Share this @internewscast.com

The intense competition for control of Warner Bros. Discovery has rapidly escalated into one of the most significant media bidding battles in recent history. At the center of this high-stakes showdown are two influential individuals and one immensely wealthy family, all poised to amass a substantial fortune, irrespective of the outcome.

For a considerable period, John Malone, David Zaslav, and the Newhouse family have been the driving forces behind Warner Bros. Discovery. Malone has served as the visionary architect and strategic mastermind, Zaslav has been the controversial CEO and public face drawing the highest salary, and the Newhouses have held the largest single block of shares.

Through fluctuating highs and daunting lows, they have weathered the storm together. When Warner Bros. Discovery was spun off from AT&T in 2022, it debuted with an impressive market valuation of nearly $60 billion. However, within a year and a half, its value plummeted by almost two-thirds. The company faced ballooning debt, a collapsing stock price, and had to cancel projects and shelve completed films amidst industry strikes. Zaslav continued to earn staggering compensation packages, often exceeding $40–50 million annually, prompting shareholder discontent and widespread industry criticism. Meanwhile, Malone and the Newhouses saw their investments diminish alongside the company’s declining market cap.

In the fast-changing media landscape, fortunes can shift rapidly and unexpectedly.

In December 2025, Warner Bros. suddenly found itself at the heart of a heated bidding war. Initially, Netflix made a move, agreeing to acquire the studio and streaming assets for $72 billion, valuing Warner Bros. Discovery shares at $27.75 each. Merely three days later, Paramount Skydance disrupted the scene with a bold $108 billion all-cash offer for the entire company, proposing $30 per share. Just months prior, the stock was trading at approximately $11 per share. This unexpected development caused the stock to skyrocket, rejuvenating billions in shareholder value seemingly overnight.

This dramatic surge is not only revitalizing Warner Bros. but also restoring the fortunes of those long associated with it. Among them, David Zaslav stands to benefit most significantly from this remarkable turnaround.

David Zaslav

For nearly two decades, Zaslav has been one of the highest-paid executives in the United States, even as the company he led cycled through turmoil, debt pressure, creative unrest, and a collapsing share price. Since 2009 alone, Zaslav has made more than $670 million in salary and bonuses. Here is the breakdown of his annual total comp since 2009:

- $11.7 million (2009)

- $42.6 million (2010)

- $152 million (2014)

- $129.4 million (2018)

- $246.6 million (2021)

- $39 million (2022)

- $50 million (2023)

In 2025, the Warner Bros. board extended his contract through 2030 and granted him more than 23 million low-strike options. At the time this package was granted, Warner Bros. Discovery’s market cap was around $23 billion, and as a reminder, when the newly merged company went public in 2022, its market cap was $60 billion. The board also threw in a crucial kicker: All 23 million options would instantly vest upon any change in control. In other words, he wouldn’t have to wait til 2030 to earn those 23 million shares.

That brings us back to December 2025.

Netflix’s $72 billion agreement immediately lifted the stock and transformed those options into a windfall worth more than $400 million. Paramount’s hostile $108 billion bid pushed Zaslav’s potential payout to around $460 million.

And that’s only the options.

On top of the options, a sale also triggers the accelerated vesting of approximately 6.3 million restricted stock units, worth more than $170 million at the Paramount offer price. Combined with the value of the WBD shares he already owns, Zaslav’s total payout inches toward $700 million, potentially more if a bidding war breaks out.

With a net worth we currently peg at $600 million, even after a hefty tax bill, David Zaslav will almost certainly walk away from the deal a billionaire.

Now let’s turn to John Malone

John Malone

If David Zaslav is the face of Warner Bros. Discovery, John Malone has always been its architect. He has shaped more media mergers than perhaps any living executive, and the Discovery–WarnerMedia combination was one of his signature strategic constructions. Though Malone’s direct stake in WBD has declined over the years, he still owns roughly 18 million shares — a meaningful position that was crushed when the stock collapsed in 2023 and 2024.

When Warner Bros. Discovery debuted at a $60 billion valuation in 2022, Malone’s stake was worth well over a billion dollars. Eighteen months later, as the stock sank into the single digits, that same stake had been chopped to a fraction of its former value. By late 2024, Malone had absorbed one of the steepest paper losses of his career.

The December bidding war has reversed that almost overnight.

Under Netflix’s $72 billion offer, valued at $27.75 per share, Malone’s 18 million shares are suddenly worth about $500 million. Paramount’s $108 billion hostile bid pushes that number even higher — roughly $540 million at $30 per share. And if the bidding escalates beyond $30, Malone’s upside increases dollar for dollar with each new offer.

Unlike Zaslav, Malone’s payout involves no vesting schedules, no performance cliffs, no contractual triggers. It is pure equity. Which means every additional $1 added to the final sale price adds another $18 million directly to Malone’s bottom line.

Now let’s talk about the Newhouse family… and the financially catastrophic mistake they made just four months ago…

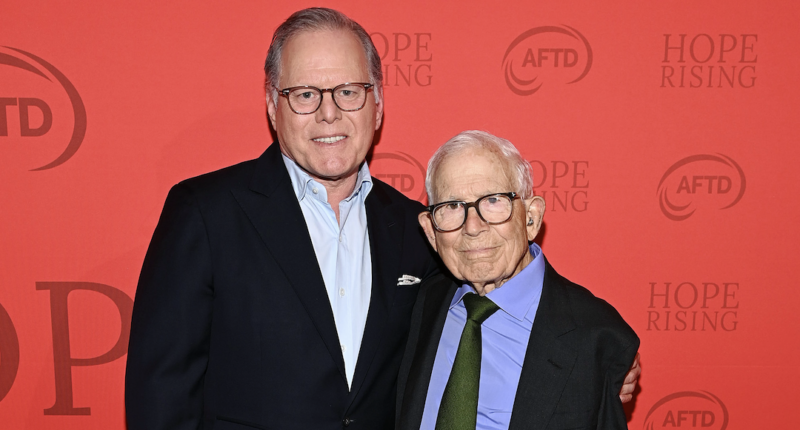

David Zaslav and Donald Newhouse (Photo by Dave Kotinsky/Getty Images for AFTD)

The Newhouse Family

The Newhouse family, led by 96-year-old patriarch Donald Newhouse (pictured above with David Zaslav), traces its stake in Warner Bros. Discovery back to their early investment in Discovery Communications in the 1990s, when cable was booming, and Discovery was transforming from a niche documentary channel into a global media force. Through their holding company Advance Publications, the Newhouses became one of Discovery’s largest long-term shareholders, and when Discovery absorbed WarnerMedia in 2022, they emerged from the merger as the single largest individual shareholder in the combined company, owning more than 8% of WBD, around 200 million shares. At the time of the merger, those roughly 200 million shares were worth more than $10 billion.

At the Paramount offer price of $30 per share, that original 8% stake would have been worth nearly $6 billion. Not as nice as $10 billion, but that’s not even the most painful part of the story.

In late June, when Warner Bros. Discovery was languishing near all-time lows, the Newhouse family decided to sell 100 million shares — roughly half their position — for $10.97 per share. That sale generated $1.1 billion in cash. At the time, it looked like a sensible liquidation. Four months later, it looks catastrophic. Maybe the worst timing in corporate history.

Those same 100 million shares would now be worth $3 billion under the Paramount bid.

Don’t feel too bad for the Newhouses, though. They still hold approximately 98 million shares, and at $30 per share that remaining stake is worth about $2.94 billion. Add in the $1.1 billion they pocketed in June, and the family will walk away with roughly $4 billion total if the Paramount deal closes.

Still… oooof. Watching $2 billion slip away because you sold four months too early? That stings, even when you’re a billionaire dynasty.

(function() {

var _fbq = window._fbq || (window._fbq = []);

if (!_fbq.loaded) {

var fbds = document.createElement(‘script’);

fbds.async = true;

fbds.src=”

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(fbds, s);

_fbq.loaded = true;

}

_fbq.push([‘addPixelId’, ‘1471602713096627’]);

})();

window._fbq = window._fbq || [];

window._fbq.push([‘track’, ‘PixelInitialized’, {}]);