout growth companies. The results were immediate. Founders who typically turned down “celebrity money” were suddenly clamoring to get Jake on their side, realizing that one tweet from him could crash their servers with new user sign-ups.

By December 2025, the firm had solidified its status as a serious institutional player, even bringing on Jake’s brother, Logan Paul, as a General Partner to double down on their media advantage.

Major Wins (So Far)

While any celebrity investor would absolutely KILL to have ONE bet turn into a unicorn, Jake Paul and Anti Fund have somehow pulled this off FIVE TIMES. So far! Below is a breakdown of Jake’s biggest VC wins:

Anduril

In late 2022, Anti Fund participated in Anduril’s Series E financing, which valued the company at $8.5 billion. This was a “growth stage” bet, meaning they wrote a much larger check—reportedly upwards of $10 million—into the defense contractor building autonomous drones and border security systems. It was a controversial play that paid off fast. By June 2025, Anduril raised a massive new round that valued the company at $30.5 billion. That $10 million check has likely already tripled in value to ~$36 million in less than three years, proving Jake can pick winners even when the entry price is high.

Cognition.ai

Riding the absolute peak of the AI boom, Anti Fund got into Cognition.ai during their Series B in early 2024. At the time, the company’s valuation was $2 billion. Fast forward 18 months, and the get-in price for a new Cognition investor is $10.2 billion.

Olipop

Jake invested in the healthy soda brand Olipop during their Series B in 2022. At the time, the company was valued at $200 million. In February 2025, Olipop raised money at $1.85 billion valuation.

Chronosphere

In 2019, Jake wrote a seed-stage check into Chronosphere, a cloud-native observability platform. When Jake invested, Chronosphere was valued at around $50 million. Fast forward to November 2025, and the company was acquired by Palo Alto Networks for $3.35 billion. If Jake invested $500,000 at the seed stage, his stake would have been worth $33.5 million at the acquisition.

And then there’s Ramp.

Ramp

Jake was an early seed investor in Ramp, a corporate card and finance automation platform, back when the company was barely a PowerPoint deck in 2019. At the time Jake invested, the company was valued at around $25 million. Today, Ramp is one of the most valuable private companies in America, with a valuation that recently topped $32 billion. If Jake invested just $100,000 at the seed stage, today his stake would be worth over $100 million. If he invested $500,000, today that stake would theoretically be worth half a billion dollars.

W

Jake is not solely a passive investor. He is also a founder. In June 2024, Jake founded the personal care brand “W.” Unlike a typical licensing deal (where a celebrity just leases their name to a third-party company), W was built in-house by Jake and his partner Geoffrey Woo. In July 2024, a month after the company was founded, W raised $14 million at a $150 million valuation.

The Bottom Line

If you assume even conservative check sizes for his early deals (and account for the standard dilution that happens as companies grow), Jake Paul’s venture portfolio is very likely worth hundreds of millions of dollars. There is a very real possibility that his equity stakes in these five companies alone are now worth more than he’s earned boxing or from social media combined.

So, why step into the ring with a heavyweight killer like Anthony Joshua? Why risk the CTE and the physical trauma when you have a portfolio that rivals the best investors in Silicon Valley? Well, it is nice to have an influx of $94 million for a day’s work. That’s $94 million that can be deployed into new VC bets. But there’s another benefit.

For Jake Paul, boxing isn’t the job anymore. Boxing is the customer acquisition channel.

Every time he fights, he dominates the global conversation. Every headline driving viewers to Netflix drives attention to his brand—and in the economy Jake Paul has mastered, attention is the only currency that matters. Jake Paul is a venture capitalist who is willing to bleed to get the best deal flow in the world.

When you put it all together, it’s not inconceivable but that Jake Paul will be a billionaire at some point in the next few years…

(function() {

var _fbq = window._fbq || (window._fbq = []);

if (!_fbq.loaded) {

var fbds = document.createElement(‘script’);

fbds.async = true;

fbds.src=”

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(fbds, s);

_fbq.loaded = true;

}

_fbq.push([‘addPixelId’, ‘1471602713096627’]);

})();

window._fbq = window._fbq || [];

window._fbq.push([‘track’, ‘PixelInitialized’, {}]);