Share this @internewscast.com

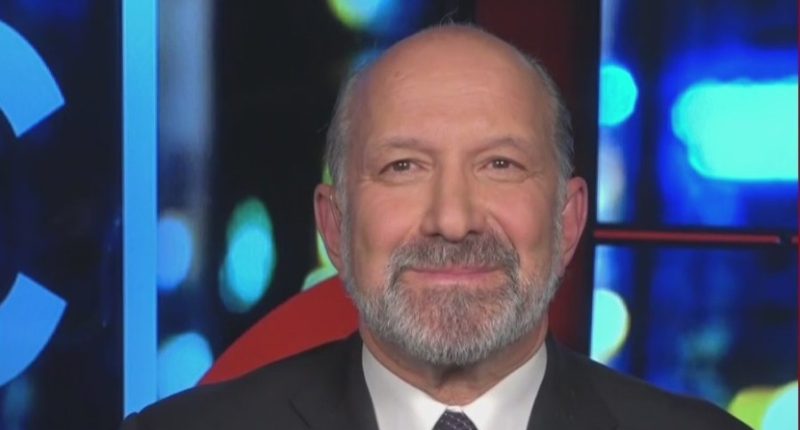

() Commerce Secretary Howard Lutnick defended the Trump administration’s tariff strategy Thursday, saying that current 10% tariffs are generating more than $30 billion monthly in revenue without causing consumer price increases.

In an interview on ’s “CUOMO,” Lutnick argued that foreign countries and currency fluctuations absorb most tariff costs at the 10% level, citing Amazon’s recent earnings call where the company reported no changes in demand or pricing.

“The United States of America is taking in more than $30 billion a month from these 10% tariffs around the world,” Lutnick said. “Our earnings as a country are rising, our deficit is going to decline.”

He dismissed concerns from credit rating agencies and market analysts, saying companies like Apple, Meta and Nvidia have committed to $500 billion investments each as part of a broader $10 trillion manufacturing initiative.

The Department of Commerce secretary acknowledged that tariffs above 15% would likely impact consumers but maintained that China would absorb higher rates. Lutnick framed the tariff policy as negotiating leverage, encouraging other countries to open their markets to American farmers, ranchers and businesses in exchange for lower rates.

Lutnick pushed back against Congressional Budget Office estimates that Republicans’ recent tax legislation would increase the deficit, calling CBO scoring mechanisms “silly nonsense” and arguing they fail to account for tariff revenue. He said the agency scores tariff income as zero because it’s not part of specific legislation.

Financial markets have shown volatility over tariff implementation and Treasury auctions have reflected investor concerns about trade policy impacts. Moody’s recently issued warnings about fiscal sustainability, which Lutnick dismissed as not accounting for increased tariff revenues.

Lutnick said the planned tax relief, including the elimination of taxes on tips and overtime pay, predicting these policies would benefit small businesses. He projected the manufacturing investments would create 5 million high-paying jobs and drive economic growth to 4% GDP.

When pressed about small businesses reporting difficulties sourcing materials, Lutnick said relief would come as trade negotiations with China progress and the broader economic benefits take effect.