Share this @internewscast.com

Before we delve into the details, it’s important to note that the following information is drawn from allegations and reporting by Business Insider (BI) in their recent article titled “Money to Blow: Inside Floyd ‘Money’ Mayweather’s Lavish, Debt-Filled Post-Boxing Life.”

In reaction to the Business Insider article, Floyd Mayweather’s lawyer, Bobby Samini, staunchly contested the portrayal, asserting that Mayweather is not facing any financial difficulties. Samini issued this statement to BI:

“Floyd Mayweather overcame poverty and adversity to become one of boxing’s greatest champions, converting his talent and discipline into an undefeated record and a thriving business empire. Spreading baseless narratives distorts the truth and undermines the accomplishments of someone who has risen from hardship to be one of the most successful athletes and entrepreneurs of his era.”

Additionally, it’s worth mentioning that Mayweather is currently suing Business Insider and one of the article’s reporters, Daniel Geiger, for defamation related to previous coverage of a commercial real estate project involving Mayweather. In his $100 million lawsuit, Mayweather alleges: “Daniel Geiger declined several invitations to examine verified transaction records and documents that would have confirmed the deals were executed as claimed.” Mayweather’s team further argued that the reporting was not only flawed but also racially biased, alleging that Geiger made derogatory remarks implying Floyd was “unqualified” to own such properties.

With these clarifications in mind, Business Insider has recently published an extensive and attention-grabbing investigation into Floyd Mayweather’s financial activities following his boxing career. According to their findings, the authors examined public documents, loan files, legal proceedings, and conducted interviews with current and former associates to present a more nuanced view of the man famously known as “Money” Mayweather.

The article scrutinizes the management of his substantial wealth in retirement, emphasizing significant borrowing against real estate, contested business ventures, alleged foreclosures, liens, legal disputes, and an increasing dependence on leveraged funds and exhibition matches to sustain his lavish lifestyle.

(Ethan Miller/Getty Images)

One Of The Highest Paid Athletes In History

Let’s start with a couple of indisputable facts:

- Floyd is an extremely shrewd businessman.

- Floyd has earned at least $1.1 billion during his career.

The vast majority of boxers who came before Floyd were not much more than highly paid employees of promoters. They received set fees for showing up and fighting, but they did not participate meaningfully in the enormous profits generated by pay-per-view, ticket sales, and event promotion. For the first decade of his career, Floyd was no different. He fought under Bob Arum’s Top Rank promotions and collected guaranteed purses.

Up to that point, Floyd’s career already looked like a textbook success story. He was undefeated, a multi-division world champion, and widely regarded as one of the best pound-for-pound fighters in the sport. Yet after nearly ten years as a professional, his total career earnings were still under $10 million.

In April 2006, Bob Arum offered Floyd $8 million to fight Antonio Margarito, a massive leap from anything Floyd had earned previously. Instead of accepting and remaining a highly paid employee, Floyd chose to become an owner.

In an extremely risky move, Floyd paid $750,000 to buy himself out of his Top Rank contract. As we like to say around here at Celebrity Net Worth: If you believe in yourself, BET ON YOURSELF.

After extricating himself from Top Rank, Floyd effectively became a self-financed independent promoter. For his next fights, he fronted the money for venues, production, concessions, marketing, and even his opponents’ guaranteed purses. The risk was enormous. If a fight underperformed, Floyd would have been personally responsible for millions in costs. The upside, however, was unprecedented: by financing the operation himself, Floyd positioned himself to capture the lion’s share of the profits.

The gamble paid off spectacularly. Instead of capping his upside at tens of millions per fight, Floyd entered an era where individual bouts routinely generated nine-figure paydays. He earned more than $550 million from just two fights alone:

- $250 million from his 2015 bout against Manny Pacquiao

- $300 million from his 2017 fight against Conor McGregor

Thanks to his $1.1 billion career earnings, Floyd Mayweather is one of the highest-paid athletes in history. At the time of his retirement from professional boxing, we estimated Floyd Mayweather’s net worth to be $400 million.

Getty Images

Business Insider’s Allegations About Floyd’s Post-Boxing Finances

Floyd retired from professional boxing following his August 2017 fight against Conor McGregor, which capped his career at 50–0. According to Business Insider, the very traits that once fueled Floyd’s success—total control, aggressive risk-taking, and a willingness to front massive sums of his own money—may have become liabilities in retirement. The report argues that instead of institutionalizing his fortune through conservative asset management, Floyd increasingly relied on leverage, optimistic dealmaking, and a loosely governed inner circle as he expanded into real estate, brand licensing, and exhibition bouts.

What follows is a breakdown of Business Insider’s central claims: how Floyd’s real estate investments were structured, why several high-profile deals are now being questioned, how debt and litigation entered the picture, and why critics quoted in the report say his post-boxing financial life looks far more fragile than the image he continues to project publicly. Again, these are allegations and interpretations drawn from public records and interviews cited by Business Insider.

Real Estate: Ownership Claims vs. Public Records

One of the central pillars of Business Insider’s reporting concerns Floyd Mayweather’s post-boxing real estate activity, particularly claims he has made publicly about owning large portfolios of commercial property. According to Business Insider, Mayweather repeatedly portrayed himself as the outright owner of high-value apartment buildings and commercial assets, especially in New York City. However, the outlet reported that it could not locate property records supporting several of those claims.

Business Insider focused heavily on Mayweather’s statements about buying a 62-building Manhattan apartment portfolio and later acquiring roughly $400 million worth of rent-regulated apartment buildings in Upper Manhattan. According to the report, people with knowledge of those transactions said Mayweather’s financial participation was nominal, short-lived, or ultimately absorbed by other partners. In one widely publicized deal, Business Insider reported that Mayweather’s initial equity investment was later wiped out, leaving him with no ownership stake when the portfolio was eventually spun off into a publicly traded entity.

Mayweather disputes this characterization and is currently suing Business Insider and its reporter, Daniel Geiger, for defamation, seeking $100 million in damages, related to earlier coverage of commercial real estate investments.

Borrowing and Leverage

Another major focus of the Business Insider investigation is Mayweather’s increased use of debt after retirement. According to the report, Mayweather borrowed approximately $54 million over a roughly 12-month period from billionaire specialty lender Don Hankey, at an interest rate of around 9%, to “fund other ventures.”

Business Insider reported that the loans were secured using a broad cross-collateralization structure that included 14 residential properties, Mayweather’s Las Vegas strip club, and his private jet. Experts cited by Business Insider noted that this type of borrowing structure carries elevated risk because a default could place multiple assets at risk simultaneously rather than one property at a time.

Mayweather’s attorney told Business Insider that borrowing against appreciated assets is a common practice among wealthy individuals and denied that the loans indicate financial distress, describing Mayweather as an “ideal client.”

YURI CORTEZ/AFP via Getty Images

Foreclosures, Liens, and Unpaid Obligations

Business Insider also detailed a series of foreclosures, tax issues, liens, and lawsuits that it says emerged in recent years. According to the report, at least two commercial properties associated with Mayweather were foreclosed upon within an 18-month span. Another Las Vegas commercial building tied to Mayweather faced foreclosure over approximately $52,000 in unpaid property taxes and penalties.

The article further cited lawsuits and liens alleging unpaid bills for a range of expenses, including aviation fuel, aircraft maintenance, luxury vehicles, jewelry, and municipal services. Among the specific figures cited by Business Insider:

- A Texas aviation fuel supplier alleged $137,000 in unpaid jet fuel bills.

- An FAA lien of approximately $358,000 was placed on Mayweather’s aircraft for maintenance work before later being removed.

- Clark County placed a $568 lien on Mayweather’s Las Vegas mansion for unpaid trash collection.

- A Nigerian media company won a judgment that has reportedly grown to nearly $3 million with interest, stemming from an alleged failure to appear at paid events.

Car Dealership Lawsuits

Floyd is also currently the plaintiff and defendant in lawsuits involving a luxury car dealer in Las Vegas called Vegas Auto Gallery.

According to a lawsuit filed by Vegas Auto Gallery, back in July 2025, Floyd bought four cars worth $2.25 million through his LLC, Mayweather Promotions LLC. He apparently returned three of the cars. The car he kept was a Mercedes G-Class SUV that is valued at $1.2 million. He allegedly agreed to pay for the car by September 1. He allegedly did not pay. Auto Gallery agreed to extend the deadline to September 18, but once again, he allegedly failed to pay. Auto Gallery also claims that Mayweather then defamed the dealership over Instagram posts in which he told his followers it “does bad business,” identifying one of the dealers by name, who apparently received threats from Mayweather fans, which had to be reported to the police.

Floyd filed his own lawsuit against the dealership, claiming it never provided him with the necessary documentation to title or register the G-Wagon in Nevada as promised.

Past Tax Issues and Liquidity Concerns

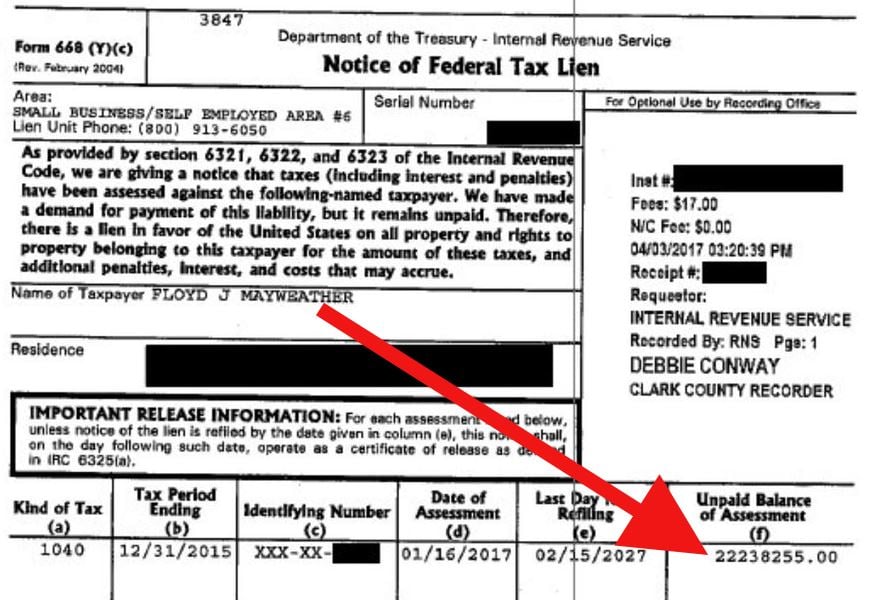

Back in March 2017, the IRS hit Floyd with a demand for $22.2 million in back taxes related to his 2015 income. More specifically, the IRS filed a “Notice of Federal Tax Lien” naming the taxpayer “Floyd J Mayweather” as having an “Unpaid Balance of Assessment” of $22,238,255.

Interestingly, Floyd responded to the lien claiming that he didn’t have enough liquid cash to cover the debt. A few months later, Floyd’s lawyer filed paperwork assuring the IRS that their bill would be paid in full soon because their client was about to have a “significant liquidity event.” That event was his August 2017 fight against Conor McGregor. The IRS had demanded to be paid immediately, to which Floyd’s legal team replied:

“Although the taxpayer has substantial assets, those assets are restricted and primarily illiquid. The taxpayer has a significant liquidity event scheduled in about 60 days from which he intends to pay the balance of the 2015 tax liability due and outstanding.”

Back in 2020, 50 Cent (Floyd’s former BFF turned ultimate hater) went on a radio show and claimed Floyd’s “money was GONE”:

In 2022, Jake Paul claimed his brother Logan had not been paid for their ridiculous fight because Floyd didn’t have the money. Jake claimed, “Floyd is Broke man. I’ve been saying it the whole entire time… I think he spent [the money] paying all those girls to be around him.“

The Private Jet and Mansion Sales

Another highly visible symbol of Mayweather’s wealth addressed in the Business Insider report is his primary private jet, the $60 million Gulfstream G650 dubbed “Air Mayweather.” According to FAA records cited by the outlet, Mayweather sold the aircraft in late 2025. This sale followed a period in which the jet had been used as collateral for high-interest loans and was the subject of liens from aviation fuel suppliers and maintenance firms over allegedly unpaid bills. Mayweather has since been seen traveling in a secondary Gulfstream III (often called “Air Mayweather II”).

Business Insider also highlighted a shift in Mayweather’s residential portfolio, suggesting that recent sales were less about “flipping for profit” and more about offloading debt:

Mayweather also sold or is in the process of selling several high-profile residential properties:

What Business Insider’s Reporting Does — and Doesn’t — Prove

A lot of people on social media (Twitter mainly) have taken Business Insider’s headline and confidently used it to proclaim that Floyd Mayweather is broke, insolvent, or unable to meet his long-term financial obligations. That’s not true. It’s important to separate liquidity issues from net worth. Many ultra-wealthy individuals hold the majority of their wealth in illiquid assets such as real estate, private businesses, or long-term investments. Borrowing against those assets, even aggressively, does not automatically indicate financial collapse.

The more reasonable takeaway is not that Floyd’s fortune has vanished, but that his post-boxing financial position may be more complex, more leveraged, and less bulletproof than the public persona of “Money Mayweather” suggests.

Floyd Mayweather’s story is not unique among ultra-high-earning athletes. The transition from peak earning years to retirement often exposes structural weaknesses in cash flow, investment strategy, and oversight. What makes Floyd’s case especially compelling is the sheer scale of his success. Very few athletes have ever earned over $1 billion. Fewer still attempted to remain their own boss, promoter, and chief decision-maker long after the primary revenue engine shut off.

For now, Floyd remains enormously wealthy, publicly defiant, and actively disputing Business Insider’s portrayal of his finances. With a defamation lawsuit pending and several financial matters unresolved, this story is far from finished.

(function() {

var _fbq = window._fbq || (window._fbq = []);

if (!_fbq.loaded) {

var fbds = document.createElement(‘script’);

fbds.async = true;

fbds.src=”

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(fbds, s);

_fbq.loaded = true;

}

_fbq.push([‘addPixelId’, ‘1471602713096627’]);

})();

window._fbq = window._fbq || [];

window._fbq.push([‘track’, ‘PixelInitialized’, {}]);