Share this @internewscast.com

A fresh twist has emerged in the mysterious case of Nancy Guthrie’s disappearance, as TMZ recently received what appears to be another ransom note from an individual claiming insider knowledge about her whereabouts. This letter, laden with potential clues, adds another layer to the unfolding drama.

“I know what I saw five days ago south of the border, and I was told to shut up, so I know who he is, and that was definitely Nancy with them,” reads the enigmatic message. This unverified note, disclosed by TMZ founder Harvey Levin, hints at intriguing developments in the case.

This latest correspondence marks the fourth message purportedly sent by the same individual, who continues to claim knowledge of Nancy’s alleged kidnapping in exchange for a reward. The contents of the message suggest three significant points, although details remain murky.

- Nancy may have been taken to Mexico

- Multiple people are involved

- It also suggests the group has a leader — a detail the writer suggested in previous letters.

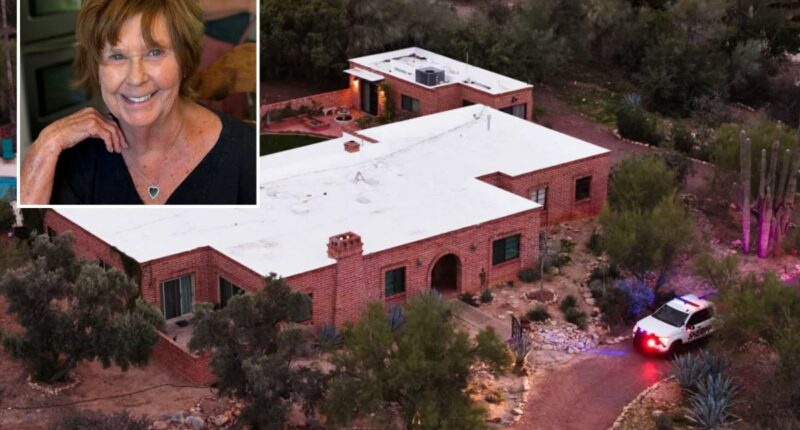

Authorities, including the FBI, are aware of these communications, but they have yet to confirm the authenticity of any claims made by the sender. Despite this, the letters have sparked concern and speculation, as the sender has been persistently taunting NBC’s Savannah Guthrie and her family since Nancy was reportedly abducted from her Tucson residence on February 1st.

The FBI is aware of the messages, but nothing about them has been verified.

The creep has been taunting Savannah Guthrie and her family ever since Nancy was taken from her Tucson home Feb. 1.

At first he demanded millions of dollars in bitcoin for her return, then he claimed merely to have knowledge of where Nancy Guthrie is.

Levin said he has turned this letter, and all the others, over to the FBI. He also warned that he the writer is a hoaxer, he is committing a crime.