Share this @internewscast.com

(NEXSTAR) – If you manage to defy the astronomical odds and secure the Powerball jackpot this Saturday night, experts suggest there are critical steps to take to prevent expensive errors.

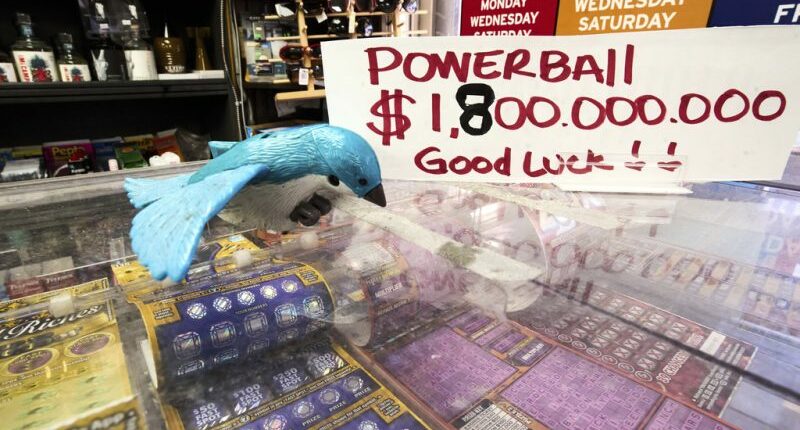

By Friday, the jackpot had risen to $1.8 billion, ranking it as the second biggest lottery jackpot ever in the U.S., second only to a prize over $2 billion claimed in California in 2022.

The pre-tax numbers are staggering, but a winner’s game plan after matching the numbers may determine how rich that person ultimately remains.

“A common concern among those who come into sudden wealth, particularly lottery winners, is the fear of mishandling their newfound fortune,” Robert Pagliarini, author of “The Sudden Wealth Solution,” shared with Nexstar.

With over two decades of experience advising clients, including lottery winners, Pagliarini emphasizes converting that lump sum into enduring wealth, while pointing out specific steps that lottery winners need to follow.

The crucial first step

The winning lottery ticket is just a slip of paper and can be stolen, lost or even destroyed in a washing machine.

Until it is signed, the ticket is a bearer instrument, or a financial document that is payable to the person who physically possesses it.

“It’s crucial they document ownership of the ticket,” Pagliarini advised. “I would suggest taking a selfie with the ticket, recording a video involving the ticket, signing it, and storing it in an extremely secure location.”

Don’t go it alone

If possible, experts advise, keep the lottery win a secret while building a team of experts.

Pagliarini cautions that once news spreads, acquaintances, friends, and even family might seek access to the fortune. To protect the winnings, promptly enlisting the services of an attorney, tax advisor, and financial advisor is advisable.

There’s going to be helicopters flying overhead when you go and collect the winnings like this. This stuff happens because the world gets excited. And now everyone knows that you’ve got a billion dollars that’s not good. In no circumstances is that a good thing.

He recommends staying out of the spotlight and telling as few people as possible, as well as crafting a plan to prepare for speaking to the media.

Annuity or lump sum?

A monumental decision that Mega Millions jackpot winners face is how to receive their winnings – in a big lump sum or spread out over years in annuity payments.

If someone beats the 1-in-302,575,350 odds and wins the current Mega Millions jackpot on Friday, they will ultimately have to choose between taking the pot in 30 payments over 29 years, or the reduced lump cash sum of roughly $602 million.

Nicholas Bunio, a Pennsylvania certified financial planner, said even with his expertise, he would take an annuity because it would so dramatically reduce his risk of making poor investment decisions.

“It allows you to make a mistake here and there,” Bunio said. “People don’t understand there is a potential for loss. They only focus on the potential for gain.”

The gulf between the cash and annuity options has become larger because inflation has prompted a rise in interest rates, which in turn results in potentially larger investment gains. With annuities, the jackpot cash is essentially invested and then paid out to winners over three decades.

“You’ve got to see what is the best option for you,” Steven Evensen, CFP, a financial advisor with Gerber Kawasaki Wealth and Investment Management, told Nexstar.

While the lump sum is more popular and would grant immediate access to the cash, it also means more taxes.

“You’d be taxed up to 37% federally, and then even more so depending on your state tax,” Evensen cautioned. “So I would speak to an accountant about that to make sure you aren’t kind of overspending in your head before you actually receive the money and receive your tax bill at the end of the day.”

Regardless of which payout plan you choose, Evensen recommends investing some of the money. What you invest in depends on your goals, but “low cost mutual funds, index funds are a great place to start.”

The Associated Press contributed to this report.