Share this @internewscast.com

As I type this article, Google’s $2 TRILLION market cap makes it the fourth most valuable company in the world. Google was founded in 1998 and went public in 2004. In 2024, Google generated $348 billion in revenue and $100 billion in profit.

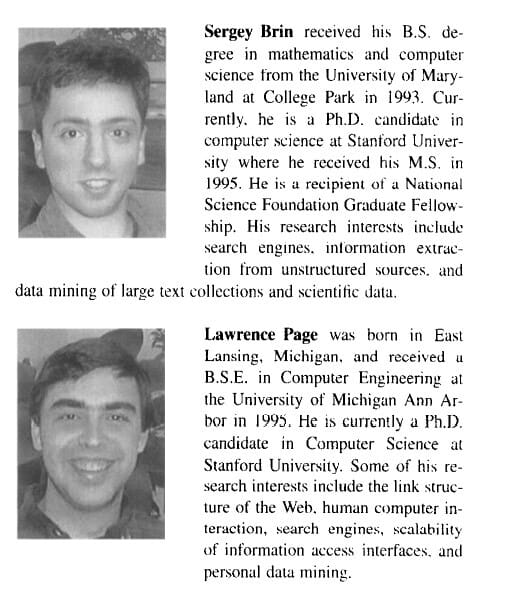

Google’s two founders, Larry Page and Sergey Brin, currently rank #9 and #10 on our real-time list of the richest people on the planet, thanks to their $150 billion and $141 billion net worths, respectively.

And Larry and Sergey are by no means alone in becoming extremely wealthy thanks to Google. Countless Google employees have become multi-millionaires. Dozens have become hundred-millionaires, and a few have even become billionaires.

In 1999, a recently divorced massage therapist took a part-time job at Google. The job paid a couple hundred dollars a week… but it also came with a few stock options. When Google went public a few years later, she was a multi-millionaire. Or take Charlie Ayers. AKA Chef Charlie. Chef Charlie also took a job at Google in 1999. He was awarded 40,000 pre-IPO shares of Google. When Charlie was interviewed in 2007 by MSNBC, he had not sold a single share. At that point, his shares were worth $26 million.

Bottom line. If you were somehow lucky enough to land a job at Google between 1999 and 2004, you are probably pretty happy right now.

Here’s a fun hypothetical: Imagine you had a time machine. And imagine you took that time machine to 1998 when Google was still a germ of an idea in the brains of two Stanford Ph.D students. You strike up a friendship, and eventually, when they’re ready to launch their idea into a business, you offer to invest $250,000.

Imagine what your life would be like right now. Well, today we’re going to tell you the story of a guy who doesn’t have to imagine that scenario. It was his real life, minus the time machine.

(Photo by John Lamparski/WireImage)

To set this story up, I’m going to show you a list of the 10 individuals who currently serve on Google’s Board of Directors:

- Larry Page: Co-founder

- Sergey Brin: Co-founder

- Sundar Pichai: Google CEO

- John Hennessy: A computer chip innovator who is generally regarded as “the godfather of Silicon Valley.” He has served on the board since 2004.

- Frances Arnold: Recipient of the 2018 Nobel Prize in Chemistry. Appointed to the board in 2019.

- Martin Chavez: The former CFO of Goldman Sachs. Appointed in 2020.

- Roger Ferguson: A former vice chairman of the Federal Reserve and former member of the FED’s Board of Governors. Appointed in 2016.

- Robin Washington: The President and COO of Salesforce. Appointed in 2019.

- John Doerr: Chairman of Kleiner Perkins, one of the richest and most influential venture capitalists of all time, thanks largely to his decision to invest $25 million into Google in June 1999. John has been a board member since that investment in 1999.

And then rounding out the list, one final name:

#10: Ram Shriram

Ram Shriram? I’m guessing even hardcore Silicon Valley/San Francisco tech employees have never heard that name. To be fair, I haven’t heard of lots of people on the list above, but I understand how their career accomplishments paved the way.

To give you some additional context, the Wikipedia bio of Frances Arnold (#5) – the Nobel Prize winner – is over 4,000 words. The bio for Roger Ferguson (#7) – the former Federal Reserve Governor – is 2,000 words.

Ram Shriram’s wiki bio is 336 words. Perhaps more confusingly, if you cut it down just to the “Career” section, it’s 55 words. It’s so short, I can take a screenshot and paste the entire section right here:

You would not think someone with such a scant resume would have the gravitas to serve on Google’s Board of Directors. Maybe he was just appointed? Maybe Wikipedia’s editors haven’t had time to update his page?

Nope.

Ram Shriram has served on Google’s Board of Directors longer than anyone OTHER THAN LARRY AND SERGEY… because he is the luckiest/smartest venture capital investor of all time.

From India to Netscape to Amazon

Ram Shriram’s path to Silicon Valley didn’t begin with elite connections or venture capital. It started in Chennai, India, where he was raised by a single mother after losing his father in a car accident at age three. His mother, a professor of English at the University of Madras, instilled in him the kind of discipline that would guide his entire career. When it came time to pursue a U.S. education, Shriram had no clear way to afford it, so he convinced his grandfather to mortgage the family home to secure a bank loan.

He earned his MBA from the University of Michigan, then landed his first job at Sycor, which was later acquired by Northern Telecom. Shriram transitioned from engineering to international marketing, traveling the world before eventually securing a transfer to California, mostly to escape Minneapolis winters. That move brought him to the heart of Silicon Valley in the early 1980s.

In 1994, Shriram joined Netscape as a vice president before the company had shipped a product or earned a single dollar. He helped lead the browser’s global distribution strategy during the chaotic rise of the early internet, staying through both the rocket-ship growth and Microsoft’s competitive assault. Netscape taught him how to build and scale a platform, but it also showed him what not to do. Years later, he would refer to his personal takeaways from Netscape as his “book of mistakes.”

After Netscape, he became president of Junglee, a price comparison startup that caught the attention of Jeff Bezos. In 1998, Amazon acquired Junglee for $185 million and brought Shriram on as VP of Business Development. The acquisition didn’t pan out the way Amazon hoped. Not only did Junglee’s technology not integrate well into Amazon, its employees – who were forced to move from the Bay Area to Seattle, HATED the climate of the Pacific Northwest. They all quit after a few months, and Amazon would eventually write off the entire $185 million purchase price.

Google In 1997-1998

Upon returning to the Bay Area, Ram’s former Junglee developers told him about a new search engine with a funny name whose accuracy was blowing their minds. A bunch of search engines existed at this point, but they were horrible, spam-and-porn-filled messes stuffed with ads that didn’t provide good results. Larry and Sergey stumbled upon a novel approach for organizing the web by applying a metric they invented called PageRank, which sorted websites not just by keywords but by how many other sites linked into them. This proved to be a powerful proxy for proving authority.

Larry and Sergey had spent most of the previous 12 months developing their algorithm and co-authoring a dissertation titled:

“The Anatomy of a Large-Scale Hypertextual Web Search Engine”

Google’s First Two Checks

One fateful morning in the summer of 1998, Larry and Sergey secured their very first angel investment. They had tapped a Stanford professor named David Cheriton to arrange a meeting with Andy Bechtolsheim, a former Stanford Ph.D student who went on to found Sun Microsystems. After viewing a demo of Google, not only did Andy write a check for $100,000, but so did David Cheriton. (David wasn’t just any professor; in 1995, he co-founded a company with Andy called Granite, which was acquired a year later for $220 million…)

When Andy and David wrote the checks out to “Google Inc.” there wasn’t technically a formal legal company formed yet. Larry and Sergey had to quickly form a company and open a bank account before they could deposit the checks.

Google’s Third Check

Thanks to his experiences at Netscape, Junglee and Amazon, Shriram instantly saw the power and opportunity of a highly improved search engine. Having befriended Larry and Sergey through his former Junglee co-workers, Ram also offered to invest in their startup. Larry and Sergey eagerly accepted.

One month after David and Andy’s combined $200,000 angel investment, Ram Shriram became Google’s third investor when he handed Larry and Sergey a $250,000 check. By this point, the Google boys had a bank account.

David and Andy had other jobs and weren’t particularly interested in being involved in the day-to-day operations of the startup, so Google’s first Board of Directors became Larry Page, Sergey Brin, and Ram Shriram. John Doerr was added in June 1999 when Kleiner Perkins invested $25 million.

Cashing Out

When Google went public in 2004, Ram Shriram owned 5.3 million shares, roughly 2% of the company. On the day of the IPO, Ram’s shares were worth $450 million. He also sold $30 million shares on that day. Not a bad return for a $250,000 investment he made just SIX YEARS earlier.

Ram has sold hundreds of millions of dollars worth of his Google shares over the decades. According to the company’s latest SEC filings, Ram Shriram currently owns approximately 2.47 million Class C (GOOG) shares and 2.11 million Class A (GOOGL) shares. At current stock prices, his holdings are worth over $747 million. Combined with his other sales, today Ram Shriram’s net worth is…

$3 billion

Again, not bad for a $250,000 investment.

After cashing out, Ram founded a venture capital firm called Sherpalo (a combination of the words “sherpa” and “palo” from Palo Alto). Sherpalo’s investments page features dozens of companies, including Gusto, Stripe, and Paperless Post.

Ram and his wife have also donated hundreds of millions of dollars to charity. In honor of his gifts, Stanford named one of its buildings the Shriram Center for Bioengineering and Chemical Engineering. The complex houses 34 custom-tailored research labs focused on biomedicine, molecular biology, health and environmental sciences, chemistry, and engineering.

Ram and his wife Vijaya have two daughters, Jhanvi and Ketaki. Jhanvi and Ketaki went to Stanford and in 2017 co-founded an AI animation company called Krikey AI that has raised $22 million to date. Interestingly, Krikey AI is NOT listed on Sherpalo’s investments page.

What Could Have Been

As we mentioned a moment ago, Ram has sold most of his Google shares over the years and has a very impressive $3 billion net worth. But what would have happened had he never sold a single share? Recall that he had 5.3 million shares at the 2004 IPO. After a 2-for-1 stock split in 2014 and a 20-for-1 split in 2022, today those 5.3 million shares would be 212 million shares. At today’s stock price, 212 million shares of Google would be worth $35 billion 🙂

FYI, David Cheriton and Andy Bechtolsheim are worth $15 billion and $20 billion today, respectively. But keep in mind, they both had other investments prior to Google and have actually founded several other very large tech companies after Google.

But Wait, There’s More

Remember that $185 million Amazon set on fire when it acquired Junglee? Jeff Bezos probably still holds a grudge against Ram for that one, right?

Well… maybe not.

Because after the Junglee team returned to the Bay Area, Ram made one more introduction for the Google guys — to Jeff Bezos. And in our next piece, we’ll tell you how Bezos’s secret Google investment — arranged by Shriram — quietly turned him into a Google billionaire… while he was busy building Amazon.

(function() {

var _fbq = window._fbq || (window._fbq = []);

if (!_fbq.loaded) {

var fbds = document.createElement(‘script’);

fbds.async = true;

fbds.src=”

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(fbds, s);

_fbq.loaded = true;

}

_fbq.push([‘addPixelId’, ‘1471602713096627’]);

})();

window._fbq = window._fbq || [];

window._fbq.push([‘track’, ‘PixelInitialized’, {}]);